March 23, 2016; Bloomberg Business

NPQ has long been covering various proposals by often cash-strapped governments at the state and municipal levels to tax or levy payments from large local nonprofits—most often hospitals and universities.

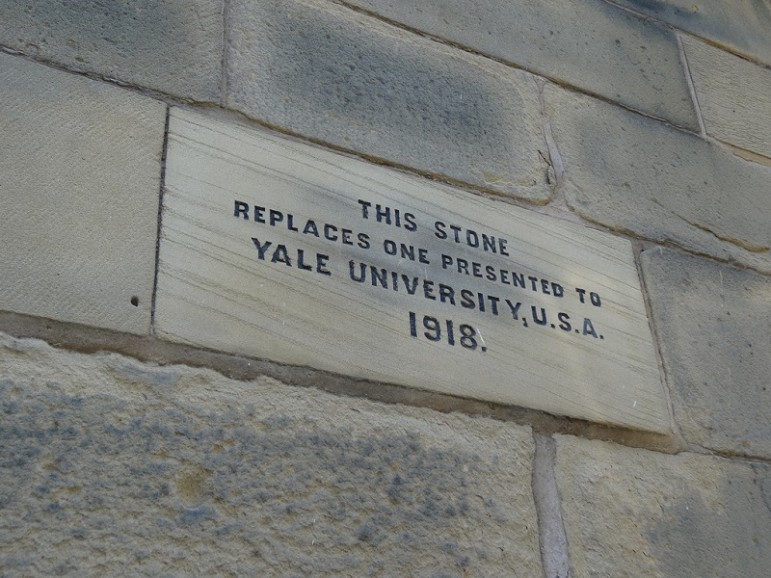

Now, Connecticut State Rep. Susan Johnson (D-Windham) has filed a bill that would require higher education institutions with endowment funds of $10 billion or more to pay a tax on the portion of their endowment investment gains not spent for mission-related purposes. But wait! How many schools can there be in the state with such an endowment? That’s right, only Yale, whose $25.6 billion endowment earned a cool $2.6 billion in investment gains—or, in other words, earned a return of 11.5 percent in fiscal 2015. On the other hand, Connecticut is facing a 2016 state budget shortfall of $266 million.

Yale already makes an $8.2 million voluntary payment in lieu of taxes (PILOT) to New Haven, and both the school and the city are opposing the bill. Richard Jacob, the school’s associate vice president for federal and state relations, deems this bill, as well as one that would tax college property, as a “specific attack on higher education.”

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

“The proposed taxes on Yale would diminish the university’s ability to carry out its charitable mission and to enable and support growth in New Haven,” Jacob wrote. “Yale’s generous financial aid policies, which enable Yale College students to avoid any loans, and which waive any parent contribution for low-income students, exist because of the endowment.”

The only endowment that tops Yale’s is Harvard University’s, at $37.6 billion.

The U.S. Senate Finance and House Ways and Means committees also have their eyes on the legitimacy of the increasingly large endowments of some colleges and universities.—Ruth McCambridge