July 6, 2020; The Nation and Patch, “Seattle”

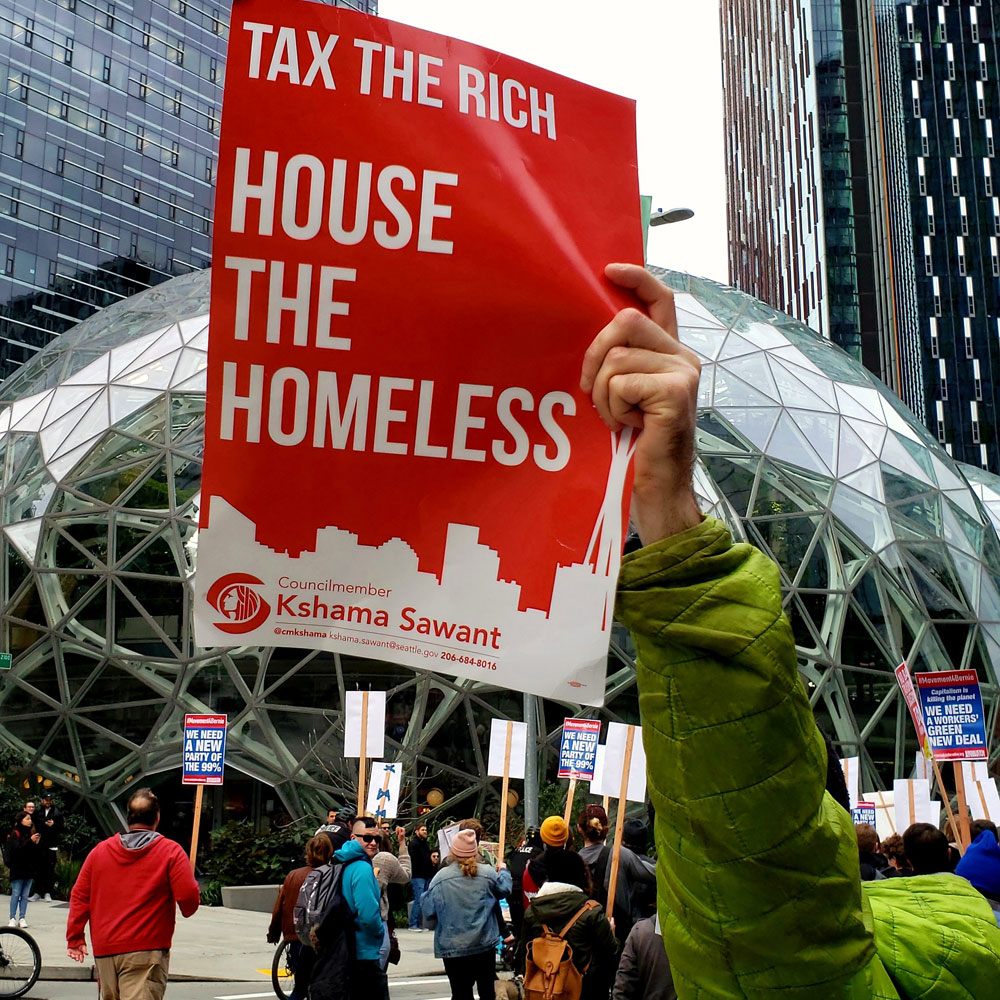

Writing in The Nation, Seattle city council member Kshama Sawant tells the story of a movement of local activists “on the cusp of winning a historic victory against Jeff Bezos.”

On July 1, the Seattle City Council voted 7–2 in its Budget Committee for an Amazon Tax that would raise more than $200 million annually. The tax will apply to the top three percent of corporations, with Amazon paying the largest share, and will go toward a major expansion of affordable housing in a city with sky-high rents and a long history of racist gentrification.

Yesterday afternoon, the city council made it official, passing the tax by the same 7–2 veto-proof margin. The measure will take effect January 1st. Even so, as Charles Woodman writes for the Seattle edition of Patch, passage of the bill, called “Jump Start Seattle,” will fund needed services now. As Woodman explains, “Councilmembers will work to set aside $86 million to be given for coronavirus relief for small businesses, immigrants and refugee support programs, housing and food security. That money will then be replenished by the JumpStart Seattle tax raised next year.”

