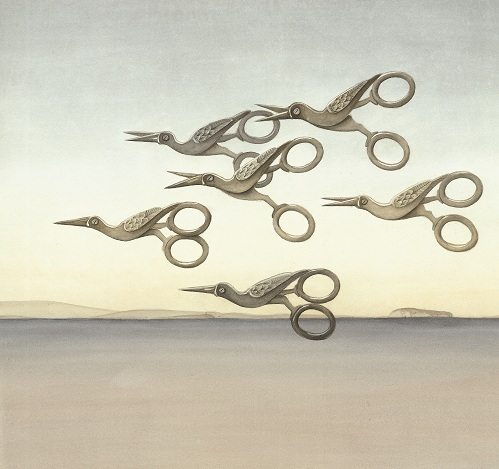

“THE SCISSOR BIRDS” BY JENNY BARRON/WWW.JENNYBARRON.CO.UK

Editor’s Note: This article is featured in NPQ‘s new, spring 2013 edition: “Nonprofits & Taxes: It’s Your Agenda.”

“How Nonprofits Can End Up Becoming a Drain on City Budgets” (The Atlantic Cities, November 12, 2012); “Squeezed Cities Ask Nonprofits for More Money” (The New York Times, May 11, 2011); “Strapped Cities Hit Nonprofits with Fees” (The Wall Street Journal, December 27, 2010). Increasingly, headlines such as these continue to appear around the country as local governments grapple with state and federal budget cuts and the larger economic woes related to slow recovery from a national recession.

This dilemma is not entirely new. For years, localities, especially those with large parcels of land held by universities and hospitals, have negotiated agreements for Payments in Lieu of Taxes (PILOTs) or other such “voluntary” arrangements with larger nonprofits. Smaller, community- based organizations are often, though not always, excluded from such efforts. But as local government budgets become more strained, different types of levies, in the form of fees, are increasingly being proposed and adopted in city council meetings around the country. Now nonprofits of all sizes are increasingly being subjected to charges for services that have traditionally been seen as a basic function of government. These fees are different from the PILOT approach in that they are not a negotiation between partners but a true levy, with cities generally having statutory authority to impose the fees on citizens and landholders.

This recent proliferation of fees and assessments by municipalities has strained traditional nonprofit-government relationships. The assumption, often unspoken, that localities so benefit from the presence of nonprofits that it offsets the loss of property-based income is thus called into question—but rather than an up-front negotiation, the levies are an entrance into a different contract by the back door.

Shortsighted Thinking or Creative Budgeting?

Recent examples of this activity include Salt Lake City, Utah (December 2012) and Minneapolis, Minnesota (October 2009). In making the case to oppose the proposed fees in Salt Lake City, the Utah Nonprofits Association (UNA) executive director, Chris Bray, urged city council members to think through the true ramifications of their decision. In a letter to all council members, UNA stated that “city street lighting is vital to the safety and security of our city, but balancing the budget on the backs of Salt Lake City’s nonprofit organizations will only increase the city’s problems.” Bray further argued that more than $100,000 per year of services to communities would be lost by imposing fees on the city’s two-thousand-plus nonprofit organizations, informing the City Council that “nonprofit organizations are tax-exempt for a reason—so they can provide valuable services that government and business do not provide.”1

Kyle LaMalfa, chair of the Salt Lake City Council, described the city’s dilemma in a recent interview: “Every local government across the country experienced hard times over the last few years.” In Salt Lake City, the council had determined that they would just “let the street lighting in the middle of the block burn out.” As bulbs burned out, streetlights would only be maintained at intersections and crosswalks. LaMalfa reported “a great clamor” from citizens who found the approach unacceptable and a “real safety hazard,” and that the controversy resulted in a turnover in membership of the elected council.

According to LaMalfa, “The council couldn’t find the priority to put street lighting first, over paying the police officers or watering the grass.” He credited the mayor with coming up with a proposal that made the new fee structure an “enterprise fund,” resulting in a fee that would appear on utility bills. (The Governmental Accounting Standards Board [GASB] suggests that enterprise funds may be used to report any activity for which a fee is charged to external users for goods or services.) LaMalfa reported some blowback from citizens denigrating the council for “raising our taxes and calling it a fee,” mirroring many conversations around the country between citizens and their elected officials about semantics. (In one state, a “health impact fee,” in the past commonly known as a “cigarette tax,” was raised to help fill a hole in a state budget.) Other fee ideas discussed in Salt Lake City Council meetings during this debate included a “street tree fee,” charging per tree for planting and maintaining trees between sidewalks and city streets. (The chair of the council said he did not believe a tree fee would be pursued in the foreseeable future, however.)

