Fidelity, Vanguard, Schwab, T. Rowe Price: the list of financial services firms managing substantial amounts of charitable assets in the form of donor-advised funds (DAFs) is short but tantalizing. Nonprofits across the nation wonder, what’s the secret code, the handshake, the password that will get an organization a chance at the billions of dollars in DAFs managed by these firms?

Donor-advised funds are special accounts created with donations of cash, stock, or other assets. Donors receive an immediate tax deduction for assets donated to these accounts, which are typically managed by financial companies, community foundations, and some independent charities. Funds are distributed from the accounts based on donors’ recommendations of specific charities or causes. Although community foundations have offered donor-advised fund services for many years, the involvement of national financial services firms in this field is less than two decades old. In that short time, these large “commercial gift funds” have come to dominate the DAF industry.

During their relatively brief existence, the two-dozen corporate-affiliated national donor-advised funds have grown to account for more than $2.5 billion in charitable grantmaking (roughly half of which is attributable to Fidelity), compared with approximately $4.5 billion in grants from more than 700 community foundations. The top three commercial funds, Fidelity, Vanguard, and Schwab, are much larger than the others. Since its creation in 1991, the Fidelity Charitable Gift Fund has assisted some 56,000 donors in distributing $9.5 billion in grants to 130,000 nonprofit organizations. Because of this phenomenal growth curve, in 2008 this fund became the nation’s third largest public charity in terms of private contributions. The Vanguard and Schwab funds are also huge, both numbering among the top 100 largest public charities.

The vast majority of nonprofits would do almost anything to reach out to the hundreds of thousands of donors represented by these firms. Unfortunately, we haven’t yet found the philanthropic version of an abracadabra or a sim sim sala bim that will unlock the commercial gift fund vaults. Should nonprofits simply write off these billions of dollars as inaccessible? Or would understanding the myths and realities of the commercial gift funds help nonprofits craft strategies to get on the radar screens of these donors?

Eight Commercial Gift Fund Myths

Myth One: After Fidelity (and maybe Vanguard and Schwab), the rest of the corporate gift funds are basically minor players.

Not long after the creation of the Fidelity Charitable Gift Fund in 1991, two of Fidelity’s major competitors in the investment world—Vanguard and Charles Schwab—established their own programs to manage investors’ charitable giving. These funds caught the foundation world, especially community foundations, by surprise. But one ought to have expected that these enormously creative, energetic, and profitable investment firms would spot a market opportunity in the expanding world of charitable giving during the 1990s.

While Fidelity, Vanguard, and Schwab are huge and have immediate name recognition in philanthropy, well-known mutual fund companies and commercial banks—including Goldman Sachs, Citigroup, and Bank of America—sponsor some 20 other funds. In addition, there are specialized firms, such as the Calvert Social Investment Foundation, which restricts its investment options to socially responsible corporations, funds, and projects, and the National Philanthropic Trust, which along with its own gift fund provides “private label” management services to other corporations.

Nonetheless, Fidelity, Schwab, and Vanguard dwarf the donor-advised funds of their competitors. Why are the big three so far ahead of the competition? Not only were they the first out of the gate, but also they made significant investments in the capacity to give donors the most rapid and flexible methods for creating donor-advised funds and directing gifts to charities.

A donor who establishes a fund at Fidelity, Vanguard, or Schwab can invest, donate, replenish accounts, designate nonprofit grant recipients, and get accurate tax information, all online. The investor-donor can also choose to place charitable funds in short- or long-term investments or in conservative or aggressive funds. From early on, these commercial gift funds were designed to make account management easy and straightforward for donors.

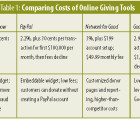

What’s more, these services are cheap. While a typical donor could potentially spend several percentage points in fees on funds invested through community foundations or other DAF managers, it costs comparatively little for donors to invest through one of the big three. Even now, with community foundations having done their best to reduce their transaction costs, fees at the big commercial funds are frequently less than 1 percent, compared to 1 percent to 2 percent at many community foundations, and more than that at other DAF managers. For funders and their promoters, less money spent on administrative costs means more money available for recipient nonprofits.

Myth Two: Commercial gift funds sit on money, enabling donors to warehouse their charitable dollars. Whether at universities, community foundations, or commercial funds, donor-advised funds face no foundation-like payout requirements.

Critics have long suspected that donors to DAFs get a full charitable deduction at the outset, but that the bulk of the funds sits in accounts and doesn’t move. If DAFs were subject to a 5 percent foundation payout requirement, these critics argue, it would presumably start the DAF payout snowball rolling.

