October 11, 2011; Source: Stateline | The fiscal desperation of revenue-strapped governments hits nonprofits in a number of ways, particularly program cutbacks. One of the revenue-generating strategies some localities and states have used is to slap nonprofits with various kinds of user and licensing fees, characterizing them as fees rather than taxes so that they can be charged against tax-exempt nonprofits. Examples discussed in the NPQ Newswire and other NPQ articles include Nassau County, New York’s sewer-user fee (the so-called “toilet tax”); St. Cloud, Minnesota’s street light utility fee; fees on nonprofit food service booths at fairs and events; and child-care center licensing fees. Governments are creatively unbundling the public functions paid for by income or property taxes, and finding pieces that can be converted to fee structures and applied against nonprofit and for-profit users alike. And, if a fee already exists, it becomes a candidate for a huge hike.

Nonprofits have chafed, but there has been little they could do other than public policy advocacy and lobbying to reduce or eliminate fees that simply get passed on to the nonprofit’s clients in the form of higher program fees or reduced program services.

Now, the likes of the very conservative governor of Florida, Rick Scott, wants to roll back fees that were raised during the recession, just as was done in New Hampshire in an effort successfully pushed by Republicans there. In other states, conservative advocates are trying to reclassify fees so that fees and taxes are treated the same.

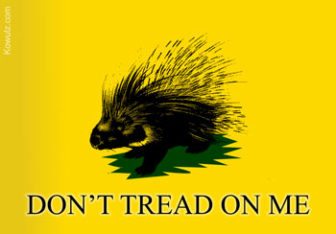

A backlash against fee increases is underway, however, as Republicans at the state level turn Tea Party enthusiasm against the rising cost of government transactions. In New Hampshire, Republicans succeeded in rolling back fees that went up during the recession. Florida’s Republican governor, Rick Scott, wants to do the same, at least for certain vehicle-related fees. Meanwhile, a wider effort from California to West Virginia is aimed at changing both language and legalities, so that “fees” and “taxes” are treated as one and the same.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

The fee slashing is key. New Hampshire, for instance, cut licensing fees on pet stores from $350 to $200. In California, Proposition 26—passed this past November with the support of the Howard Jarvis Taxpayers Association—requires that all fee increases get a two-thirds majority vote, just like with taxes.

Where does the Tea Party enter into this? In Florida, Governor Scott received substantial Tea Party support for his tight victory over his Democratic opponent and may be one of the handful of governors to serve with widespread Tea Partyish identities. In West Virginia, a state legislator introduced the “Tea Party Act,” which would require that all fees be recognized as taxes. An unlikely ally indeed.—Rick Cohen