In the Locked Out: Black Women, Wealth, and Homeownership series, members of Insight Center, Springboard to Opportunities, and several expert co-authors connect the lived experiences, hopes, and dreams of low-income Black women and their perspectives on homeownership to the historic and current policies that fuel our exclusionary housing market—and its impact on health and wellbeing—to advocate for equitable housing solutions for Black women.

Homeownership has long been touted as a primary wealth-building mechanism for the white middle class. As such, expanded homeownership is often presented as necessary to rectify racial and gender wealth inequalities. The reality of the US housing market, however, is that Black Americans have been either shut out from it or preyed upon, resulting in a significant loss of Black wealth.

These historic inequities coupled with rising living costs and sex-based discrimination have further delayed homeownership for many Black women, locking them out of the US middle class. Shameka, a mother of three living in downtown Atlanta, says inflation has derailed her plans indefinitely: “I had my mind set on purchasing or renting a home by the end of last year, but with the price of bills going up we are not able to afford to move right now, or to even save to move.”

Tools that help white people build wealth are not the same for Black people because the systems and institutions that enable wealth building are themselves discriminatory. While many would like to believe that financial progress has been made for Black Americans, in fact, racial wealth inequality has actually worsened as a result of the pandemic and persistent structural racism in the labor and housing markets. The percentage gap between white and Black homeownership is wider in the US today than it was in 1900.

The truth is, when you compare white and Black wealth, a true Black middle class does not exist in America, as the impact of systemic racism complicates the core belief that homeownership is a pathway to wealth building for Black families. In 2016, the median net worth for all households was $97,300; 64 percent of Black households had a net worth less than this median. The median wealth of Black households, meanwhile, was $22,150. In other words, half of Black households had less than $23,000, whereas almost 70 percent of white households had a net worth of nearly $100,000 or more. Given this massive disparity, Black families are at a significant disadvantage when it comes to accessing the wealth needed to purchase and maintain a home. The numbers don’t lie when it comes to wealth-building: what works for white middle-class families cannot work for Black families.

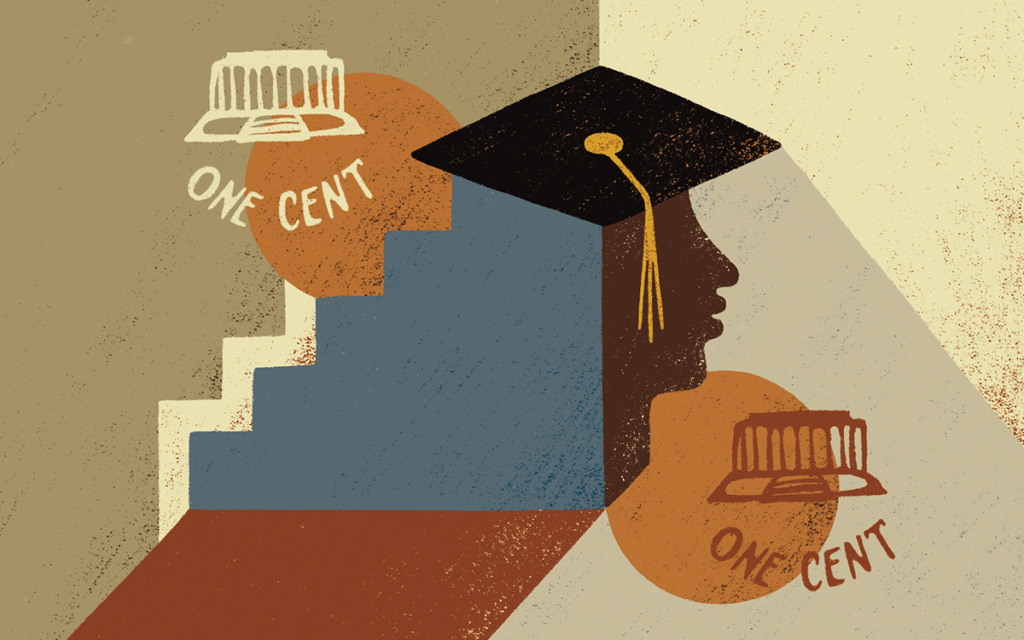

Black women are often forced into multiple streams of debt, as our economy is built to extract wealth from them disproportionately, presenting a major barrier to homeownership. For example, Black women are saddled with more student debt than any other group, as they are less likely to come from families who have the resources to help them pay for college. This is emblematic of the ways in which inequities intersect and build on top of one another, multiplying poor outcomes.

Black women are also often responsible for taking care of their families’ financial needs. Ella Baker Center’s 2015 Who Pays report, which examines the financial and emotional costs to family members with incarcerated loved ones, shows that 63 percent of court related costs associated with conviction were paid for by family members on the outside—83 percent of whom were women. The report also finds that close to 90 percent of phone call costs—controlled by an industry that is privatized and monopolized—were paid for by women. Because Black people are overrepresented in prison due to targeted policing of Black communities and biased court rulings, Black women are forced to shoulder these exorbitant costs, often taking out predatory loans or increasing their credit card debt to connect with their loved ones.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Systemic racism and sexism in the workplace mean Black women are less likely to earn enough to pay those loans back. As the Department of Labor notes, Black women earn 63 cents on every dollar that white men earn. A college degree ups a Black woman’s earnings by only two pennies—to a meager 65 cents for every dollar a white man with the same degree earns. The gender disparity in college completion is even greater among Black millennials; Black women completed college at almost twice the rate of Black men (22.76 percent and 13.36 percent, respectively). Yet, the median wealth of Black male millennials ($8,105) was two and a half times greater than that of Black female graduates ($3,316).

Black women’s limited earning power translates to Black households generally—professional Black households had $38,800 in median wealth versus the $276,000 possessed by the typical professional white household. Wealth differences widen dramatically as Black Americans become more educated. As Insight Center laid out in its paper, Still Running Up the Down Escalator, white heads of households with a professional or doctorate degree have more than $930,000 in wealth than comparable Black households. The gap between the Black and white middle class is truly a million-dollar problem.

Given such a severe wealth imbalance, homeownership is more costly for Black homeowners—even if they can overcome the odds. Due to unfair property assessment, they pay more in property taxes, and must spend more of their income on housing than white people typically do, thanks to a range of systemic issues. Housing market discrimination and residential segregation diminish the value of Black houses, which, in contrast to most white-owned homes, depreciate over time. Unlike their white counterparts, Black homeowners are unable to access or build their wealth via home equity; the property values of houses located in majority-Black neighborhoods are devalued by half compared to equivalent homes in neighborhoods without Black residents.

It is also important to understand that the financial capital needed for homeownership includes more than a down payment. Homes require routine upkeep—such as roof repair, landscaping, electrical or plumbing issues—and are also increasingly at risk from damage due to climate change-related disasters such as floods and fires. Segregated Black neighborhoods are more likely to experience floods, but Black families typically have fewer resources to recover from a disaster. When federal or nonprofit assistance is available to victims of natural disasters, Black families often find that they do not qualify for relief because of informal land ownership arrangements that are the legacy of Jim Crow laws, which often denied Black people formal means of passing property from one generation to another. Instead, property inheritance was done informally, leaving no legal record of ownership. As a result, many Black families cannot provide the legal documentation of property ownership required to access post-disaster aid.

In sum, a myriad of embedded structures and policies continue to keep Black women from being on par with white middle-class families. Black women will not collectively enter the middle class that homeownership ostensibly provides if they are unable to equitably purchase and invest in homes to build wealth. In next week’s final installment of Locked Out, we’ll examine both private and public solutions to achieve an equitable housing economy for all.