September 9, 2020; CNBC

Two of the nation’s wealthiest men are using their fortunes in an electoral battle over a state constitutional amendment that Illinois voters will decide this fall. Two years ago, NPQ covered a similar battle where Salesforce co-CEO Marc Benioff and Twitter CEO Jack Dorsey fought over a business tax in San Francisco to address homelessness. For those keeping score, Benioff won, and the tax measure passed. In June, a court challenge to the tax failed.

This time, the state of Illinois is at the heart of the conflict, and the electorate is being asked to choose between the state’s current “flat” income tax and a new approach that will allow it to enact a graduated income tax, as the US has at the federal level. In a state where longstanding financial troubles have been worsened by the economic impact of COVID-19, the outcome of this faceoff will say much about where the burden of keeping state government functioning will fall.

Governor JB Pritzker, who ranks number 238 on the Forbes 400 list of the wealthiest in our nation with assets valued at $3.4 billion, has been a longtime supporter of the amendment. In opposition stands investor Ken Griffin, whose wealth totals $15 billion, placing him in 34th place on the Forbes list.

Both men have been willing to tap their huge fortunes to bring victory to their side. Governor Pritzker, who campaigned on the need to make this change during his run for office two years ago, guided the amendment through the state legislature to get it on this fall’s ballot. He has donated at least $56 million to efforts to get the amendment approved. Griffin, a staunch fiscal conservative who has spent heavily in previous state elections, stepped into this struggle last week when he made a $20 million donation to a committee working to keep the amendment from passing.

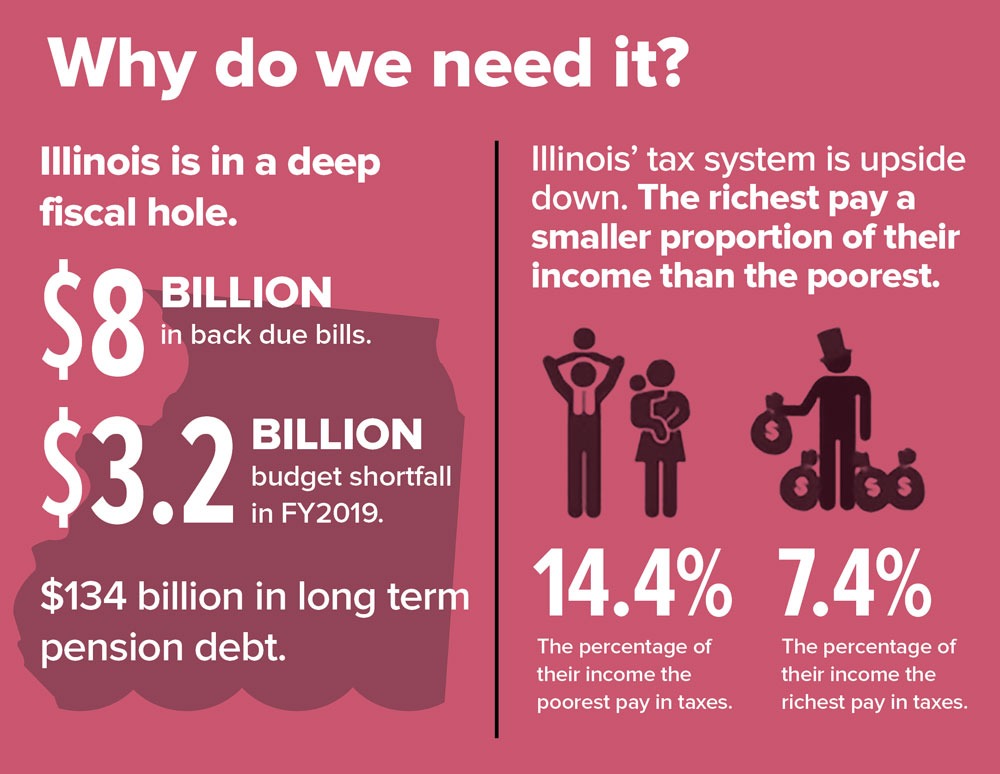

This expensive battle takes place over the removal of just a few words—“A tax on or measured by income shall be at a non-graduated rate”—from the Illinois constitution. This won’t change income tax rates directly, but it will give the state’s legislature the power to change the way those rates are applied. Unlike the federal income tax and income taxes in most states, Illinois taxes those with the lowest incomes at the same rate as those with the highest. Anticipating approval, the legislature passed a new, graduated tax that will go into effect if the amendment passes.

For those supporting passage, which includes a long list of nonprofit organizations, a key argument for the amendment is to end a regressive tax system that unduly burdens those with the least resources while allowing wealthy citizens to escape paying their fair share for essential services. One advocacy website reads:

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Low-income households now pay almost double what the wealthiest pay in taxes as a share of their income! That’s wrong—and it doesn’t raise enough revenue, pushing up property taxes and forcing harmful cuts to education, human services, health care, infrastructure, public safety and jobs.

Supporters recall that just a few years ago the state was gridlocked, unable to pass and fund a state budget. The state’s universities and a large swath of nonprofits that provide safety net services to those in need were stranded without necessary funding. The damage from this remains unresolved. Some organizations had to close their doors. Others stayed open but remain in financial distress. This legacy was captured in a report commissioned by The Chicago Foundation for Women, which concluded “lasting damage to the social service infrastructure will make serving people…much harder in the years to come.”

Illinois accumulated a backlog of bills totaling $14.7 billion with expected late payment interest costs of approximately $800 million. It will take years to work through the backlog of bills.

The fair tax, Pritzker and other proponents argue, will let the state raise new, needed revenue without further ladening those with few resources. The proposed new tax schedule is projected to increase state revenues by $3 billion but will require only the wealthiest three percent of the population to foot the bill.

Griffin and other defenders of a flat tax contend that fault lies with an incompetent, dishonest state government that’s allegedly driving the wealthy from the state. As he made his donation, Griffin issued a statement, as reported by CNBC, saying, “What’s now being marketed to voters under the guise of a ‘fair tax’ is nothing more than a graduated tax scheme engineered to extract the greatest amount of money possible from all Illinois taxpayers.”

Wealthy people wield inordinate power in the electoral process and can shape public policy, and that’s of great concern. But, in this election at least, the contest seems more even, as advocates backed by billionaires on both sides face off. Grassroots organizations, which often find themselves outgunned financially, come to this Election Day able to engage the electorate and make their cases.

But it should not be this way. Balancing supporters from within the Forbes 400 should not be of such importance. Alas, in today’s political system, it often is.—Martin Levine