November 9, 2019; The Conversation

Philip Hackney used to work as an expert on charitable law at the IRS, and in an article in The Conversation, he reminds us that even though the Donald J. Trump Foundation can now be considered defunct, and Trump has been personally fined $2 million for the misuse of charity, he may still be liable for more penalties at the federal level.

Hackney says the admissions made by Trump in settling the case are nothing less than “startling,” revealing patterns of neglect and flagrant, and repeated abuse. The board, made up of his three children, did not bother to meet between 1999 and 2018, and the instances of self-dealing were many and varied.

New York Supreme Court Judge Saliann Scarpulla ruled that the directors also failed to “provide oversight, set policy or approve the direction, operations or acts of the foundation.”

Among other things, Trump donated $25,000 from the foundation to support the reelection campaign of then-Florida Attorney General Pam Bondi, who was just recently tapped to join Trump’s legal team resisting impeachment.

Trump has launched his usual offensive defense, insisting over Twitter, “All they found was incredibly effective philanthropy and some small technical violations, such as not keeping board minutes.” He also referenced his decision to move his official residence from New York City to Palm Beach, Florida.

Hackney writes, “It’s unprecedented that a sitting president of the United States officially admits to this kind of wrongdoing and agrees to formal supervision if he should ever venture back into the charitable world. And while it’s not unheard of, it’s uncommon for legal authorities to order anyone to spend millions of dollars to compensate the public for misusing charitable funds under their control.”

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

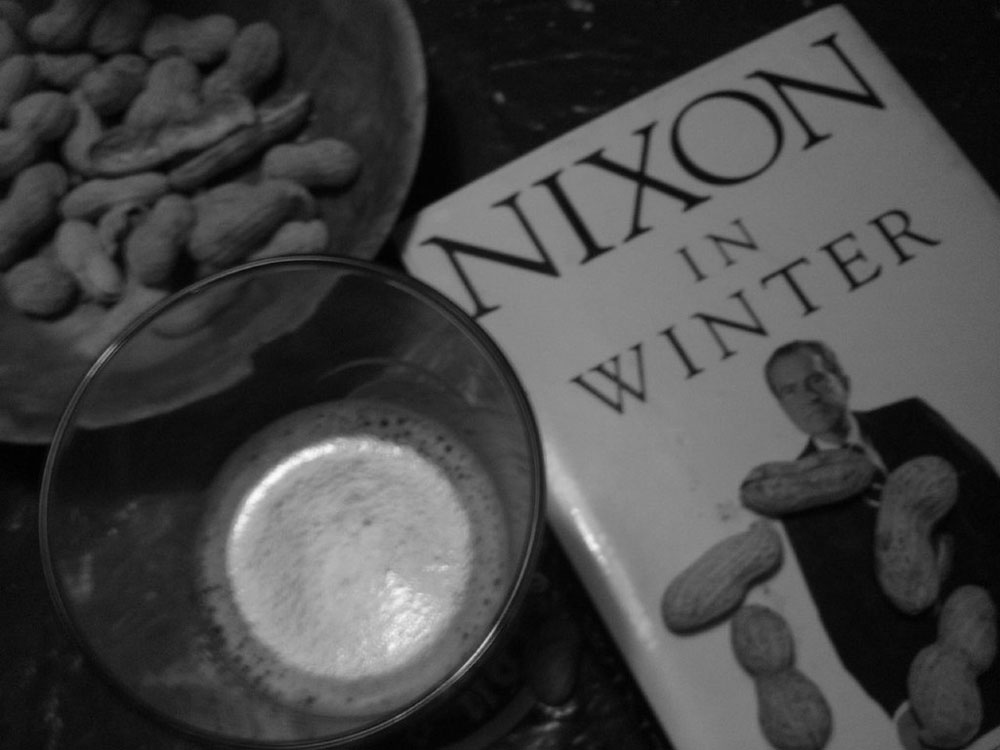

Hackney contends that the closest precedent involving the White House and charitable transgressions involved, perhaps revealingly, President Richard Nixon:

President Richard Nixon’s attorneys falsified documents from him to take a tax deduction on the value of his pre-presidential papers he said he’d donated to the National Archives prior to July 25, 1969.

After an IRS employee leaked information about Nixon’s tax return, he agreed to allow the Joint Committee on Internal Revenue Taxation to examine the propriety of his returns from that time. It found other failures to boot. Nixon had to pay more than $450,000 in back taxes and interest.

Nixon also allegedly exchanged $2 million in dairy industry campaign contributions for increasing milk subsidies. Those revelations came out in the middle of the Watergate inquiry that led to his exit from office.

He also writes that although the New York attorney general’s office may consider themselves done with this ugly instance of petty greed and corruption, the IRS may not yet be satisfied in that “tax law clearly bars charities like the Trump Foundation from attempting to ‘influence the outcome of any specific public election.’”

“I believe that the foundation could owe a 10 percent excise tax of the amount involved—$282,300,” Hackney says. “The precedent for this would be the $2,500 Trump paid to the IRS in 2016 after reimbursing the Foundation for the $25,000 Bondi campaign contribution.”—Ruth McCambridge