This article comes from the summer 2018 issue of the Nonprofit Quarterly, “Nonprofits as Engines of a More Equitable Economy.”

From the middle of 2010 to the end of 2017, the IRS revoked the tax-exempt recognition of more than 760,000 nonprofit organizations for failing to file Form 990 returns.1 More recently, it has implemented the 1023-EZ process, which makes applying for federal tax-exempt status easier. What effect have these changes had on the numbers of nonprofits in our sector? Are there marked differences in trends vis-à-vis 501(c)(3)s and 501(c)(4)s?

This first-of-its-kind analysis is informed by two key data sources. The first is the Internal Revenue Service Data Book, the annual compendium of IRS statistics published since 1863—specifically, the data contained in Tables 24, 24a, and 25 of the Data Books from 2007 through 2017.2 The second data source is the IRS’s automatic revocation data, downloaded from the IRS website.3 A single ASCII file contains all automatic revocations made since 2010. The IRS updates the bulk file monthly. The version used for this analysis was downloaded in January 2018, and included data for the 2010–2017 fiscal years.

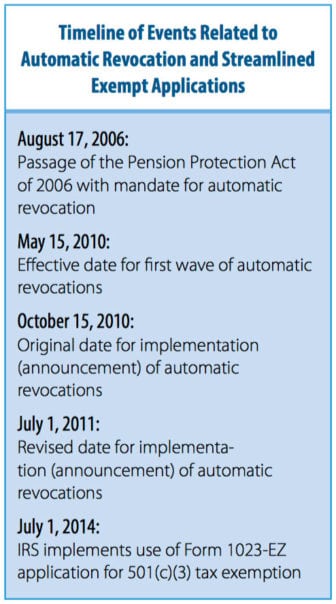

Before 2011, it was impossible to get a sense of the true numbers of federally tax-exempt nonprofits in the United States; this is because there were so many listed nonprofits that never reported to the IRS—either because they were legitimately too small to have to report, or they were defunct, or they were sloppy. No one really knew how many belonged in which category. The Pension Protection Act of 2006, however, changed the reporting requirements by including a provision that requires the IRS to revoke the tax-exempt recognition of any nonprofit that fails to file an annual Form 990 return with the IRS for three consecutive years.4 The IRS was charged with organizing itself to send a written notice of revocation to the last-known address for each nonreporting nonprofit, with revocation happening after the 990 filing deadline passes for the third consecutive year of noncompliance.

The timeline set in place by the 2006 law provided that automatic revocations would begin on May 15, 2010. Using that timeline, almost 400,000 nonprofits—more than 60 percent of them 501(c)(3) charities—were slated to have their exemptions revoked.5 However, the IRS delayed implementation of the revocations from October 15, 2010 (just after the start of the 2011 fiscal year), until the summer of 2011 (the last quarter of the 2011 fiscal year), to make sure that more nonprofits were aware of the law and of their requirement to file.

Many very small nonprofits that had not been required to file a Form 990 or Form 990-EZ in the past were particularly unaware of the new Form 990-N, known as the “postcard” return. The Form 990-N is an electronic form that requires a nonprofit not required to file a 990 or 990-EZ to provide annual updates to basic contact information for the organization. Thus, these smaller groups were at risk of being surprised by the action. To prevent that, the IRS, national infrastructure groups, and the media did broad outreach amplifying the new requirement.

The IRS’s implementation delay gave many organizations the opportunity to bring their filings up to date, but a review of the IRS’s automatic revocation database shows that the FY 2010 and 2011 revocations still affected more than 450,000 nonprofits,6 including 275,000 501(c)(3) public charities and private foundations.7

The IRS posts a list of all automatic revocations to its website, both in a bulk download option and as part of its newly revised “Tax Exempt Organization Search” service, which provides access to basic information about all tax-exempt organizations.8 (The file contains information on automatic revocations only; it does not include any organizations that had their exemption revoked as a result of a review of activities and either an administrative determination by IRS staff or determination by a court.)

