Editor’s Note: Last week, Tim Delaney, president and CEO of the National Council of Nonprofits, the nation’s largest network of nonprofits, guided us through the opening of an uncomfortable conversation based on new data showing that funding for the infrastructure on which all charitable nonprofits and private foundations depend has been biased in favor of philanthropy-specific infrastructure at the expense of nonprofit infrastructure.

In today’s segment, he identifies what’s at risk when the nonprofit portion of infrastructure is underfunded. To advance this conversation, NPQ again invites you to add your observations and insights to give body and life to this discussion.

“Like a back without a backbone, a sector without a strong infrastructure will crumble; yet, the nonprofit sector’s infrastructure—its role and what it contributes to society—is still a mystery to many funders.”

So wrote leaders of 10 major foundations in 2004 when urging their colleagues at foundations across the country to join them in investing at least one to five percent of their giving to nonprofit infrastructure. By nonprofit infrastructure, they were referring to organizations providing “capacity-building assistance: the intermediaries working at the local, state, regional, or national levels that offer management support, advocacy, training, technical assistance and other services to [foundation] grantees and…other nonprofits that benefit from them.”

Despite the foresight of those concerned leaders, from 2004 through 2012 funding for the nonprofit side of infrastructure “grew” at a rate of just 9.1 percent (before inflation), falling far behind the 63 percent rate by which overall giving grew, according to the Foundation Center study. When factoring in the inflation rate of more than 21 percent during that time period, however, this purported growth completely vanished. Worse, funding for the nonprofit side of infrastructure actually shrank by failing to keep up with inflation.

It’s not that foundations are opposed to infrastructure funding. Indeed, during this same time period, foundation giving to their own philanthropy-specific infrastructure grew at a rate that actually exceeded overall giving (+79 percent before inflation). As the Foundation Center study observed, foundations are investing in infrastructure “organizations with which they are most directly engaged—in this case, grantmaker networks.”

So it seems that, to protect the entire 501(c)(3) community that benefits from the work of the normally invisible nonprofit side of infrastructure, the challenge is to find a way to catch the attention of foundations so they see the extensive impact that nonprofit infrastructure delivers. Fortunately, longstanding mission partners of nonprofit infrastructure already pay attention and notice, with heroes at all levels: national foundations (such as the C.S. Mott Foundation), regional foundations (such as the Murdock Charitable Trust), and local community foundations, among many others. But to open more eyes and demystify things, perhaps it’s time to connect the dots to explicitly show a sampling of what foundations risk if the nonprofit side of infrastructure crumbles due to lack of support.

What’s at Risk for Foundations: Money, Freedom, Time, and Impact

Not all nonprofit infrastructure organizations are the same. Some focus on research, others on capacity building, some on policy, and others on an array of matters. Each has its own strengths, just as athletes competing in the upcoming summer Olympics specialize in one sport. I won’t pretend to speak for the work of the sprinters, divers, or gymnasts among nonprofit infrastructure. But I can identify how the all-around decathletes—the state associations of nonprofits across the country that do a lot of everything—work to protect foundations in their states as well as charitable nonprofits.

The work of this branch of nonprofit infrastructure ensures that foundations have more money, enjoy more freedom, have more time, and achieve more impact. Collectively, the state associations of nonprofits and other nonprofit infrastructure groups upon which we also all rely are as indispensable for foundations as they are for charitable nonprofits. Here are just four examples:

1. Protecting Foundations’ Money

Since the Great Recession, state and local governments have become increasingly aggressive trying to find ways to extract money from nonprofits and foundations. Space doesn’t permit even an overview of the many protections provided by state associations of nonprofits, but here are two illustrations of financial benefits delivered for the entire 501(c)(3) family (charities and foundations).

- Property taxes. Local and state governments have been trying to nibble away at the universal rule across the country that exempts from taxation real property owned by nonprofits—charities and foundations alike—and used for their charitable purposes. Their attacks come from all branches of government. Last year, Maine’s governor sought to break from this rule and partially repeal the exemption for some properties. A judge in New Jersey, who struck down the property tax exemption for a nonprofit hospital, is allowing a case by residents to challenge the exempt status of Princeton University, which could spawn challenges against any and all nonprofits in the state. In Michigan, local tax assessors are applying subjective interpretations of longstanding law, resulting in proactive legislation from nonprofits seeking clarity. Local legislative bodies across the country have tried to impose property taxes (sometimes disguised as fees) or demand PILOTs (payments in lieu of taxes) to take money away from charitable and foundation missions to fill tax coffers. The network of the National Council of Nonprofits actively opposes multiple property tax challenges every year, winning most, and using the opportunities to educate policymakers about how nonprofits (including foundations) earn their tax exemptions every day.

- Charitable giving incentives. A cap on the value of charitable giving was proposed at the federal level each of the last eight years. Yet these proposals, which never had a chance at passage and were effectively DOA, garnered significant attention (and dollars for federal lobbyists). Contrast that with the actions at the state level. In 2011, state legislatures and new governors eliminated charitable giving incentives in Hawaii (where $60 million in donations were lost) and Michigan (where $50 million in donations were lost). In 2013, the Hawaii Alliance of Nonprofit Organizations successfully led a campaign to uncap the state charitable giving incentive, allowing funds to flow again to support the missions of nonprofits serving local communities. Framing and tactics developed there were redistributed across the network of state associations of nonprofits to defeat substantial attempts in four other states that year to limit charitable giving incentives. Victories were won in more states in 2015. If, conservatively, the 2011 losses in two states were roughly $50 million each, and that amount was reinstated or saved in five states in 2013 (and thus saved in those states each year thereafter), then that’s serious money kept to advance the work of nonprofits without turning to foundations seeking to replace those funds that state governments tried to take away. More importantly, that’s real money in those states to continue to advance missions to serve people and improve local communities.