The truth is that payout rates of donor-advised funds at commercial gift funds and at community foundations far exceed foundation payouts, which rarely surpass the 5 percent required by law. Between 2003 and 2007, Fidelity’s payout was 23 percent, Calvert’s 14 percent, Schwab’s around 20 percent, and Vanguard’s 21 percent, compared with an average payout of community foundations surveyed by the Council on Foundations (COF) of 13.1 percent and a median payout of 9 percent.

Although exempt from mandatory payout rules that apply to foundations, most charitable gift funds voluntarily maintain policies that require a composite or cumulative 5 percent payout. Even at those firms that do not establish fund-specific payout levels, the corporate sponsors will monitor accounts to determine whether individual DAFs’ low activity levels might contribute to the funds’ falling below the 5 percent payout threshold.

Observers expect that in the future a DAF payout requirement will get congressional attention. Although mandatory DAF payouts were considered and dismissed in the run-up to the Pension Protection Act of 2006 (the last major national legislation to touch on DAFs), it is logical to expect that the payout issue will eventually be revisited. In light of recent behavior, however, corporate funds should have no trouble meeting a mandated threshold.

Myth Three: Financial firms offer only donor-advised funds and nothing else.

While DAFs are without a doubt the primary charitable offering at investment firms, they are only one tool among several. Other options include charitable remainder trusts (CRTs), charitable lead trusts, and pooled-income funds.

Still, the importance of commercial DAFs cannot be denied. They have transformed financial-service firms into significant players in philanthropy while occupying an important market niche. Donor-advised funds have been described as “the poor donor’s foundation,” enabling an individual donor, who may not have billions or millions of dollars, to establish a personal charitable-giving vehicle to support his or her charitable priorities and beneficiaries.

Myth Four: If you’ve seen one commercial gift fund, you’ve seen them all.

Not quite. Commercial funds have explored several market-defining distinctions with varying degrees of success. The challenge is to make these programmatic distinctions work without undoing their benefit for donor-investors: that is, combining low administrative and investment costs with speed and simplicity. Commercial gift funds vary in their features and benefits and offer a range of investment alternatives, minimum fund sizes (for example, $5,000 at Fidelity and Schwab, $25,000 at Vanguard), and disbursement policies.

Commercial funds have also developed specialized products and functions to appeal to donors who want additional giving options. Fidelity’s Gift4Giving program, for example, allows investors with charitable accounts to designate gifts—in amounts as small as $50—to other individuals who can then direct the funds to the IRS-qualified public charities of their choice. This service gives a donor a way to involve friends and family members in charitable giving while introducing Gift4Giving recipients to Fidelity’s advanced DAF technology.

Calvert’s large array of socially responsible investments is an important mechanism in maximizing the social benefits of otherwise passive investments of charitable monies. Schwab has received significant positive publicity for its variation on socially responsible investing, the Double Give Program, which enables donors to designate up to 10 percent of their charitable-gift account balance to guarantee microfinance loans in the developing world. The first phase of the program sought to generate $10 million in guarantees for more than 100,000 microloans through the Grameen Foundation.

Community foundations routinely solicit donations to unrestricted funds managed by professional foundation staff. While commercial funds do not specifically promote donations to unrestricted funds, most offer this option to donors. For example, at Schwab, donors can pick the “Philanthropy Fund,” Schwab Charitable’s unrestricted giving account that supports not only unrestricted grants made by Schwab’s trustees but also research and educational programs.

Myth Five: Corporate gift funds are bad (because they are corporate);? community foundations are good (because they are not corporate and are managed by knowledgeable local professionals).

This myth was the original impetus for the community-foundation critique of commercial gift funds. How could the IRS allow these corporate behemoths to be recognized as charities? “They should never have received IRS approval in the first place,” one critic says. “They have succeeded in having a tax exemption for investing in their for-profit accounts.?.?.?. Why should taxpayers be assisting the for-profit Fidelity Investments program?”

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

The foundation world has protested to the IRS and even litigated in some instances. It has also tried to ostracize the commercial gift funds. The Council on Foundations offers membership status to corporate foundations sponsored by some of the world’s most widely criticized corporations, such as BP and Exxon Mobil, while barring financial firms that administer donor-advised funds. In an odd anomaly, this means that the Fidelity and Schwab foundations are COF members while their much larger charitable gift fund affiliates are not.

What explains the opposition to commercial gift funds? Is there really something inherently impure about them? A better explanation for the hostility is that the commercial gift funds have grabbed significant market share from the more than 700 community foundations because of lower operating costs and more powerful technological platforms. Still, that doesn’t explain why the Tulsa Community Foundation (with $3.7 billion in assets) and the New York Community Trust (with $1.5 billion in assets) cannot accept the Fidelity Charitable Gift Fund (with nearly $5 billion in assets) as a peer in institutional philanthropy.