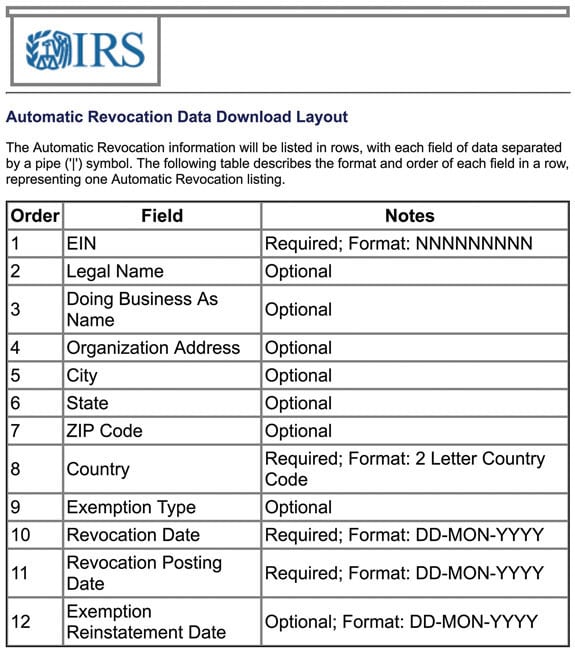

The automatic revocation dataset is very simple, containing twelve fields, only four of which are required, as can be seen in the IRS table at top.9

Interestingly, the exemption type (for example, 501(c)(3), 501(c)(6), etc.) field is optional. Fortunately, only 28,300 out of 761,780 records, or about 3.7 percent, do not have an exemption type identified; they are carried in the database with a 0 value, despite there being no such thing as a 501(c)(0) organization.10