The tax, adds Woodman, applies to “corporations whose payrolls reach over $7 million annually. Even then, the tax is only applied to individual payrolls for employees who make more than $150,000 each year. Depending on how more much those employees make, their employers will be taxed between 0.7 and 2.4 percent of their pay.”

This is a story with an almost unbelievable number of twists and turns. The tech-fueled economy of Seattle is well known for its shortage of affordable housing, so, in 2018, community housing activists sought to get city council approval to levy a small tax on the businesses that were fueling gentrification.

An initial measure passed by a city council committee back in 2018 on a 5–4 vote would have assessed a $500 per full-time employee tax on employers with over $20 million in revenue and would raise $86 million. But a 5–4 vote meant that the mayor could stop the legislation with a veto. As a compromise, the $500 tax was scaled back to $275 and was slated to raise $47 million a year, with a sunset provision after five years. That measure passed on a unanimous 9–0 vote—and that, you might think, was that.

The measure was called the “Amazon tax” because Amazon is so large that the firm would end up paying about 20 percent of the tax, or $10 million a year. Still, for a firm with $280 billion in sales, $10 million—or even the $50 million over five years that was slated to be collected—is chump change. Surely, Amazon wouldn’t object to such a small fee in its home city. Indeed, before 2018 was over, the firm gave $97.5 million to housing nonprofits nationwide. A year later, Amazon also donated $8 million to a Seattle housing nonprofit.

But this was never about the money. It was about power. And, so, Amazon and its allies fought. Threatening to leave Seattle—a laughable threat if there ever was one—and paying to collect petition signatures to hold a city referendum on the tax, less than one month later, the very same city council that had voted 9 to 0 to approve the tax reversed it on a 7–2 vote. At the time, NPQ asked, “Might Amazon’s petition tactic come back to bite it?” And now it has.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

In the intervening two years, a number of developments occurred:

First, San Francisco in November 2018 passed a ballot measure that raised five times as much money as the Seattle measure would have, this time with the backing of a major tech employer, Salesforce.

Second, Amazon in November 2019 tried to buy a City Council more to its liking—and failed spectacularly. Sawant, the Seattle city council socialist and a housing tax campaign leader, was among those targeted. In the campaign, Sawant was outspent in political action committee money by $617,592 for her opponent versus the $2,060 she raised. Sawant won anyway.

This then led to desperate measures. Maybe Amazon and others could get King County to step in. That failed, too. The tax formula approved yesterday by the Seattle City Council is estimated to raise $214 million a year—over four times the payment level that the 2018 measure would have required.

But don’t shed too many tears for Amazon, whose stock price just hit $3,000 per share, a value that lifts the net worth of CEO Jeff Bezos to $172 billion, “a new record that pushes his financial wealth back above its levels prior to his divorce settlement last year,” reports GeekWire.

For her part, Sawant credits the Black Lives Matter uprising, along with broad working class organizing as two key steps that led to city council approval.

“The legitimacy of the status quo has been utterly smashed by the protest movement, the pandemic, and the deepening crisis of capitalism,” Sawant writes in The Nation. “In Seattle, Tax Amazon was widely taken up at the Justice for George Floyd protests where we gathered 20,000 signatures in 20 days.”

Sawant calls the victory the most important political achievement in the city since Seattle passed a $15 minimum wage back in 2014. She adds that she hopes, like the Fight for $15 campaign, that the business tax for housing proves to have a broader national impact.

“We hope that once again we can inspire working people and youth nationally and globally to spread this victory to other cities and regions,” Sawant explains. “We will do everything in our power to assist in this crucial fight against the billionaire class that is attempting to force working people to pay for the current crisis of capitalism with massive budget cuts. Our rallying cry everywhere must be, ‘NO to austerity under this pandemic and recession! Tax big business, not working people!’”—Steve Dubb