Yesterday, on February 10, the House of Representatives’ Education and Labor Committee approved a bill to raise the minimum wage, moving it on for final consideration by the full House. The committee’s act marks an important step forward on the quest for economic justice. It also launches a new round of struggle over a minimum wage that has remained frozen for years.

As NPQ noted, the movement to raise the minimum wage suffered a setback last week when the US Senate voted to bar increasing its level until the pandemic subsides. Nonetheless, the long-term effort to raise the wage floor to $15 an hour continues, with the House committee vote a big step in that direction.

Earlier this week, the nonpartisan Congressional Budget Office (CBO) released its assessment of the Raise the Wage Act (HR 603) which, if enacted, would increase the long-stagnant federal minimum wage to $15 by 2025 and index it to inflation thereafter, as well as eliminating sub-minimum wage exceptions for young and disabled workers and for tipped workers at restaurants. The CBO’s findings provide ammunition for both supporters and opponents of higher minimum wages. The study’s authors found that the bill would provide 17 million workers with a pay increase, and another 10 million workers who earn slightly above the new minimums would likely see their paychecks rise. For 900,000 workers, the increase would move them out of poverty.

Andrew Hsu of National Public Radio notes that Economic Policy Institute (EPI) research finds that the measure would “boost income for people of color, who make up a disproportionate share of low-wage workers. Nearly one-third of African American workers and one-quarter of [Latinx] workers would see raises.”

In short, bringing the federal minimum wage up to $15 an hour would be an important step toward both economic and racial justice. But these gains have a cost. The CBO projects that employers would shed 1.4 million jobs, with young workers disproportionately affected.

It should be noted that the CBO’s estimate is highly controversial. Many economists believe the effects of increased demand from higher minimum wages would completely offset the elimination of jobs that might result from companies shedding low-wage workers. A group of EPI economists state plainly, “We believe that the CBO’s assumptions on the scale of job loss are just wrong.”

The CBO also estimates a modest cost of $54 billion over 10 years to government. Again, the EPI economists beg to differ, noting that “exaggerated job loss assumptions account for 80 percent of the total increase in mandatory outlays.” Of course, even if the cost were $5.4 billion a year, that’s still a modest amount—a tiny fraction of the $2 trillion-and-change cost of the CARES Act.

The debate over the minimum wage is too often posed as a binary. For progressives, the direction forward is clear. From the perspective of the House’s progressive caucus, the increase is an important and necessary step in aiding our nation’s struggling economy. In a press release, they write:

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

First, it is essential that this package increases the minimum wage to $15 an hour. Our current minimum wage is an abhorrent, immoral poverty wage—and it’s particularly shameful that frontline workers are being asked to risk their lives in a pandemic while being denied a decent, livable wage.

For conservatives, the costs to business and the potential job loss are too high. Senator Joni Ernst (R-IA) contends that, “A $15 federal minimum wage would be devastating for our hardest-hit small businesses at a time when they can least afford it.”

Yet while Ernst emphasizes harms to small business, the CBO report contends the costs would mainly fall on the wealthy. The authors note that “the share of total income derived from labor would rise, on net, and the share derived from capital would fall.” Specifically, “corporate profits would be lower, reducing dividend income. Other types of nonwage personal income, such as proprietors’ income, would also decline.”

Of course, we have long seen the opposite—a longstanding pattern of income shifting from workers to owners of capital, on the scale of over $5,000 per worker. Just two years ago, Jerome Powell, chair of the Federal Reserve, called that shift “very troubling.” And amid the COVID economy, inequality has worsened at an alarming rate. Raising the minimum wage would help even the scales.

