IberiaBank—founded in New Iberia, Louisiana, and now based in nearby Lafayette—announced it would direct $6.72 billion over the next five years to provide loans and services for low- and moderate-income communities. Specifically, this includes “$2 billion in mortgages in low- to moderate-income areas and communities [of color]; $3.2 billion in small business lending; $1.5 billion in community development, including areas affected by hurricanes; and $20 million in grants and philanthropy such as workforce development and housing counseling.”

The accord was negotiated by a collation of 37 community groups located throughout the service area of IberiaBank, backed by the national advocacy nonprofit, the National Community Reinvestment Coalition, or NCRC. According to NCRC, the commitment amount is the equivalent of 24 percent of post-merger bank assets and 33 percent of total bank deposits.

Since 2009, Iberia has acquired more than a dozen banks, including Sabadell United Bank in Miami this year. IberiaBank operates branches in many southern US southern states—with most in Arkansas, Louisiana, Texas, Florida and Tennessee.

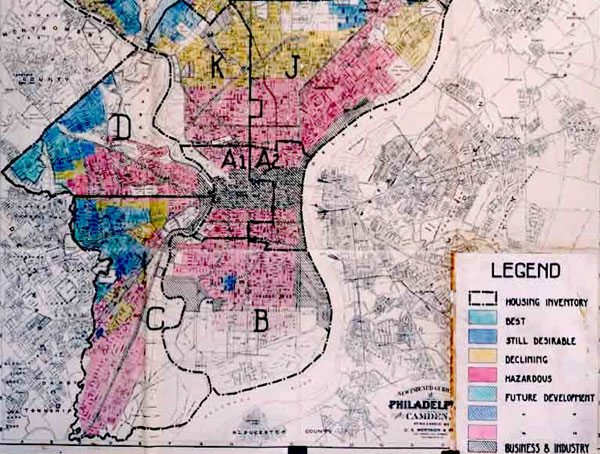

When acquiring other financial institutions, banks often make similar commitments—if prodded to do so. Why banks make these commitments has a lot to do with the federal Community Reinvestment Act (CRA), which became law in 1977 after community activists organized to push through legislation that said banks had an “affirmative obligation” to make financial services and loans available to low- and moderate-income residents, especially in communities of color, which had previously been denied loans due to redlining. (From 1934 to 1968, neighborhoods where people of color resided were literally colored red on federal mortgage lending maps, a designation that blocked resident access to federally subsidized loans).

Back in 2008, NPQ’s Rick Cohen called the Community Reinvestment Act, which began to reverse this practice, “one of the nonprofit sector’s biggest advocacy triumphs.” Of course, enforcement has gone up and down over the years, and the Community Reinvestment Act is regularly attacked. Back during the 2008 financial collapse, a few absurdly blamed the law for causing the financial crisis. (The real culprits were deregulation and high-risk bank practices like collateralized debt obligations, as a wide range of sources, including the pro-business Economist, have repeatedly explained.)

Mergers and acquisitions provide an opportunity for community groups to intervene formally in regulatory hearings, which is why bank announcements of large community investment commitments typically come at this time. The IberiaBank case is no exception in this regard.

As NCRC reports, some specific commitments of IberiaBank include:

Mortgage Lending to Low- and Moderate-Income Borrowers & Communities

Community Benefits Commitment: $2 billion over 5 years

IberiaBank will adopt a mortgage lending goal for LMI borrowers and neighborhoods of $2 billion. IberiaBank will create a portfolio loan product, and retain Sabadell United’s key Latino loan originators in Miami. IberiaBank will also create a marketing budget to fund partnerships with CDCs/non-profits/credit counseling groups to support counseling efforts in bank assessment areas to low- and moderate-income borrowers.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Small Business Lending to Small Businesses & Low- and Moderate-Income Communities

Community Benefits Commitment: $3.2 billion over 5 years

IberiaBank’s lending goal for small businesses and businesses in LMI neighborhoods is $3.2 billion. IberiaBank will form a strategic plan to reach underserved small business communities in Miami Dade market. Subsequent to the implementation of the Miami small business plan, IberiaBank will develop a statewide Florida small business plan as well.

Community Development Lending and Investment (CDLI)

Community Benefits Commitment: $1.5 billion over 5 years

IberiaBank will devote $1.5 billion to community development investments and lending. Included in this, IberiaBank will explore opportunities to support non-profit housing developers, especially in hurricane-impacted areas. IberiaBank will also look for opportunities to invest in more creative options such as Small Business Investment Companies (SBICs).

Philanthropy

Community Benefits Commitment: $20 million over 5 years

IberiaBank will disseminate $20 million in grants over the next five years, a 97 percent increase. Philanthropic giving will focus funding on low- and moderate-income children, workforce development, pre-purchase housing counseling, CDCs, CDFIs, and commercial corridors with a focus on small businesses.

New Branches

IberiaBank plans to open two new branches in low- or moderate-income census tracts during the term of the plan. One new branch will be opened in an LMI census tract in Miami Dade, and one new CRA branch will be opened in Atlanta.

Other Commitments

IberiaBank will support, community land trusts, healthcare services and healthy living—such as financing grocery stores in food deserts, rural areas in Louisiana, and financial literacy education throughout every state in the bank footprint.

Plan Governance

IberiaBank will create a national community advisory board which will consist of approximately 18-20 members and will meet twice per year.

Given the size of the promised lending commitment relative to its balance sheet, there is little doubt that the IberiaBank deal is precedent-setting. Still, the deal is part of a larger industry trend. Last year, NCRC negotiated similar deals with two much larger banks. One of these deals involved Key Bank, based in Ohio, which committed $16.5 billion in lending and $175 million to philanthropy (focused on education and workforce development). Huntington Bank, also in Ohio, committed $16.1 billion in lending and $25 million to philanthropy, as well as creating a $30 million fund to support bank branches in low- and moderate-income communities and other service improvements. All of these agreements also include a commitment of continued meetings with community representatives to ensure accountability to the commitments made and to troubleshoot issues as they arise.

One reason these deals work is that they provide banks community data that informs planning. As IberiaBank CEO Daryl Byrd explains, “a written plan provides a clearer understanding of our commitment to continue to invest in low- and moderate-income communities within our service areas.” Or, as John Taylor, CEO of NCRC puts it, the bank, by engaging in community consultations, is “well positioned to meet the needs of underserved communities.”

Taylor also underscores the scale of the IberiaBank accord. “This community benefits commitment,” Taylor says, “is the gold standard and raises the bar for all banks on what constitutes a forward-thinking community commitment.”—Steve Dubb