Editors’ note: This article, first published in print during July/Aug 2015, has been republished for Nonprofit Quarterly with minor updates.

CONGRATULATIONS! You’re convinced the time has come to start a “planned giving” program for your nonprofit. This is a sign of aspirational growth and organizational maturity. But please take a moment, before you read further, to use the space below to write down your organization’s definition of a “planned gift”

You just defied your goal from your perspective, which is valuable. This definition will represent part of any gif conversation. Take a moment now to put yourself on the other side of the coffee table and write down what you believe the typical new possible donor’s definition of a “planned gift might be.

I hope this gives you food for thought, and cause to pause. Consider my own definition of a planned gift which is based on my conversations with hundreds of potential donors: A planned gif is one that requires forethought by the donor, and usually the participation of one or more allied planning professionals (lawyer, accountant, realtor, investment broker, etc.). Note that words like “outright” and “deferred” do not appear in this definition.

Now you’re ready to consider my two steps to start a planned giving program for your nonprofit.

Step 1. DO NOT Start a Planned Giving Program

Several months ago I received a request from Western Wildlife Corridor (WWC), a small nonprofit in Cincinnati OH, to help them create a “planned giving” program. I met with the board president and asked him for clarification—just what did he mean by planned giving program? He replied, “You know, wills and trusts,” and then handed me a folder of brochures he had collected from other nonprofits promoting their bequest programs.

I complimented him on his foresight and commitment to his organization’s funding future, and then asked him to reconcile his focus on bequests with the organization’s mission, which was land acquisition for conservation. Wasn’t he interested in promoting outright gift of real estate in addition to encouraging gift via wills? It stopped him in his tracks. He and the rest of the board were so focused on establishing a program similar to those in the brochures they had collected that they had entirely overlooked the potential from outright gif plans.

After further discussion and research, we committed to designing a gif planning program for Western Wildlife Corridor, components of which are used as examples in this article.

This experience illustrates the great shortcoming with the longstanding definition of, and mind-set around, “planned giving.” The narrow focus on a few deferred gif planning strategies leaves a lot of gift on the table.

Step 2. Start a Gift Planning Program

Development directors and executive directors of nonprofits of all sizes fantasize about the day when they will be ready to start a planned giving program. For far too many, that day never comes. Some don’t know what to do fist. Some assume they can’t afford to start. Some are frozen with the fear of learning the legal and technical aspects of charitable gif planning.

Too many fundraising professionals believe they must become planned giving experts before they can announce that their charities seek and accept planned gift. Too many can’t even define exactly what a “planned gift is. Thy convince themselves that it’s beyond them. Too many believe all the parts must be in place prior to contacting prospective donors. Once this sort of inertia sets in, the potential for progress is halted.

By the way, while you’re waiting and procrastinating, your prospective donors are making or updating their wills, planning to sell their businesses and retire, and converting appreciated property into income streams for retirement. Thy aren’t waiting for you to get ready, nor are the other nonprofits they support—you know, the groups whose brochures you’re looking at for reference.

Two Steps to a Successful Gift Planning Program

Here is a proven two-step approach to starting a charitable gif planning program that includes both outright and deferred gift.

Step 1. Preparation

Draft gif acceptance policies that address what sorts of gift you will accept and under what circumstances. This starts with examining a menu of the traditional giving strategies—both outright and deferred—you may want to consider for your program. The menu you might choose from typically includes:

- Real Property (outright and deferred): Do you have the resources and willingness to conduct due diligence reviews of offered gift of real estate, and to liquidate any accepted real estate?

- Tangible Personal Property (outright and deferred): What will you accept, and how will you either use or dispose of it?

- Life Insurance (outright and deferred): What types of life insurance will you promote, accept and acknowledge?

- Deferred Compensation Plans (outright and deferred)

- Charitable Gif Annuities: Do you have the cash reserves to back the issuance of charitable gif annuities? Are you prepared to apply for a state license?

- Charitable Remainder Trusts: Is your organization willing to serve as trustee? What minimum amounts will you accept if you serve as trustee?

- Charitable Lead Trusts (outright and deferred): Is your organization willing to serve as trustee? What minimum amounts will you accept if you serve as trustee?

- Wills and Revocable Living Trusts: What proof will you require that a will bequest actually exists? Draft sample bequest language to share with donors and their professional advisors.

- Retained Life Estate

Regardless of whether you decide to focus on only a bequest program or something more inclusive, it is vital to draft your pertinent policies regarding what gift you will consider and under what circumstances. Only once you have written your rules and guidelines will you be able to comfortably (and safely) invite meaningful gif planning conversations with potential donors. You’re welcome to refer to my sample Gif Acceptance Policies, available on my website at: thefrontlinefundraiser.com/resources.

