November 6, 2019; CT Mirror (in the Hartford Courant)

Budget and inequity issues have plagued the state of Connecticut and its nonprofits for years. Recently, Governor Ned Lamont (D) disappointed the state’s nonprofit sector yet again, showing a stance of “all talk, little action.” Lamont spoke words of support for Connecticut nonprofits but denied them funding.

NPQ has been covering Connecticut’s money woes for a while. In October 2017, NPQ’s Jim Schaffer wrote about the state’s budget stalemate and its consequences. The Connecticut Nonprofit Alliance (CNA) worked diligently to encourage lawmakers to pass a budget to protect the sector’s programs and services. Just months later, Schaffer updated readers with unfortunate news of budget cuts to nonprofits—even after arrests, protests, and tireless work.

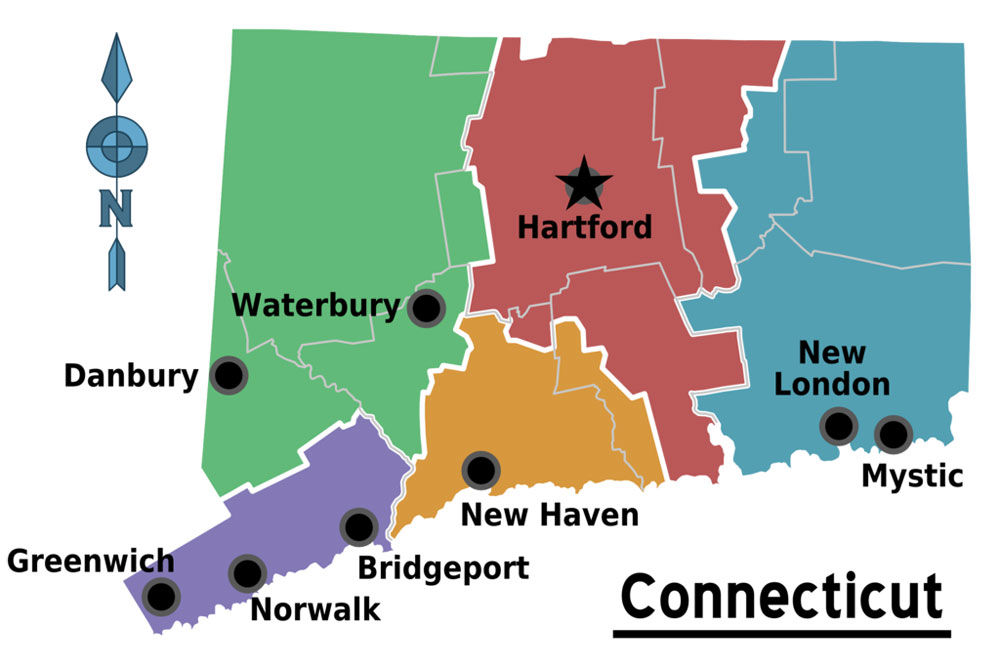

Two years and a new governor later, Connecticut nonprofits are still underfunded and fighting for their position as a vital resource in helping provide public services. In March 2019, NPQ’s Eric Fullilove detailed Lamont’s plan to suspend a $25 million capital grant program. The program “provided hard-to-raise funding for capital improvements, building repairs, and information technology upgrades that help maintain and enhance the physical plant and back-office functions of nonprofits employing 190,000 people and helping 500,000 statewide.” As Fullilove pointed out, this kind of programmatic and operational support is hard to get from private funders.

Lamont’s justification for holding back was his concern for ballooning pension and retirement benefits once baby boomers began to leave the workforce. Fullilove questioned this rationale, asking whether Connecticut must “continue a history of balancing the budgets on the backs of service providers,” with state leaders hoping services will continue, with someone else paying the bill.

This summer, someone else—specifically, Dalio Philanthropies—did pick up a chunk of the bill ($200 million) for public education shortfalls—but at the cost of democratic transparency for public education. NPQ’s Martin Levine noted this cheap “sale” and what it might entail for the fate of the state’s public schools.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Can the state of Connecticut afford to pay for social services and education through public funds? Of course, every state must confront competing public funding priorities, but it is worth noting that as of 2018, Connecticut had the highest per capita income of any state in the US. Clearly, Connecticut is not a poor state, even if its state government sometimes acts as if it were.

In terms of its public coffers, Connecticut has seen some success of late, and it has even developed a rainy-day fund, estimated at $2.5 billion or roughly 13 percent of budget; under Connecticut state law, the reserve will max out at $2.9 billion or 15 percent of one year’s budget.

CNA has requested a $100 million allocation from this reserve to support state nonprofits. According to CNA, state funding for nonprofits has increased since 2002 by 10 percent; during that time, compounded US inflation has been 39.5 percent, meaning that funding for nonprofits has fallen in real dollars over the past 16 years by nearly 30 percent.

Nonetheless, as state dependence on nonprofits continues to rise—state payments to nonprofits through contracts totaled $1.4 billion last year—one would think the state’s improved financial condition would lead to better funding for nonprofits. The government’s reliance on nonprofits for its social services continues to grow, with contracts to nonprofits outpacing the costs of services delivered through the departments of transportation, corrections, and motor vehicles combined. According to Gian-Carl Casa, president and CEO of CNA, an estimated 95 percent of Connecticut nonprofits experienced increasing demand for services over the past five years.

The governor’s attempt to encourage the continuance of services while asking someone else to pick up the bill shows an unremitting lack of understanding, to the detriment of a sector that’s crying out, “We’re already facing rainy day after rainy day at this point.”—Sarah Miller