The last major revision of the IRS Form 990 was done for the 2008 tax year. Even though it’s been almost a decade, many nonprofit leaders—both staff and volunteer—seem unaware of the annual information return as anything more than something the auditor or CPA fills out as part of their work.

What most people don’t realize is that the changes have made the Form 990 even more a diverse document than it was in the past. They may also not realize that their organization’s 990 is a public document, available online for free from websites such as Guidestar.org and nccs.urban.org. In addition, all nonprofit organizations must keep copies of their last three years’ 990 filings at their principal place of business and make them available for inspection immediately upon request during normal business hours.

The Form 990 tells the public a lot about your organization beyond the basics of income and expense, assets and liabilities. A review of the 990 and its schedules shows that many of the parts of the 12-page core form, and significant portions of the schedules, address non-financial issues such as governance, programs, and fundraising.

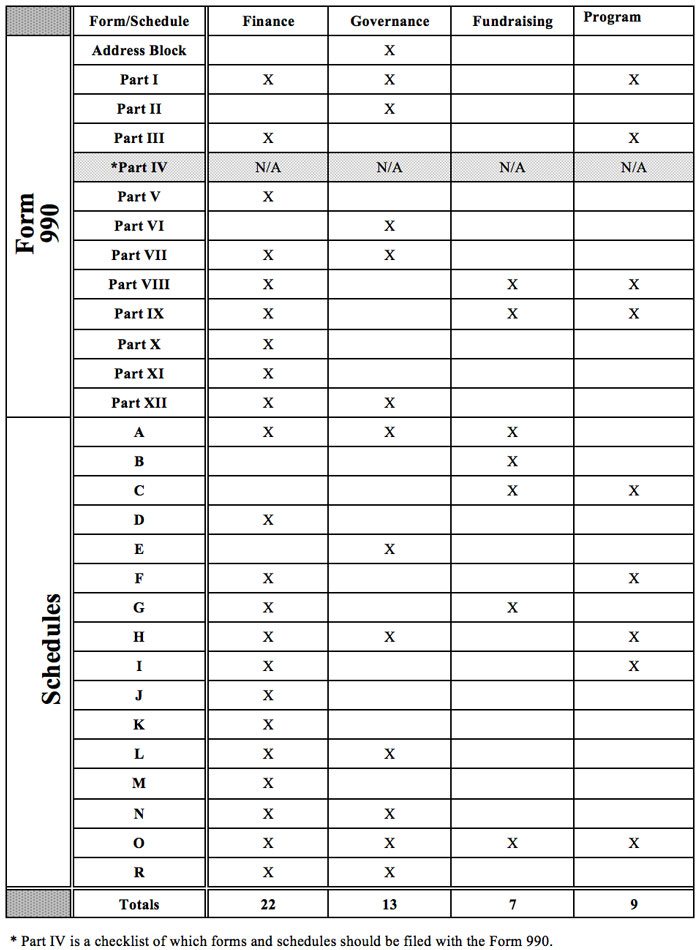

The following chart shows the breakdown of the Form 990 and how each part of the form addresses one or more areas of a nonprofit organization’s existence:

IRS Form 990 and Schedules Breakdown by Functional Area Relevance

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

The chart identifies 51 times the 12 parts of the main Form 990 and the 16 schedules address one or more of the four categories.

Many of the Form 990 parts and schedules address multiple categories of governance, finance, programs, and fundraising. Parts VIII (statement of revenue) and IX (statement of functional expenses) are primarily financial, but they also address both fundraising and program-related information. Schedule O, of course, is the “Supplemental Information” (think “other”) page where explanations about any other part of the 990 or schedules may (and occasionally are required to be) documented.

There are single-purpose areas of the 990. For example, Part VI (governance) is focused exclusively on governance, including governing body and management, policies, and disclosure (how a nonprofit shares information about itself with state governments and the public). Schedule F focuses exclusively on financial matters.

Not all organizations fill out all parts of the main form, and not all organizations file each and every schedule. For example, while most 501(c)(3) public charities must file Schedule B (Schedule of Contributors), it is considered confidential and is not disclosed to the public. Private foundations, on the other hand, must disclose contributions received on the Schedule B and make the schedule publicly available with the rest of their Form 990 return. Some of the Form 990 schedules have a method to their placement order in the alphabet. Schedule H is designed for hospitals; Schedule E is for schools (education); and Schedule F (foreign) is for nonprofits with activities outside the United States. Every nonprofit and every IRS Form 990 filing is different, though many share key characteristics in the areas of the main form and schedules which must be completed and filed.

Don’t dismiss the 990 as a requirement for auditors and finance experts to deal with. Nonprofit staffs, boards, donors, and volunteers should be aware that the publicly available return is a public relations tool that communicates governance, program, and fund development information as well as income and expenses, assets and liabilities. In other words, your nonprofit’s 990 is showing. What is it showing and what conclusions are people drawing from the disclosures—or lack of disclosures—within each year’s form?