Create basic marketing materials that might include a brochure, announcements in your newsletter or magazine, and/or a modest addition to your website. Base your design on those gif planning strategies you choose to pursue and accept. The layout and copy of the brochures you collect and the websites you visit are valuable references, but be careful not to let them influence you to focus on too narrow a perspective.

TIP: Assign each member of your governing board the task of bringing you samples of the promotional materials they receive in the mail from other charities they support. Ask each to provide the URL addresses of their favorite nonprofits’ giving websites. Don’t lose sight of the fact that those other charities your board members also support already have their gif planning programs in place. You don’t want to be left out of the conversation a day longer than you have to in order to get in the conversation.

Components of your marketing materials (print and electronic) might include:

- A simple, focused introduction/invitation. This simple copy appears at the top of both the giving brochure and giving website of Western Wildlife Corridor. Note that reference is made to gif plans both outright and deferred. When you donate to Western Wildlife Corridor you help people in our community protect the lands that enrich your life—protecting natural habitats for flora and fauna, contributing to clean air and water, and inspiring you with natural beauty.

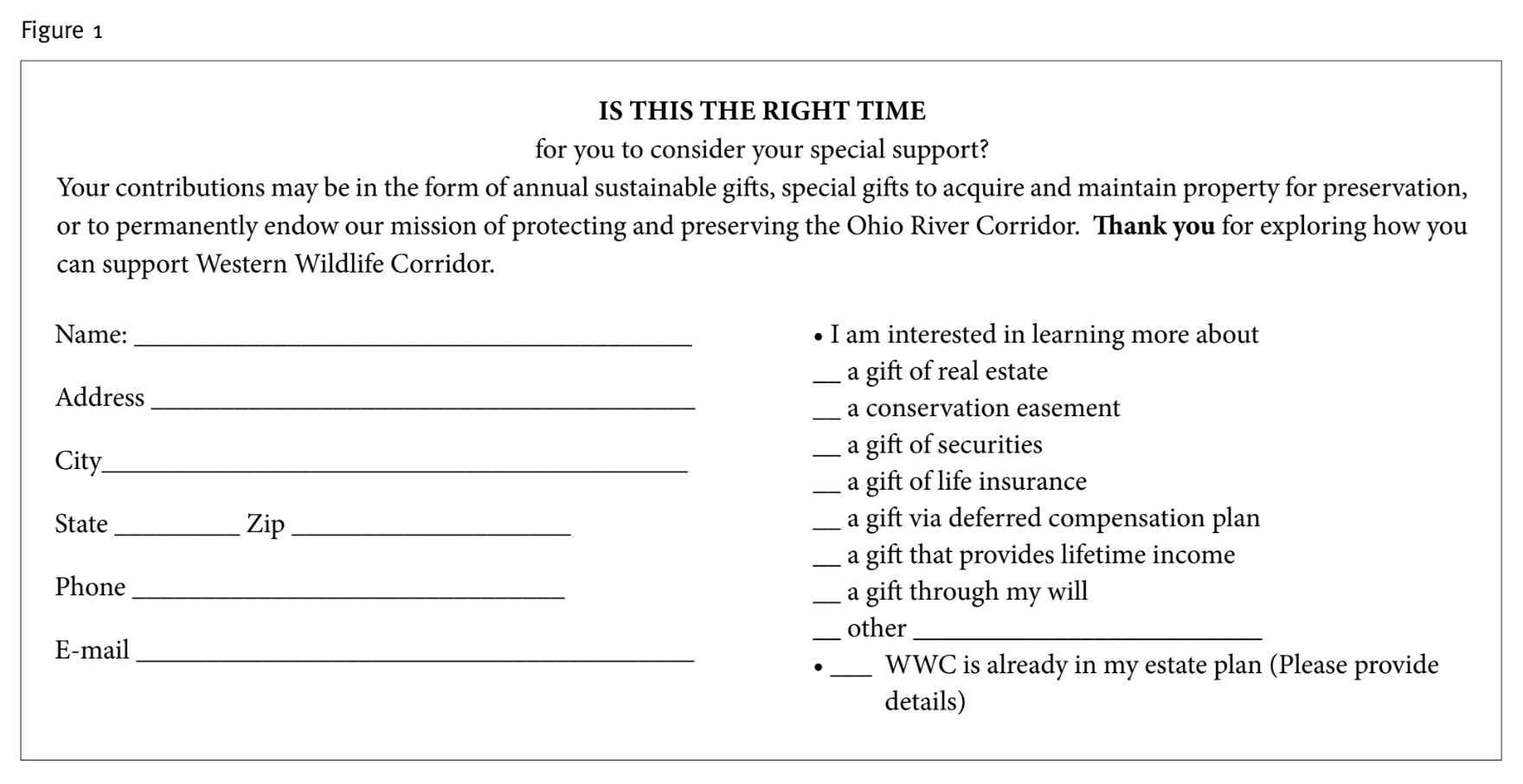

Your contributions may be in the form of annual sustainable gift, special gift to acquire and maintain property for preservation, or to permanently endow our mission of protecting and preserving the Ohio River Corridor.