While it is true that for-profit investment houses have created or are affiliated with these gift funds, they are established as “independent public charities,” and in interviews, these funds’ managers adamantly underscore that independence. “A majority of the Program’s Trustees are independent of Vanguard,” the firm’s Web site notes. “Although Vanguard provides certain investment management and administrative services to the Program through a service agreement, the Vanguard Charitable Endowment Program is not a program or an activity of Vanguard.”

The commercial gift funds do appear to maintain autonomy by purchasing administrative support and accessing investment options from sponsoring financial firms in arm’s-length transactions (paid for through the fees charged to donors), as opposed to simply operating as divisions or departments of Fidelity, Vanguard, or Schwab. In some cases, the sponsoring firms financed the creation of online donor-advised fund platforms and other elements of the commercial gift funds’ business models, investments that are now being repaid over time.

Overall, the sponsoring financial firms do not appear to control the commercial gift funds in a way that might jeopardize their 501(c)(3) charitable status. To be sure, corporate sponsors have a strong business rationale for establishing the charitable gift funds: by leveraging their sophisticated online money-management platforms, financial firms can offer a “one-stop shop” where investors can also take care of their charitable giving. Many of the firms’ baby-boomer customers are already comfortable with managing their portfolios online, and they are attracted by the notion of online charitable giving.

The major community foundation complaint about the commercial funds is that the IRS allowed for-profit investment firms to create 501(c)(3) public charities with the mission of raising and distributing funds for charitable projects, essentially a commercialization or perhaps a commodification of the core charitable function of community foundations. Commercial gift fund supporters are not shy about reminding critics that commercial banks and trust companies established many community foundations. For some time, these foundations operated with as much, if not more, functional integration with their bank sponsors than commercially affiliated funds have with their mutual-fund sponsors. The charge that commercial gift funds are somehow less charitably pure than community foundations, particularly in an era of significant business involvement in charity and philanthropy, is less persuasive now than it was when Fidelity’s gift fund first came into being and received IRS approval.

Observers suggest that in time, strident opposition to community foundations will be overcome because of increasing acceptance that commercial funds have matured, are growing in market share, and are filling—as one Midwestern community foundation CEO put it—“a [market] niche of price sensitivity .?.?. giving donors a transactional product for a very, very low price.”

Myth Six: Because of their convenience and low cost, corporate gift funds have boosted the total amount of charitable giving.

Has the advent of commercial gift funds raised overall charitable giving (historically, charitable giving in the United States has amounted to roughly 2.0 percent to 2.1 percent of gross domestic product)? It is impossible to answer that question with absolute confidence.

According to one philanthropic expert, “The percentage of Americans who give stays pretty steady over time, and the percentage of wealth [devoted to charitable giving] stays pretty steady over time. [So] it’s possible that there’s nothing [about the commercial gift funds] that has expanded the pie.” On the other hand, Fidelity Charitable Gift Fund CEO Sarah Libbey told NPQ that more than half the firm’s current donors had zero funds in accounts on the firm’s investment side.

External observers confirm that given its advertising resources, Fidelity has probably attracted donors that use its services exclusively for charitable giving. This suggests that—at least in Fidelity’s case—the firm attracts people through the Charitable Gift Fund’s own portal rather than simply mining current Fidelity investors for their philanthropy business. Libbey also noted that based on surveys, 70 percent of Fidelity donors report that their personal giving has increased as a result of maintaining a charitable fund at Fidelity.

But these increases could simply reflect a reallo-cation of charitable giving from other channels, such as donors moving their DAFs from community foundations or other sponsors to Fidelity. One donor, for example, recalls his experience in establishing a charitable account at Vanguard, noting that it would have taken longer at the community foundation where he formerly had his DAF, taking three to five days as opposed to a quick online transaction, and would have been more expensive, costing 100 to 150 basis points (1 percent to 1.5 percent), while Vanguard’s administrative fee was only 30 to 40 basis points (0.3 percent to 0.4 percent). Similarly, some small foundations have disbanded and shifted their assets into donor-advised funds, but both examples amount to shifting charitable giving from one venue to another rather than generating new dollars.

Myth Seven: Corporate gift funds have put a nail in the coffin of community foundations.

Unlike community foundations, commercially affiliated charitable gift funds are primarily transactional. There is little interest in having the funds “sit” in accounts rather than be disbursed quickly to charities.

