This is the third article in NPQ’s series, Just Transition: Liberating Finance to Build a Better World. Coproduced with Justice Funders, a group that organizes philanthropy to advance a just transition to an equitable and sustainable economy and planet, this series highlights case studies of emerging funding networks facilitating investment in liberatory economic practices in frontline BIPOC communities.

For many people in Black, Indigenous, and people of color (BIPOC) communities in the United States and across the globe, the connection to land is core to cultural identity, spirituality, and livelihoods. While the capitalist economic system considers land to be a commodity that is privately owned and profited from, our communities seek to be in a reciprocal relationship with the land, which we consider a lifesource to be collectively and cooperatively stewarded using the knowledge and traditions of our ancestors.

For Black and Indigenous communities especially, the forces of White supremacy and racial capitalism that have resulted in the centuries-long violence and oppression against our people—including genocide, slavery, and land theft and dispossession—have severed our relationship to land and our ancestral practices of land stewardship.

To transform the financial landscape, we must position our traditions and values front and center.

Our communities have always resisted and risen against this dispossession, and we are now in a time of growing momentum for land reclamation and return. As part of this movement, Black- and Indigenous-led organizations have been building innovative solutions rooted in our ancestral cultural values to provide equitable and nonextractive financing to farmers, land stewards, and entrepreneurs.

We recognize that to transform the financial landscape, we must position our traditions and values front and center because the current systems undermine the investable potential of our communities.

From Land Theft to Land Return

US capitalism was built on land stolen from Indigenous tribes and the forced labor of enslaved Africans on that stolen land. The genocide of Indigenous people by European settlers and the violent seizure of the lands that they stewarded created the landscape for the development of a cotton empire that relied on enslaved African labor.

Following the end of slavery, Black Southerners began acquiring land, but most of this progress was later reversed. Between 1910 and the late 1990s, close to 90 percent of Black farmland was lost through a range of mechanisms, including lynchings and legal chicanery.

Meanwhile, as European settlers expanded westward, Indigenous people were forced onto reservations—mostly on unfarmable land—which separated Indigenous people from the lands of their ancestors. Those already limited reservation lands were reduced by an additional 65 percent from the late 1880s to the 1930s.

Both Black and Indigenous peoples are living in diaspora today, making the fight for land back and reparations critical. According to the 2020 US Census, nearly 87 percent of Indigenous people in the United States live off the reservation.

The rapid decline of Black and Indigenous land stewardship has devastated our capacity to grow and harvest our own food, which has contributed to a lack of access to healthy, affordable, culturally significant foods, and other negative health disparities (including mental, emotional, and spiritual health). Furthermore, in a capitalist economy where land ownership is directly tied to one’s ability to accumulate and transfer wealth from generation to generation, discriminatory policies and practices have deepened the racial wealth gap. Understanding the monetary worth of US land, which according to a 2009 federal estimate (the current level would evidently be higher) is $23 trillion, helps us shed on just how much has been stolen—and therefore, how much is owed.

A Tale of Two Funds

How can Black and Indigenous communities recover lost and stolen land? One important strategy involves creating dedicated BIPOC-led funds that support land recovery and food stewardship.

What does BIPOC-led finance for land recovery look like? The funds that we are involved in—the Black Farmer Fund (BFF) and the Moonsoon Fund, which is still in formation but builds off of a track record of lending in Indigenous communities—offer two examples.

There are many parallels between how Black and Indigenous communities have experienced land theft and dispossession.

BFF, which Allen co-leads, was founded by two Black farmer-activists, Karen Washington (aka Mama K) and Olivia Watkins, who were frustrated by the lack of financial assistance available for Black farmers and sought to create a means for community members to access capital. They created BFF to nurture Black community wealth and health by investing in Black agricultural systems in the Northeast. This involves helping Black farmers, business owners, and land stewards access nonextractive financing coupled with technical assistance, business coaching, and networking support. For BFF, working with people and enterprises across the food system, and not just farmers, is critical to strengthen Black ownership from seed to table and build a racially just Black agricultural ecosystem.

The work of BFF is rooted in the legacy of radical Black activists, changemakers, and figures in the fight for collective land ownership, wealth redistribution, and food sovereignty through economically and environmentally sustainable food systems. Given that the wealth denied the Black community through farmland loss exceeds $120 billion, the call for reparations is central to this struggle.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Black Farmer Fund’s $1 million pilot fund attracted over 50 applications and invested in eight farm and food businesses. Financed projects include the worker-owned cooperative Black Yard Farm, which focuses on animal husbandry and vegetable production, and Rootwork Herbals, an herbal education business that concentrates on serving queer and BIPOC communities. While this round was centered around farmers and herbalists, BFF supports businesses across the entire food ecosystem—food production, distribution, and consumption.

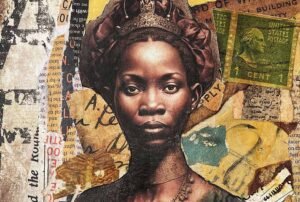

Moonsoon Fund, where Gloshay focuses her energies, has similar ambitions. The goal is to create a US impact investment fund that provides restorative capital to established Indigenous women-owned businesses through a rematriation lens. Moonsoon Fund defines rematriation as “the recentering of Indigenous women as caretakers and leaders of economic systems that support their family, communities, and tribes.” It is about rebalancing the feminine energy back into decision circles and rebuilding and reimagining systems through a matriarchal lens.