Thank you for exploring how you can support Western Wildlife Corridor.

- Donor endorsements. These illustrate to readers what others have done and the benefits to both your organization and the donor. Here are a couple of examples from the Giving to Western Wildlife Corridor brochure:

“Knowing now that the property we have cherished and enjoyed for 50 years will forever be preserved with no development, no concrete, no blacktop— just natural—gives us a feeling of real joy and satisfaction.” (Donor’s name) (photo optional)

“One of my concerns was to make gifts that didn’t commit me to something I might not be able to afford in the future. Naming WWC as beneficiary of portions of two Individual Retirement Accounts was the perfect solution for me.” (Donor’s name) (Photo optional)

- Brief explanations of your selected giving strategies. A newsletter (whether print or electronic) is an excellent vehicle for short descriptions of various giving strategies to educate readers. Each issue can highlight a different strategy or message. Here are two samples:

Bequests: Simple & Safe Gift Planning you may feel a strong desire to support Western Wildlife Corridor while not feeling comfortable making an outright gift. Deferred gift vehicles such as bequests in wills, revocable living trusts, life insurance, deferred compensation plans, and other future gift commitments offer appealing alternatives. Thoughtfully crafted gift plans offer benefits to the donor as well as to Western Wildlife Corridor.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Perpetual Gifts Charitable gifts designated to permanently endowed funds provide benefits to both Western Wildlife Corridor and to those visionary philanthropists who participate. The principal of a gift to establish an endowed fund is invested and not invaded; only earnings are expended for the donor’s stated purpose. Endowed funds support maintenance of conservation properties and educational programs. Please consider what lasting impact you would like to have on Western Wildlife Corridor through your own philanthropy. What legacy would you like to establish through your giving?

- A brief listing of the specific giving strategies (both outright and deferred) you have decided to promote and invite. This, too, can be done in both print and electronic materials. A screenshot from WWC’s giving web page follows on the next page.

- An invitation/call to action. This allows readers to request details, and you can follow up. Be sure to mention each gif strategy you have elected to pursue and accept, as well as a space for responders to inform you that your organization is already in their estate plans. (See Figure 1 below.)

TIP: Consider assigning pertinent components of this project to either a standing committee of your board or forming an ad hoc committee to help guide your decisions.

Expand your donor recognition program to include those whose gift are deferred and endowed. A comprehensive donor recognition plan also addresses lifetime giving, providing donors multiple incentives to consider a full array of gif planning strategies. A sample stewardship plan, that both acknowledges and motivates donors, is available at: thefrontlinefundraiser.com/ resources.

A key companion to this plan is your policy regarding gift valuation. Inviting a generous donor to transfer $100,000 into a Charitable Gif Annuity, then recognizing her for only $87,000 due to her age can be more than counterproductive. A meaningful (to both your organization and your donors) recognition program will provide incentives for additional gift, both during and after your donors’ lifetimes. Refer to my article, “The Five Definitions of Gif Valuation,” at: thefrontlinefundraiser.com/resources.

Identify your go-to gift planning expert, the professional who can speak with your prospective donors about wills, charitable trusts, appreciated assets, hard-to-value assets, etc. You may have an in-house expert; you may need to identify one or even several allied professionals on whom you can call as needed. At minimum, fid an attorney with expertise in estate and tax law who will be available to you upon request.

Identify your major donors/prospects. Set your threshold amount for a minimum major gift You may already have a dollar amount you use in that definition. If not try this:

- Sort a list of all your donors from last year in descending gif amount order; include all gift during that year from each donor.

- Go down the list until you reach 75 percent of the total dollars given, then count the number of donors at that point. If it’s too many to manage, move up the list to identify the number of individuals and key institutional donors you choose to manage as your major donors.

- Give yourself permission to add the names of others you know should be included due to leadership, gif potential, lifetime giving, etc.

- Include your board members, whether yours is a working board or a fundraising board. At minimum it will help you educate them and grow their capacity.

Decide how much time you have and how many prospects and donors you will select to manage. If your research identifies more names than you feel comfortable committing to, pare down the list.

- Prioritize them based on such key indicators as giving history, rated gif capacity, level of engagement with your organization, and age. Focus on those most likely to have both the motivation and the means to give.

- Consider allocating two hours per contact (travel and meeting time), and determine how much time each week or month you will commit to this vital work. Set your weekly/ monthly goal for those key contacts. Give yourself permission to adjust after several months, but keep your commitment to meeting your goals.