Salt Lake City’s street lighting fee raises “on the order of 2 percent of the general fund,” according to LaMalfa. When asked if it was worth risking community protest for a relatively small chunk of the city budget, he stated, “The fee is always there; it is always the same”—meaning that once a fee is enacted, it becomes a permanent part of the tax structure—adding that its attraction was in being “stable, secure, locked-in revenue to support a community asset.”

Unlike Salt Lake City’s approach, which included applying the fee to government (county and state) properties as well, the fee passed by the Minneapolis City Council was directed solely at “nongovernmental tax-exempt parcels,” leaving nonprofits and churches feeling particularly targeted. The reality of this approach is that for what is generally a relatively modest increase to the city budget (the majority of exempt property is owned by government itself, not nonprofits), there is a disproportionate and converse impact on needed community services. Nonprofits, by virtue of their reliance on individual donors, foundation support, and government contracts, have no fund from which to draw payment for these fees other than directly out of program budgets.

In October 2009, Peter Rodosovich, then the vice president of operations for the YMCA of Metropolitan Minneapolis, argued before the city council that nonprofits “earn their nonprofit status every day” by providing essential services to the community, and that the assessment “undercut the purpose of the exemption and limits the extent to which we are able to fulfill our mission and lessen the burdens of government.”

In the Minneapolis example, it was not a new attempt but an updating of a statute that had been on the books for several years. State law allowed the original assessments payable on 1974 taxes. Rates were updated in 1978, but it was not until 2009 that the levy was extended to nonprofits. Further, the charge was broken out into two separate assessments: street lighting and street maintenance. Assessed properties were now to include charitable institutions, private schools and colleges, and churches. The 2009 decision also altered the rate-setting methodology, incorporating a square-footage formula. The assessment rate is now determined by dividing the street-maintenance and street-lighting portions of the budget by the citywide assessable square footage. Nonprofits were, in essence, “buying down” the rate for all other property holders who had been paying since 1974.

Minneapolis City Council member Betsy Hodges remembers the discussion quite well. She did not view the 2009 vote, which ended up being unanimous among all thirteen city council members, as new policy, stating, “We just hadn’t enforced the policy we already had.” There was enough protest from nonprofits of all stripes (churches, hospitals, social service agencies, and arts groups) that the assessment was adjusted to be gradually phased in over a three-year period.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

“The reason people equate it with a tax is because they’re talking about the overall cost load on residents for city services. It’s not a tax,” Hodges explained. In describing the nonprofit-local government relationship, Hodges said, “Government and nonprofits do far more together; the relationships are crucial. We [Minneapolis] do a lot of partnering with nonprofits to advance common agendas. That’s why disagreements like this feel more fraught, because the relationships are so close.”

All in all, local governments are feeling forced to make decisions regarding reduced services to their communities. And, not unlike government, nonprofits are increasingly needing to make the choice of “doing less with less,” facing reduced funding from all sources. Even while it is widely recognized that investments made in preventive and other community-based services can save money over the long term, short-term budget fixes, combined with relatively short election terms, can result in decision makers going for more immediate rewards.

So What’s the Big Deal, Anyway?

While city officials may assume that they are proposing a less onerous approach to raising money from the nonprofits in their midst by focusing on what appears to be a relatively low-cost “dollars and cents on a square-footage” basis, there are some serious short- and long-term consequences to the encroachment of fees:

- The first consideration is that new fees will have an impact on the already increasingly stretched budgets of nonprofits. Depending on rate-calculation formulas and the amount of property owned by the nonprofit, the fees can vary from a few dollars to a few thousand dollars a month. Either can be disastrous depending on the type of nonprofit and the type of fee being imposed.

- Another consideration is the erosion of what is often constitutionally protected exempt status, and nonprofits have fought back against such fees on principle.

There are many other less immediately apparent losses that can occur as a result of this approach:

- It can be divisive for the sector. Attempts at PILOTs or fees often target large landholders like colleges and hospitals, and smaller organizations end up feeling like collateral damage.