But for the actions by state associations of nonprofits and their members who rally in defending the entire 501(c)(3) community, foundations could be paying property taxes on their buildings, meaning less money for foundations’ missions. Plus, if charities lose charitable giving incentives or have to pay taxes on their property, it’s less money for them to advance missions, so they’ll turn to foundations to try to fill the void caused by state and local governments. Given the tens to hundreds of millions of dollars at risk in each state, investing in nonprofit infrastructure seems like savvy insurance.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

2. Protecting Foundations’ Freedom

State governments have tried to invade foundation and nonprofit boardrooms by making decisions for independent 501(c)(3) organizations. Consider, for example, that states have attempted to cap compensation of executives at “public charities,” a term defined in Massachusetts to include private foundations with revenues of $1 million or more. State-level nonprofit infrastructure groups step forward to block legislation that would infringe on the independence of 501(c)(3) organizations.

Stealth invasions of boardrooms occur when state governments slash spending on human services—but don’t cut human needs. They essentially expect nonprofits and foundations to fill the voids, effectively saying to foundation and nonprofit boards: Redirect your funding and work to accommodate our decisions. Yet foundation assets were not created to bail out governments, and nonprofits were not established to take care of everyone that governments abandon in the cold. As an understanding New York City Council member recently observed when commenting on the unfair ways that governments treat nonprofits and thereby foundations, “the city would never say to a construction company, ‘We’re going to pay you $35 million [to build a $40 million bridge]. Try to get philanthropy, foundations, or other jobs that you do to pay for the remaining $5 million.’” Nonprofit infrastructure groups, not individual organizations, are the most vocal in opposing the expectation that foundations and nonprofits must subsidize governments.

3. Protecting Foundations’ Time (and Money)

Charitable nonprofits collectively earn almost a third of their revenues from government contracts/grants. It is well documented that governments routinely fail to pay the full cost of services, change contract terms midstream, and pay late. Much of that documentation comes from nonprofit infrastructure research entities, like the Urban Institute, and word is spread by infrastructure groups like Nonprofit Quarterly so nonprofits can understand the broader trends. If nonprofit infrastructure in the field had dedicated resources for the systems reform work needed to improve long neglected, oft-broken, and routinely inefficient “systems” by just one or two percent, then the annual savings available for services could be as large as the Gates Foundation grants globally each year. That’s real impact.

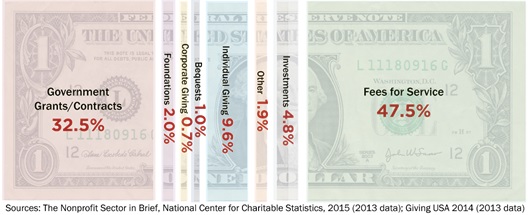

When governments fail to pay the full cost of services, pay late, and impose other costs, they shift more burdens onto nonprofits, which naturally turn to foundations for support and relief. Yet foundations have neither the time to respond to otherwise endless requests caused by government failings, nor the money to subsidize funding gaps created by harmful government practices. As the graphic above reminds us, it’s a fool’s errand to think that philanthropy can fill the hole of government funding. The needed systems reform work requires attention that no individual nonprofit can effectively undertake alone. By investing in nonprofit infrastructure to reform these practices, the payoff can be enormous for everyone, and foundation time and assets can be dedicated more to mission advancement than subsidizing government.

4. Helping Foundations Achieve More Impact

But it’s not just policy work like that identified above. When foundations invest in nonprofit grantees, they expect a lot, from accountability and good governance to financial management and transparency. These and other capacities are reasonable expectations. Yet they don’t happen automatically. When a state certifies creation of a new nonprofit and the IRS issues tax-exempt status, neither provides an “operators manual” on how to run a charitable nonprofit. New groups, which rarely have resources to pay accountants or attorneys for guidance, instead turn to state associations of nonprofits to help build their core internal capacities. From establishing the most basic policies for the first time to sharing how to operate efficiently, effectively, and ethically, nonprofit infrastructure groups help everyone from seasoned nonprofit executives to new nonprofit board members to mid-level staff to the next generation of nonprofit workers create impact in their community.

And hundreds of thousands additional nonprofits are turning to nonprofit infrastructure for help. The number of charities registered with the IRS has expanded by 276,345 since 2004 (the first year in the Foundation Center study), from 821,344 as of December 2004 to 1,094,029 as of April 2016, according to the National Center for Charitable Statistics. As Lindsay Louie observed in “Infrastructure Matters, But Funding Hasn’t Kept Pace,” “This means that there are many more foundations and nonprofits to use and engage in the infrastructure and many new organizations on one of the steepest parts of the learning path.” Yet, as the Foundation Center study revealed, funding for nonprofit infrastructure failed to keep up with inflation, let alone expand to accommodate this huge increase in organizations to be served.

Reality Check

What’s at risk for foundations if the nonprofit side of infrastructure is ground down, unable to continue to protect and support the entire 501(c)(3) family? Loss of foundation money, loss of foundation freedom, loss of foundation time, and loss of foundation impact.

So what can be done? Simply follow this modified advice from the Fram oil filter commercial of yesteryear: You can pay a little now to invest in nonprofit infrastructure for the common good…or pay a whole lot more later directly to governments, to fill in the gaps caused by governments, to hire more staff, to pay more attorneys and accountants, and to replace what has been allowed to decay.