- If you initially identify 12 board members and only 12 other major prospects to pursue, you can probably find the time to contact two of these key donors each month. 24 names /12 months= 2 contacts per month, if you make only one annual contact with each.

TIP: A successful gif planning program is not a passive activity. In addition to the promotional materials you will share with prospects, you must actively engage them in order to invite gif planning conversations. Otherwise, what’s the point of starting?

Step 2. Execution

Identify opportunities for contact and cultivation. Start on this now, not after you complete your to-do list from Step 1.

- Identify reasons to contact—plan a special meeting with a particular donor or prospect based on your realization that this person ought to be visited due to gif potential, gif anniversary date, birthday, etc.

- TIP: Plan to personally visit and thank any donor of $1,000 or more; learn what’s behind that $1,000.

- Invite potential donors to or meet up at special events (including scheduled activities in your stewardship program).

- Determine frequency of contact—anywhere from annual to monthly. Refer to your highest rated prospects for future gif plans, and decide who warrants your individual attention.

Design a plan to make those contacts.

- At identified events, special invitations can be sent in groups or individually.

- At minimum use events as an occasion to thank and inform them.

- Decide before each thank you or stewardship contact if it’s a good time to discuss a new gift Look for opportunities.

- Your objective should ALWAYS be to look for the next gift

Start inviting conversations about charitable gif planning with your prospects. Remember that your prospect’s definition is the one that matters; don’t limit yourself.

- Invite gif conversations, not planned gif conversations. Don’t ask about will bequests; ask about gif motivation.

- Proactively seek the gif that is available, whether outright or deferred. The gif plan is the plan that gets the gift If the best plan happens to be a gif via will, then that’s the gif plan. If it happens to be the transfer of $10,000 in appreciated securities, that’s the gif plan. These who tell you (because you asked) that they are promising candidates for charitable gif planning may very likely become the first donors to your gif planning program.

Refer to your gif acceptance policies on those giving strategies you discuss with a prospect to decide if you can accept the gif being discussed.

Seek help from your identified gif planning expert as needed. Participate in those conversations, and take full advantage of these learning experiences. You’ll be utterly amazed at how competence breeds confidence, and how confidence builds your fundraising capacity.

Complete any required gif documentation. After all, you just closed a gift Go out and celebrate, then do it again tomorrow.

A Beginner’s Alternative: It May Be Okay to Start an Estate Giving Program

You may not be ready for even this modest approach to starting a gif planning program. A number of smaller nonprofits take a simple first step by focusing on a single giving strategy: starting an estate giving program.

The steps above are still valid, but you only need to pay attention to a select few of the giving strategies mentioned. Start by considering this short list of estate giving bequest vehicles:

- Bequest via will: There are three basic types of bequests: a specific bequest; a residual bequest, which leaves the remainder of one’s estate after debts, taxes, expenses and other bequests; and a contingent bequest, which provides for a contingent beneficiary if one’s fist-named beneficiaries do not survive. Sample will language (see below) for each type can be included in your promotional materials.

Specific Bequest: “I give, devise and bequeath all my right, title, and interest in and to (describe the specific property— real, personal, securities, other) to __________ or, “I give, devise and bequeath (insert dollar amount or percent of estate) to _________.”

Residual Bequest: “I give, devise and bequeath my residuary estate, which is all the rest, residue, and remainder of my property, real and personal of every kind and description and wherever located (including all legacies and devises that may for any reason fail to take effect), belonging to me at the time of my death or subject to my disposal by will, too __________.”

Contingent Bequest: “If the above-named beneficiary predeceases me, then I give, devise and bequeath such amounts or property absolutely to __________.”

- Bequest Beneficiary of Life Insurance: Charity may be made the beneficiary of a policy if the policy owner asks the insurance company for a Change of Beneficiary Form and names charity as beneficiary of all or a portion of the policy.

- Bequest Beneficiary of a Deferred Compensation Plan: Charity may be made the beneficiary of a plan (Individual Retirement Account, 401(k), 403(b), etc.) if the plan owner asks the plan administrator for a Change of Beneficiary Form and names charity as beneficiary of all or a portion of the plan.

- Bequest of a Donor Advised Fund (DAF): The donor who has established a DAF may make provisions for its eventual distribution to one or more named charities. You can request/suggest that your nonprofit be named the final beneficiary of the DAF.

Even if you decide to start small, with only an estate giving program, begin with your end in mind. Schedule a review of your new gif planning program after six months or a year. Assess what’s working, what needs attention, and how you want to expand your program. Look for opportunities to open the giving door wider as your capabilities and resources grow. Aspire to as full a menu of giving opportunities as makes sense during each periodic review.