September 7, 2018; The Conversation

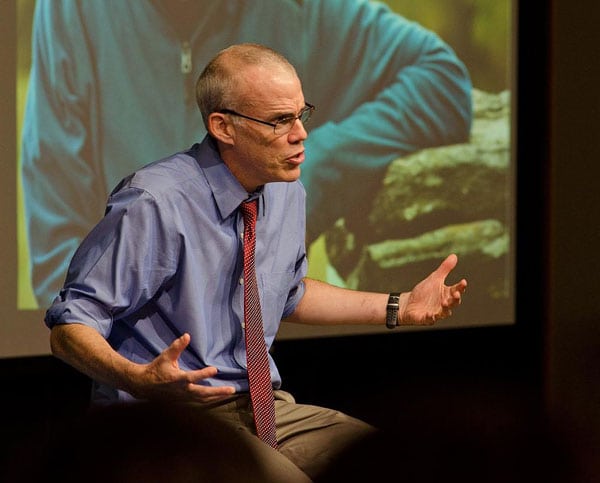

It’s been six years since activist Bill McKibben called for institutions to divest assets from fossil fuel companies, declaring in Rolling Stone that fossil fuel companies were “Public Enemy Number One to the survival of our planetary civilization.” Writing in The Conversation, Jennie Stephens, Director of the School of Public Policy at Northeastern University, takes stock of the movement as it turns six.

Climate advocacy, notes Stephens, “has become well established on US campuses over the past decade,” with over 600 schools signing the American College and University President’s Climate Commitment. But McKibben’s call for colleges to divest their holdings in fossil fuel companies has found fewer adherents. “So far,” notes Stephens, “only about 150 campuses worldwide have committed to fossil fuel divestment—and less than a third of those are in the United States.”

While only a limited number of schools have divested, student and faculty support for divestment is high. A survey at Harvard last spring, for instance, found 67 percent of faculty favored divestment, with nine percent opposed and 24 percent neutral.

Stephens argues there are two main obstacles to making divestment more widespread. “First,” Stephens writes, “divestment is controversial because it acknowledges the need for radical change.” There’s also a disconnect in institutional priorities between administrators and their students and faculty. Harvard, for instance, despite overwhelming faculty support for divestment and even pressure from one of its own trustees, has yet to shift assets away from fossil fuels.

One reason administrators cite, says Stephens, is “their fiduciary responsibility to maximize returns on endowment investments.” However, a study published earlier this year in the Journal of Ecological Economics found that, if, for the 1927–2016 period, you compared a portfolio with fossil fuels stocks from one without, portfolio performance is not affected.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Stephens suggests that some university leaders may oppose divestment to avoid alienating constituents connected to the fossil fuel industry. Stephens adds university leaders may feel pressure “to protect direct or indirect funding from fossil fuel companies for academic programs, or to maintain a non-threatening environment for board members with fossil fuel interests.”

That said, to date more than 40 US colleges have divested themselves of at least some fossil-fuel stocks. The University of Massachusetts board, for example, voted unanimously to “divest from all direct fossil-fuel holdings in its $770 million endowment” in May 2016. Syracuse University divested a year earlier. And a few prominent universities—including Columbia, Stanford, and Georgetown—have divested from coal companies. Georgetown also recently decided to pull out of the tar sands industry.

Prodded by growing climate change-related weather disruptions, worldwide some 985 institutions with $6.24 trillion in assets have divested at least some assets from fossil fuel industries. While universities are highly visible, faith-based institutions and foundations often lead the way. Also, public pension funds (including the two largest public employee pension funds in California) and city governments—including such cities as Madison, Wisconsin; Minneapolis, Minnesota; Portland, Oregon; Seattle, Washington; and San Francisco, California, with New York City expected to follow— have divested. Internationally, in July 2018, the Irish parliament passed a bill that, once the upper house concurs, as expected later this year, would make Ireland the first country in the world to divest from fossil fuels.

As NPQ’s Rick Cohen observed when discussing McKibben’s motivation for launching the campaign, the idea is not that divestment will stop fossil fuel companies from accessing investment dollars on capital markets. Rather, as McKibben put it in a Washington Post op-ed years ago, “Divestment will undercut the industry’s political power, just as happened a generation ago when the issue was South Africa and hundreds of colleges, churches, and state and local governments took action…divestment is one tool to change the zeitgeist, so that the day arrives more quickly when the richest and most powerful can no longer mock renewable energy and play down climate change.”

Divestment, Cohen also noted, has played such a role before, not just by undermining support for South Africa’s apartheid regime, but, more recently, in undermining support for the tobacco industry. “When Harvard University divested from tobacco, the reverberations were powerful and have continued,” Cohen wrote a few years ago.

With fossil fuels, when might a tipping point arrive? That’s hard to say. Certainly, pressure on trustees to divest is likely to increase. As noted in NPQ earlier this year, hundreds of universities have declared a public mission that involves, simply put, living their values in their actions. As Stephens puts it, “At this moment in human history, education must engage with how to bridge the gap between knowledge and action. Divestment debates are forcing colleges and universities to reconsider how to contribute to a more resilient and sustainable future.”—Steve Dubb