- Historical nonprofit-government partnerships are threatened, creating tension. During times of reduced resources and economic downturns, this partnership couldn’t be more important in continuing to meet critical community needs.

- “Community benefit” gets reduced to a mathematical formula. Preventive and responsive services to strengthen and sustain individuals, families, and communities often have long-term payoffs that are recognized but challenging to quantify.

- Local governments weaken their own delivery systems (often contracted through nonprofits) as program dollars get diverted. Nonprofits raise money to support services aimed at the public good, and any diversion raises issues of donor intent and draws directly out of program budgets.

- Nonprofits that have multi-city operations need uniformity and predictability for budget purposes across geographic boundaries. A city-by-city method to revenue-raising creates disparities and inconsistencies across communities.

- Nonprofits are employers, too. Any dollars lost out of program budgets produce a cumulative effect that can result in job losses to the community. Nationwide, nonprofits make up roughly 10 percent of the workforce.2

What Should Happen Now?

First, the sector needs to articulate better to both elected officials and the general public how nonprofits serve “the public good.” In the “new normal” of reduced government, reduced resources, and greater competition, scrutiny of the nonprofit sector will only increase. Public perception of the role of nonprofits in a civil society needs to be tested and amplified. Positive perceptions of the nonprofit sector will increase public pressure on elected officials not to pursue back-door solutions, as they could come at a political cost.

To this end, the Minnesota Council of Nonprofits (MCN) has engaged in public polling, with support of the University of Minnesota, since 1989. The telephone survey, conducted with eight hundred households around the state, informs respondents, “Nonprofit organizations provide social services, health services, education, and arts to the public. Under Minnesota law, nonprofit organizations have been free from paying sales or property taxes because their services benefit the public.” Callers then ask the household member, “Do you agree or disagree that nonprofit organizations should continue to be free from paying sales and property taxes?” In the Minnesota poll, respondents consistently place support (in the categories “strongly agree” and “somewhat agree”) of continued exemptions around or above the eighty-fifth percentile. “This is not the time to hesitate or make an ‘aw shucks’ case for tax exemption. Nonprofits are better off making a strong case—and having polling data to back it up—that the public wants to see all of their funds going for their mission,” said MCN’s founder and executive director, Jon Pratt.

Second, the sector should develop principles for differentiating a “fee” from a “tax.” Questions to consider when examining items could include:

- Is it tied to consumption (e.g., electricity or water)? (True fees are generally tied to a cost per use.)

- Is it a public utility that individuals are not charged for (e.g., fire or police protection)? (Government generally provides these services, paid for with taxes.)

- Is the charge applied only to nonprofits or to all property owners? (This could be a “tax” in disguise as a “fee.”)

- Is it something that has always been provided by government (e.g., street lighting) and that has now been pulled out of the city’s general or property tax fund? (This is a relatively new and increasingly frequent method to turn “taxes” into “fees.”)

- Is the rate calculated based on property tax values for the purpose of improvement in market value of the property (e.g., sewer hookups)? (Improvements to properties of this sort are generally funded by “special assessments,” which nonprofits have traditionally paid and which are seen as a straightforward cost of improving the property.)

Finally, nonprofits need to increase their levels of advocacy activity to speak out against proposed measures that appear not to be part of thoughtful policy-making consistent with transparent processes and principles but rather a crisis-induced attempt to fill a city budget hole by any means available. And, nonprofits should be willing to stand side by side with local government officials at state capitols in order to educate elected officials about the need for adequate resources, including raising appropriate revenues, to pay for needed community services and basic functions of government.

NOTES

- Chris Bray, “December 10 Statement on Proposed Street Lighting Fund Program,” Open City Hall (forum), www .peakdemocracy.com /portals /79 /entries /1783?a=98.

- Per the National Center for Charitable Statistics, nonprofits accounted for 9.2 percent of all wages and salaries paid in the United States in 2010. Katie L. Roeger, Amy S. Blackwood, and Sarah L. Pettijohn, The Nonprofit Almanac 2012 (Washington, DC: Urban Institute Press, 2012).

Jeannie Fox is the deputy public policy director for the Minnesota Council of Nonprofits. She is also an adjunct faculty member at the University of Minnesota’s Hubert H. Humphrey School of Public Affairs and a Training Fellow for the Center for Lobbying in the Public Interest, Washington, D.C.