How the Action Affected 501(c)(3)s and 501(c)(4)s

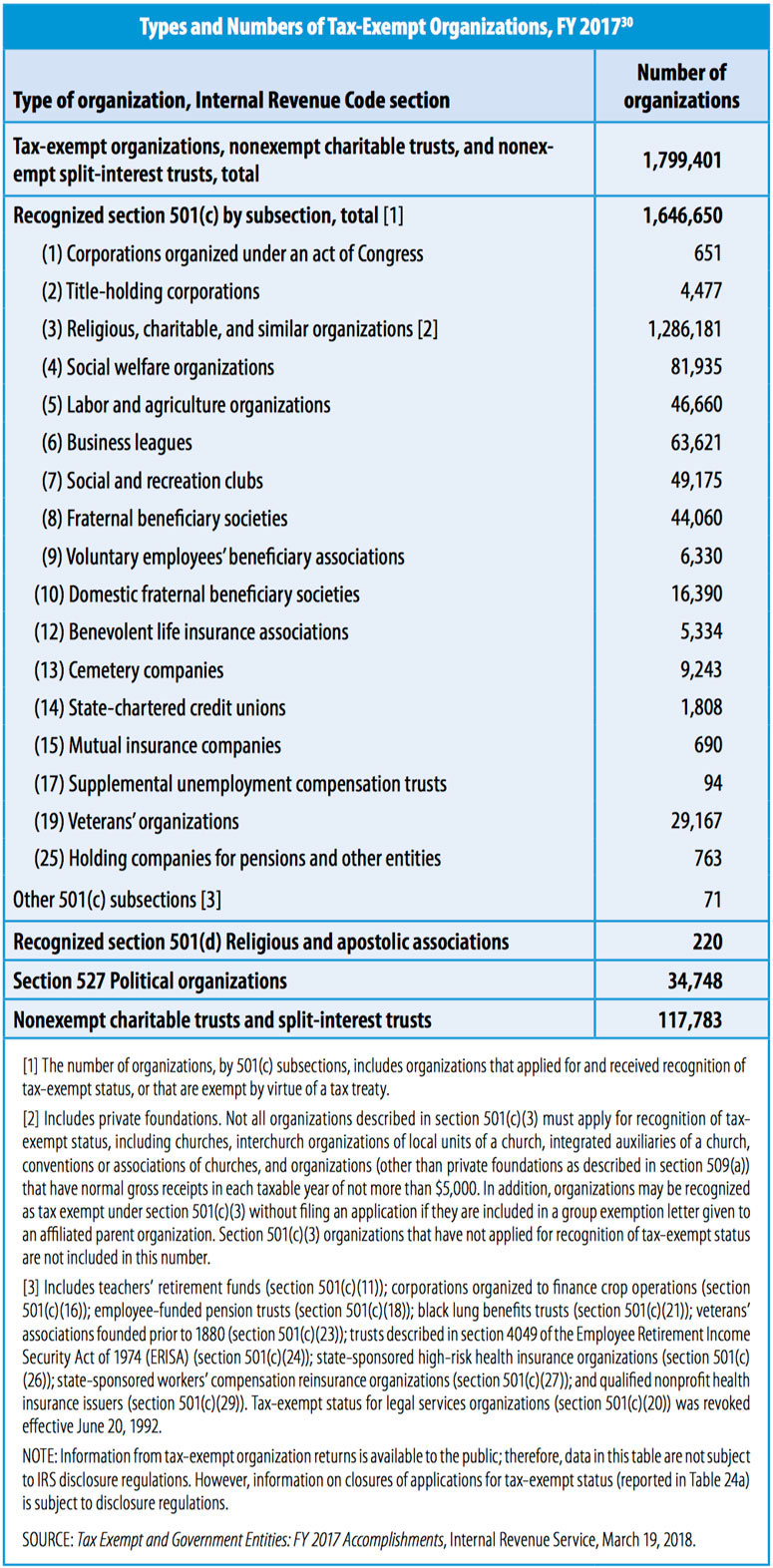

Not surprisingly, 501(c)(3) organizations topped the list of revoked exemptions from 2010 to the end of 2017, representing just under 60 percent of the total. Following 501(c)(3) groups were 501(c)(4) social welfare groups, with almost 16 percent; 501(c)(7) recreation clubs, with about 5.3 percent; 501(c)(6) business leagues, with 4.8 percent; and 501(c)(19) veterans’ organizations, with 2.4 percent.11

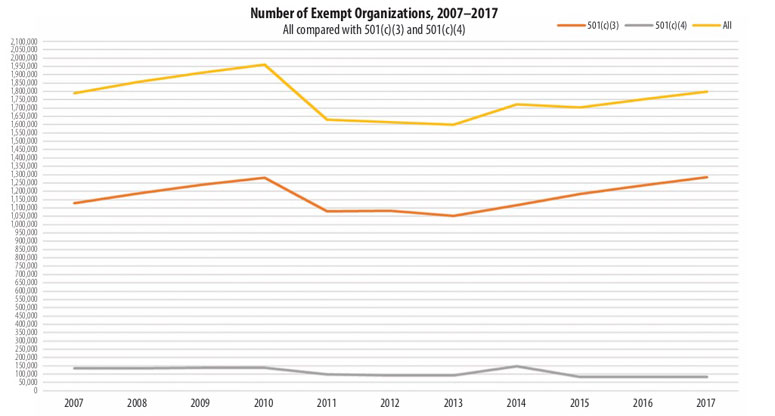

Chart 1

Chart 1 shows each year’s total of all 501(c) organizations and the corresponding totals of 501(c)(3) and 501(c)(4) organizations that are included in the reported total.

- The total numbers of all 501(c)(3) and 501(c)(4) organizations were at or near their highest levels in FY 2010, the last year before automatic revocation was implemented.

- The 501(c)(3) numbers dropped significantly in FY 2011, and only recovered to the FY 2010 level in FY 2017.

- The 501(c)(4) numbers have dropped significantly and steadily since 2010, with the exception of a one-year spike in FY 2014.

- The 501(c)(3) and 501(c)(4) organizations comprise an average of about 67 percent of the total for all 501(c) organizations.

One key finding in reviewing the database is that 501(c)(3) organizations have had their tax exemptions automatically revoked at a lower rate than would be expected, given their premier place among 501(c) tax-exempt groups.