Community foundations, on the other hand, are fundamentally community institutions, often positioned as community problem solvers, deploying philanthropic capital and knowledgeable staff to address community issues. As a result, community foundations often encourage donors to make “unrestricted” donations that are available to the foundation to use as it sees fit rather than having to create individual funds that must follow donors’ charity-specific recommendations. Frequently, community foundations solicit donations to “field of interest” funds—devoted to programs for youth, women’s issues, affordable housing, and so on—in which foundation staff then make grant decisions. That sort of programming requires a level of staffing that makes community foundation operating costs higher than those of commercial charitable gift funds.

Do commercial gift funds add distinctive charitable or philanthropic value in the distribution patterns of their grantmaking? Critics of the commercial funds and of donor-advised funds in general suggest that DAF-supported grantmaking is essentially equivalent to individual charitable giving, except that it has been made simpler, faster, and cheaper by these big firms.

For example, the Fidelity Charitable Gift Fund began processing grant dollars for Haitian earthquake relief activities just two hours after the earthquake in Port-au-Prince, with a total of more than $13 million donated for earthquake relief as of March 2010. Fidelity’s speed in making Haitian relief grants underscores what donors want from commercially affiliated funds: the capability to respond quickly to donors’ funding directives.

According to one community foundation CEO, the commercial funds’ technology and operational efficiency have compelled changes in the community foundation world. According to one philanthropic adviser, “Many (community) foundations have since caught up, made it easy to do things, calling someone on an 800 number, processing checks and grants more quickly.”

While the community foundations cannot compete with the commercially affiliated funds on costs and investment options, particularly because of the commercial firms’ huge scale, they can offer an important charitable-giving resource to donors who have specific community interests. The end result may be an improvement in community foundation operations. These organizations can leverage their competitive advantage with donors interested in geographically specific charitable investments and field-of-interest charitable concerns, while commercially affiliated funds attract charitable giving that is less geographically constrained.

Myth Eight: If you know whom to call at Fidelity, Schwab, and Vanguard, you too can get in on billions in charitable giving through their DAFs.

If only that were true. The problem is that these firms manage funds for donors who, for the most part, already know whom they want to give to. As one philanthropic adviser notes, “Most Americans are local givers and they’re not looking for any—or needing any—advice and direction, and thus for them, whatever way is cheapest or most convenient is going to work for them.” He adds, “The commercial providers [have provided] the equivalent of a philanthropic checking account.?.?.?. For most of the people who use the donor-advised funds of the big three, their experience is only about convenience and cost. It’s a commodity, and they’re no more interested in an experience with their DAF than with their checking account.”

For those donors who want a more tactile charitable experience, they can still go to community foundations with geographically specific interest areas, or choose specialized funds dedicated to specific issues and topics such as women’s issues, religion, or social change. Donors might be willing to pay more for the more personalized service that community foundations offer.

Evidence increasingly suggests, however, that most small and midsized donors are not interested in paying a premium for advice. One of the nation’s philanthropic experts contends that “what Fidelity proved in 1991 is that [many] donors in fact don’t want any advice. [Fidelity] served a no-advice product, and they hit it out of the ballpark.”

That said, the commercially affiliated funds do offer their customers links to the standard sources of information on public charities. For example, on Vanguard’s Web site the Education and Resources for Donors button provides links to the Council on Foundations, the United Way of America, GuideStar, the Better Business Bureau’s Wise Giving Alliance, and the Independent Charities of America. Fidelity gives its donors access to GuideStar Analyst Reports covering some 200,000 charities with financial and narrative analyses, including benchmark measures for comparisons among nonprofits in specific groups and subsectors. The message from the commercial funds is that donors can avail themselves of these free services, but the funds are encouraging the donors to do what experts tell all donors: do their own research on the charities they might support.

Fidelity, Vanguard, and other firms maintain general funds consisting of charitable donations from their customers, as well as funds left in accounts abandoned without a designated successor, and nonprofits can certainly attempt to approach them. But there is no magic incantation that will give access to the commercial firms’ donor-advised funds. To reach these affluent but not superwealthy donors, nonprofits should do what they always do: be visible, do outreach, connect to volunteers, and develop smart major-gift fundraising efforts that target higher-net-worth donors. Once recruited, these major individual donors are likely to make contributions from donor-advised funds located at Fidelity, Vanguard, Schwab, T. Rowe Price, the Calvert Social Investment Fund, the National Philanthropic Trust, and the other major financial firms.

Copyright 2010. All rights reserved by the Nonprofit Information Networking Association, Boston, MA. Volume 17, Issue 3. Subscribe | buy issue | reprints