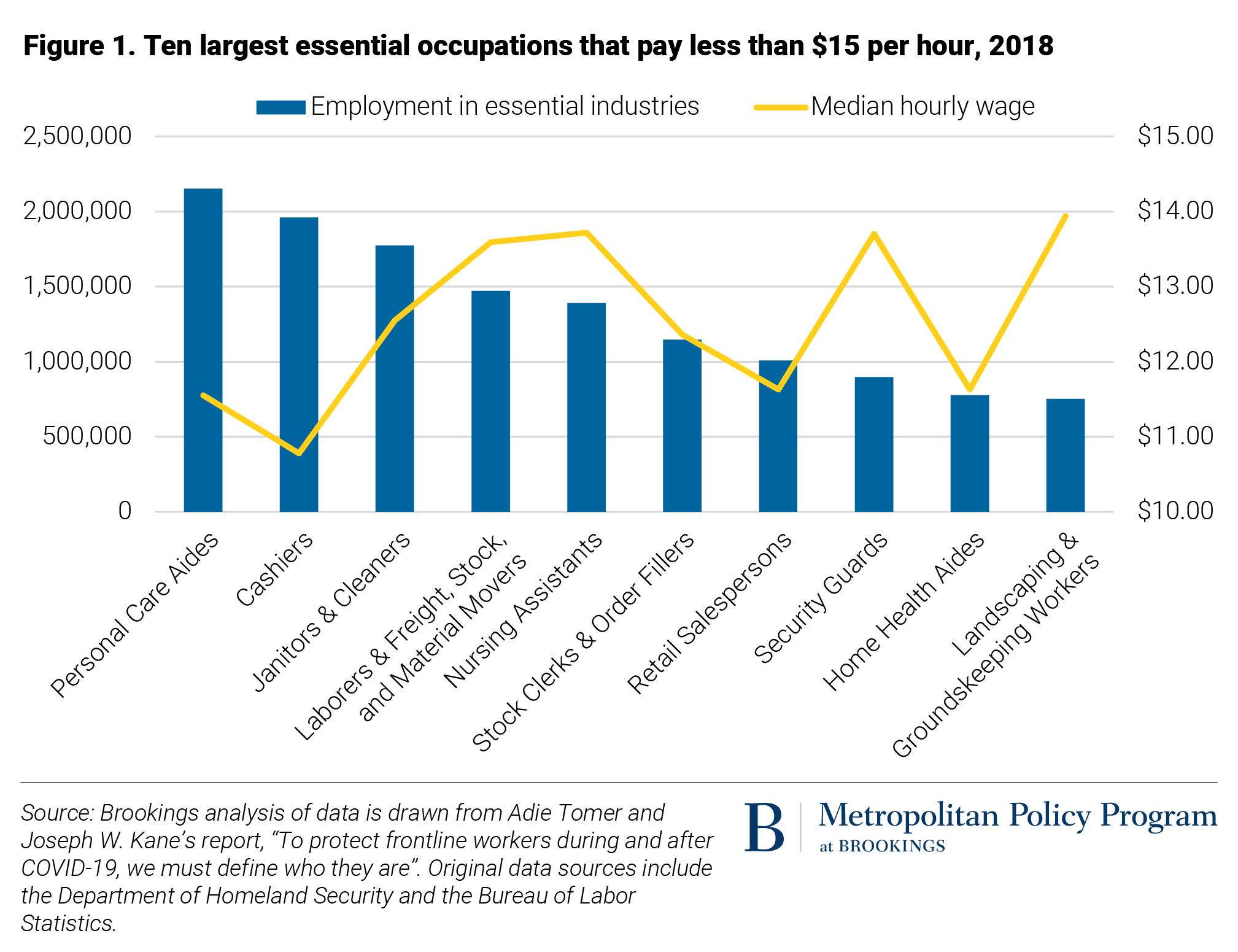

We know too from work done by the Brookings Institution that the benefits of a wage increase would accrue to large numbers of those in jobs the pandemic has painfully taught us are “essential”: “In 2018, 47.7 million US workers were in occupations with a median wage of less than $15 per hour. Of these, 47.7 million workers, 22.3 million were in occupations considered ‘essential.’” Employment levels and current wage levels in 10 of these industries are illustrated on the chart below.

The pandemic has spotlighted the importance of essential workers, but the rewards have fallen largely to their employers. Brookings, looking at 13 of the nation’s biggest retail and grocery stores, found that “in the first three quarters last year, these companies combined made an additional $17.7 billion in profit during—and largely because of—the pandemic. Yet few companies shared those windfall profits through sustained hazard pay, and even fewer raised wages above typical starting pay of around $11 an hour.”

NPQ has been covering the ongoing efforts to respond to the financial harm of the pandemic and the inequities that underlie the nation’s economy. In our writing, we have come to understand that this issue is not just about wages, but workers’ lives.

Workers cannot be expected to struggle under unlivable wages. The key issue is poverty, not just wages. To address this requires rewiring a skewed economy, one that currently rewards a small segment of the population with immense wealth, while keeping far too many trapped in a life of economic struggle.—Martin Levine