The 501(c)(3) s represented 68.5 percent of all 501(c) organizations in 2010; by 2017, that percentage had increased to 78 percent, based on figures available in the annual Data Book published by the IRS.12

In that seven-year period, as mentioned above, automatic revocations of 501(c)(3)s averaged just under 60 percent of the total, and only approached 70 percent in one year (2015). Automatic revocations made prior to July 2011 (beginning in May 2010) were first publicly posted by the IRS in June 2011. Fiscal year 2011 announcements included 390,168 revocations, including almost 250,000 501(c)(3) private foundations and public charities. This was to be expected, as many long-dormant groups were identified in the first wave of automatic revocations.13

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

In the following years, the number of nonprofits processed through automatic revocation varied, both in total and for 501(c)(3) groups specifically. Total annual automatic revocations for 2012–2017 reached a low of 36,185 in 2015 and a high of 84,478 in 2017. Automatic revocations during the same period affecting 501(c)(3) groups varied from almost 25,000 in 2015 to 36,180 in 2013.14

Significantly, the total number of nonprofits—and the number of 501(c)(3) groups—has essentially remained stable since 2010. Looking at Table 25 of the Data Book is intriguing, because it shows a drop of 200,000 501(c)(3) groups from 2010 to 2011, when the first automatic revocations were announced.15 The 2017 Data Book (latest available) records show there were only 5,442 more 501(c)(3) organizations in that year than there were in 2010. Overall, there were 175,000 fewer 501(c) groups of all tax-exempt classifications in FY 2017 than there were in 2010.16

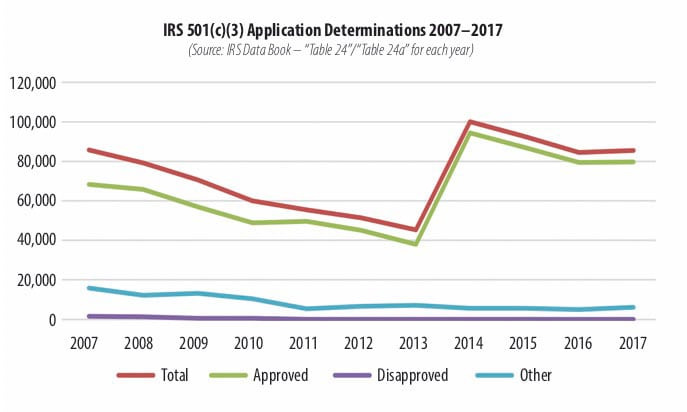

The use of the short Form 1023-EZ for tax exemption as a 501(c)(3), which began in July 2014 (the final quarter of the 2014 federal fiscal year), may be responsible for reversing the downward trend in the number of 501(c)(3) groups seen in 2010 through 2013. The short form was introduced by the IRS in reaction to bad publicity over a growing backlog of Form 1023 long form applications that had reached more than 66,000 during 2013.17 The number of 501(c)(3) applications approved annually by the IRS grew from a low of 37,000 in 2013 to 94,000 in 2014, and remained near or above 80,000 in the 2014–2017 period (see Chart 2). The IRS reports that the Form 1023-EZ was used for 65 percent of all applications for 501(c)(3) tax exemption during FY 2017.18

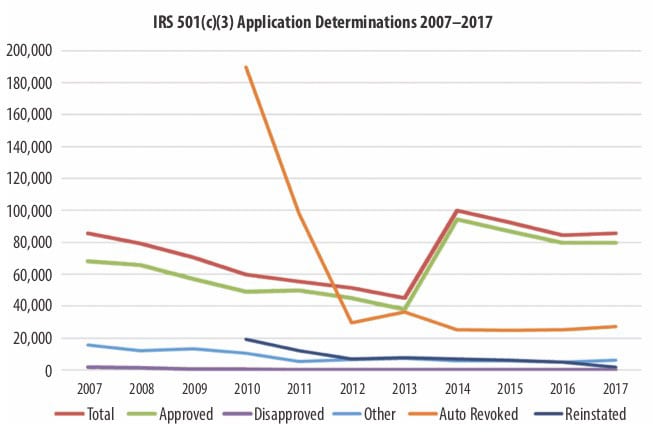

Chart 2

Chart 2 shows annual applications for 501(c)(3) tax exemption received by the IRS and how they were processed, based on Table 24a of the IRS Data Books.

- The overwhelming majority of applications are approved each year.

- Very few applications are disapproved.

- “Other” usually means that the IRS has held the application pending further information from the applicant.