Indigenous women are the backbone of their communities. Two out of three Indigenous women are primary breadwinners in their families, and the number of Indigenous-women-owned businesses has grown more than twice as fast as women-owned businesses in general. Yet Indigenous women face tremendous barriers to accessing capital—including institutional racism, gender discrimination, and predatory lending.

To address this, the Moonsoon Fund is using an underwriting framework it has developed which fund founders are calling the five Rs of Rematriation. A five-R lending approach favors businesses that are relational, rooted, restorative, regenerative, and revolutionary. This framework seeks to challenge antiquated and exclusionary underwriting practices and frameworks that deny Indigenous women and their communities access to capital and resources in many ways.

An example of the type of entrepreneurs Moonsoon Fund founders have supported and aim to continue to uplift is Tina Archuleta, a traditional Pueblo farmer and the owner of Itality, a Pueblo restaurant serving Indigenous plant-based foods that inspire a return to Indigenous diets and food systems. She opened her restaurant on Jemez Pueblo land, a federally recognized tribal nation located 50 miles northwest of Albuquerque.

Moonsoon Fund and [Black Farmer Fund] demonstrate the possibilities…when Black and Indigenous communities steward their financial infrastructure.

Organizing and Solidarity

While our histories are distinct, there are many parallels between how Black and Indigenous communities have experienced land theft and dispossession, redlining, and food apartheid (a term coined by Black Farmer Fund cofounder Washington). With this recognition, our communities have been coming together in solidarity around deeply aligned visions, values, and strategies.

A common understanding, particularly among those engaged in grassroots organizing and movement building around these efforts, is that replicating the capitalist-driven model of commodified, privatized land ownership for individual wealth building will further exacerbate racial disparities and injustices. Instead, we hold a shared vision of collective ownership and cooperative governance of land to bolster self-determination and our economic power.

Integral to manifesting this shared vision is an alternative way of funding land return and reclamation efforts that heal and repair the harm that the extractive financial system has caused. One of the many innovative funding solutions being developed by Black and Indigenous leaders are nonextractive investment funds that prioritize the needs and priorities of the frontline communities rather than the financial returns or reduced risk for funders and investors.

Models, Structures, and Terms: Disrupting the Financial Landscape

To intervene in the financial world, nonextractive loan funds—like BFF and Moonsoon Fund—are critical. These two funds are led and governed by Black and Indigenous people to ensure that capital flows equitably to community members who are stewarding land, advancing food sovereignty, building on ancestral knowledge and traditions, and contributing to their local economies. Both funds aim to test new terms, structures, and models to reimagine our current economic paradigm.

- Community-led governance structure: Most funds are currently controlled by fund managers and other financial professionals, who typically seek to maximize profit. The barrier to entry is extremely high. BFF instead relies on a community of 10 Black farmers and food systems entrepreneurs across the Northeast to steward the fund. The fund uses a consensus-seeking process for shared decision-making and is guided by values of economic justice, community wealth building, and managing environmental/ecological impact. Grounded in the reality that Black people have been prevented from making decisions about the conditions that affect our lives and livelihoods, BFF offers a place for community members to invest together in each other.

- Integrated capital approach: While conventional finances sometimes combine capital and noncapital support to entrepreneurs and enterprises, an integrated capital approach is not the norm. Popularized by RSF Social Finance, integrated capital is a blend of monetary and nonmonetary resources that support the holistic development of an enterprise.

BFF, for example, uses a blend of financial and nonfinancial resources to provide businesses with loans, gifts, technical assistance, and relationship/network building. BFF has also structured its second fund to attract capital from communities with lived experience. Effectively, investment is structured so that people with limited resources who invest in “community wealth building” notes receive the highest returns and take the least risk, while impact investors and philanthropy accept higher risk and lower returns—basically the opposite of a conventional financing structure where those who are wealthiest and lend the most get the highest return and accept the least risk.

Moonsoon Fund is being developed by Roanhorse Consulting LLC, an Indigenous-led firm that purposefully changes power dynamics to build a world where our children and grandchildren will thrive by approaching finance with a trauma-informed lens—centering lived experience, right relationship, and Indigenous ways of knowing and being. The design of the Moonsoon Fund reflects this vision and approach.

- Challenging perceptions and redefining risk: Historically, “risk” describes the impact on investors. BFF and Moonsoon Fund view risk differently. Instead of asking: “What is the risk of investing in this business?” we ask, “What is the risk of not investing?

The racist and sexist stereotypes and misconceptions that circulate about Black and Indigenous people, farmers, or entrepreneurs being too risky to invest in keep many locked out from accessing capital. We recognize that BIPOC communities are the ones who bear risks to their physical, spiritual, mental, and financial wellbeing daily.

- Redefining returns: We call on funders and investors to expand their thinking beyond the extractive expectations of return in the mainstream funding landscape. For example, a 5-to-7 percent annual return may not be possible for many Indigenous women and Black entrepreneurs, where lower rates over longer periods may be more feasible.

Building for the Future

Moonsoon Fund and BFF demonstrate the possibilities of an alternative economic paradigm when Black and Indigenous communities steward their financial infrastructure. As the saying goes, those closest to the problem are closest to the solution.

Despite the need and growth of both funds, we know there is more work to do to close racial wealth gaps and unfetter the self-determination of BIPOC communities across Turtle Island. These funds can serve as examples for others to mirror and adapt in their communities for significant investments and asset transfers of stolen land—and as a way for those who have benefited to act in a reparative fashion and support burgeoning funds like ours that work at the intersection of reparations and land back movements.

We know that BIPOC self-determination, liberation, and safety depend on being able to access, live, and connect to the very land we come from, care for, and protect. This is a struggle in which we all have a role to play.