- The trend of new applications declined annually from 2007–2013, spiked in 2014, and retreated from that high in 2015–2017, though the numbers received and approved have remained at high levels since the advent of the 1023-EZ short form application in 2014.

- The numbers of other applications and disapproved applications have remained fairly constant since 2011.

Reinstatements

Nonprofits that have had their tax exemption automatically revoked have the opportunity to apply for reinstatement. For the years 2010 through 2017, 13 percent of all automatically revoked nonprofits have been reinstated by the IRS, totaling just over 98,000 organizations. Typically, the IRS has restored these organizations’ exemptions from the dates they were revoked, so that there is no gap in their record of exemption. However, about one-third of the reinstated organizations have a reported gap during which time they were not tax exempt. The reported gap between revocation date and reinstatement date varies from a couple of months to more than three years.19

The number of reinstatements for 501(c) organizations has dropped each year from 2010 to 2017, beginning with about 33,000 reinstated in 2010 and only about 2,000 organizations reinstated in 2017.20 This may reflect the low number of truly dormant nonprofit organizations of all exemption types, as well as a growing understanding of the need for annual Form 990 reporting using one of the options available to filers.

Chart 3

Chart 3 adds to the previous chart depicting handling of new applications for 501(c)(3) tax exemption by including automatic revocation and reinstatement data for 2010–2017.21

- Automatic revocations for 501(c)(3) organizations started out high in 2010 and 2011, with more organizations being automatically revoked than new applications for exemption were received by the IRS.

- Revocations of 501(c)(3) organizations have remained stable since 2014, with automatic revocations occurring at a level approximately 30 to 35 percent of new 501(c)(3) tax exemption applications received.22

- The number of 501(c)(3) groups having their tax exemption reinstated after having been automatically revoked is a small percentage of the total revoked—and, of course, a much smaller number than for new applications approved.

- Annual reinstatements of exemption for 501(c)(3) organizations have declined since automatic revocation started in 2010, from a high of 19,379 in that year to a low of 1,821 in 2017.23

501(c)(4) Mysteries

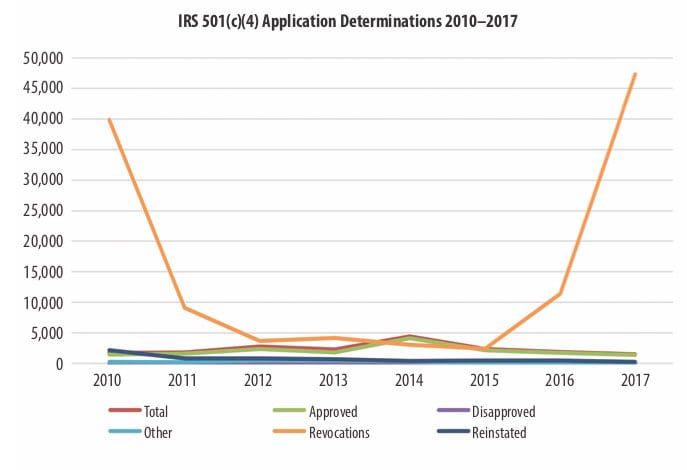

Two findings without an explanation are: (1) the changes in the number of 501(c)(4) organizations between 2010 and 2017; and (2) the extraordinary number of 501(c)(4) groups that were automatically revoked in 2017. There were almost 140,000 501(c)(4) organizations in 2010; by 2017, that number had dropped to just under 82,000—a reduction of more than 40 percent that is not explained by the automatic revocation data for those years.24 In 2017, 58 percent of all automatic revocations made by the IRS were to 501(c)(4) groups (47,315 out of 77,077), a significant departure from the annual average of 15 percent.25 This may be due to an extraordinary number of 501(c)(4) groups being active during the 2012 and/ or 2014 election cycles and subsequently failing to file 990s beginning in 2014, resulting in automatic revocation in 2017. This theory may be supported by the jump in 501(c)(4)s from 91,000 in 2013 to more than 148,000 in 2014, followed by a drop to 84,000 in 2015.26 However, if the automatic revocation of 501(c)(4) organizations was due primarily or solely to the 2014 spike in 501(c)(4) groups, that spike should have continued through 2016 and even into 2017.

Chart 4

Chart 4 shows new tax exemption application determination activity and automatic revocation and reinstatements for 501(c)(4) groups between 2010 and 2017.27

- New applications, approvals, disapprovals, and other activity (typically applications held by the IRS awaiting additional information from the applicant) closely follow trends seen in 501(c)(3) applications and for all nonprofits generally.

- In general, 501(c)(4) applications account for less than ten percent of all exemption applications for a given year.

- There was a spike in applications and approvals in 2014, with a steady decrease in annual 501(c)(4) applications in 2015–2017.

- Automatic revocation of 501(c)(4) organizations was a relatively small percentage of all revocations for each year until 2017, when 49,426 501(c)(4) revocations accounted for almost 60 percent of the total of 84,478 automatic revocations for the year.

It should also be noted that, until recently, new 501(c)(4) groups were not required to apply for tax exemption or otherwise notify the IRS of their formation until their first Form 990 was due to be filed. However, beginning in 2016, new 501(c)(4) groups are now required to file Form 8976—a “Notice of Intent to Operate”—with the IRS within sixty days of formation.28 In 2017, the IRS acknowledged 1,908 forms and rejected 474 for purely technical reasons unrelated to a judgment about their proposed activities.29

…

We now have several years of data on IRS automatic revocations covering almost 800,000 organizations. A few trends can be identified:

- After the initial wave of automatic revocations in 2010–2011, the trend is that automatic revocations for all types of nonprofits are reaching an equilibrium in the vicinity of 44,000 organizations annually—with the exception of the 501(c)(4) revocations in 2017 as a significant outlier.

- Reinstatement of tax exemption once automatically revoked is decreasing each year, accounting for less than 10 percent of all revoked organizations.

- The 501(c)(3) groups are not only automatically revoked at a greater rate than other types of nonprofits but also are revoked at a higher percentage rate than the percentage of 501(c)(3)s relative to all 501(c) organizations.

- Automatic revocations reported in 2011 affected approximately 20 percent of 501(c)(3) organizations recognized by the IRS in 2010, and the total number of 501(c)(3) organizations took until 2017 to recover to 2010 levels.

- The number of 501(c)(4) organizations has declined significantly since 2010, with the exception of a spike in 2014 and a 40 percent drop the following year—a drop not reflected in the automatic revocation database at the time.

In future years, the Internal Revenue Service Data Book may be redesigned in such a way as to allow for inclusion of automatic revocation information as a distinct dataset of interest. In the meantime, the bulk download of the Excel spreadsheet and searching the IRS website provide the opportunity for researchers and others to examine and interpret information about tens of thousands of nonprofits each year that lose tax exemption without human interaction or determination.

Notes

- Author’s own analysis, using “Tax Exempt Organization Search Bulk Data Downloads,” Internal Revenue Service, accessed January 12, 2018. (Note: This hyperlink leads to the current version of the file accessed in January 12, 2018 via a different link that no longer functions. The IRS changed the location of the data from the time of the author’s access. All references in this article to the “Tax Exempt Organization Search Bulk Data Downloads” are from January 12, 2018 access date.)

- The Internal Revenue Service Data Book, Department of the Treasury (Washington, DC: Internal Revenue Service); and “Tax Exempt Organization Search Bulk Data Downloads.” Note: each IRS Data Book covers one fiscal year. Charts in this article that address multiple years and cite the IRS Data Book tables (“Table 24,” “Table 24a,” and “Table 25”) reflect the same table or tables from multiple Data Books covering those years. “Table 24” is titled “Table 24. Closures of Applications for Tax-Exempt Status, by Organization Type and Internal Revenue Code Section, Fiscal Year [2010, 2011, 2012, 2013, 2014, 2015—the years referenced in this article]”; “Table 24a” is titled “Table 24a. Closures of Applications for Tax-Exempt Status, by Organization Type and Internal Revenue Code Section, Fiscal Year [2016, 2017—the years referenced in this article]”; “Table 25” is titled “Table 25. Tax-Exempt Organizations and Nonexempt Charitable Trusts, Fiscal Years [2007–2010, 2010 and 2011, 2011 and 2012]” and “Table 25. Tax-Exempt Organizations, Nonexempt Charitable Trusts, and Nonexempt Split-Interest Trusts, Fiscal Year [2013, 2014, 2015, 2016, 2017—the years referenced in this article].” Following notes that reference these IRS Data Books and tables are abbreviated, unless the Data Book from a specific year was used, in which case the full source is cited.

- “Tax Exempt Organization Search Bulk Data Downloads.”

- Pension Protection Act of 2006, Public Law 109–280—Aug. 17, 2006, 109th Cong. (2006).

- Stephanie Strom, “One-Fourth of Nonprofits Are to Lose Tax Breaks,” April 22, 2010; and “Automatic Revocation of Exemption List,” material from the IRS website archived by “Wayback Machine,” accessed May 29, 2018.

- “Tax Exempt Organization Search Bulk Data Downloads.”

- Amy S. Blackwood and Katie L. Roeger, Revoked: A Snapshot of Organizations That Lost Their Tax-Exempt Status (Washington, DC: Center on Nonprofits and Philanthropy, The Urban Institute, August 2011), 1.

- “Tax Exempt Organization Search Bulk Data Downloads”; and “Tax Exempt Organization Search,” Internal Revenue Service, accessed January 12, 2018.

- “Automatic Revocation Download Layout,” from “Tax Exempt Organization Search Bulk Data Downloads.”

- “Tax Exempt Organization Search Bulk Data Downloads.”

- Ibid. Note: Author used the IRS automatic revocation database data to calculate the presence of each exemption type as a percentage of the total number of records in the database file.

- “Tax Exempt Organization Search Bulk Data Downloads”; and The Internal Revenue Service Data Book 2017: October 21, 2016 to September 30, 2017, Publication 55B, Department of the Treasury (Washington, DC: Internal Revenue Service). Note: Author made calculations based on information from both sources for the applicable years.

- All calculations were made using data from “Tax Exempt Organization Search Bulk Data Downloads.”

- “Tax Exempt Organization Search Bulk Data Downloads.”

- “Table 25. Tax-Exempt Organizations, Nonexempt Charitable Trusts, and Nonexempt Split-Interest Trusts, Fiscal Year 2017,” The Internal Revenue Service Data Book 2017, 57. Note: Data Book figures from multiple years are obtained from each year’s IRS Data Book.

- The Internal Revenue Service Data Book 2017. Note: Author made calculations based on information for the applicable years.

- Michael Wyland, “Widespread Form 1023-EZ Abuse Reported by IRS,” Nonprofit Quarterly, January 8, 2016.

- Tax Exempt and Government Entities: FY 2017 Accomplishments (Washington, DC: Internal Revenue Service, March 19, 2018), 6.

- Calculations were made using data from “Tax Exempt Organization Search Bulk Data Downloads.”

- Data is from “Tax Exempt Organization Search Bulk Data Downloads.”

- Calculations were made using data from “Tax Exempt Organization Search Bulk Data Downloads;” and “Table 24”/“Table 24a” (for referenced year/s). Note: This chart reflects around 20,000 reinstatements in 2010, to give a sense of the overall picture. The relative scale of the numbers makes it difficult to represent the reinstatements fully on a single chart.

- “Table 24”/“Table 24a.” Note: Calculations were performed based on data from these tables for the referenced years.

- “Tax Exempt Organization Search Bulk Data Downloads.”

- All calculations were made using data from “Tax Exempt Organization Search Bulk Data Downloads”; and “Table 25” (for referenced year/s).

- “Tax Exempt Organization Search Bulk Data Downloads.”

- “Table 25” (for referenced year/s).

- Data for the referenced years taken from “Tax Exempt Organization Search Bulk Data Downloads”; and “Table 24”/ “Table 24a.”

- “Electronically Submit Your Form 8976, Notice of Intent to Operate Under Section 501(c)(4),” Internal Revenue Service, May 4, 2018.

- “Table 24b. Receipts of Forms 8976, Notices of Intent To Operate Under Section 501(c)(4), Fiscal Year 2017,” The Internal Revenue Service Data Book 2017, 56.

- “Table 25,” The Internal Revenue Service Data Book 2017, 57.