Last spring, news broke of deals valued at hundreds of thousands of dollars between the University of Maryland Medical System (UMMS) and nine members of its 30-person board of directors. This story was reported at NPQ as it unfolded, culminating in the resignation of Baltimore Mayor Catherine Pugh, who was implicated in self-dealing around sales of her children’s book, titled Healthy Holly: Exercising is Fun, to UMMS and Kaiser Permanente. Pugh had received $500,000 from UMMS for book sales. In response, the Maryland General Assembly passed legislation requiring board turnover.

Now, for the first time since these deals became public, UMMS board members have filed financial disclosures with the Maryland Health Services Cost Review Commission (HSCRC). Disclosures are required within 60 days of appointment. This comes after Maryland Governor Larry Hogan (R) named 11 new members to the board in June following the so-called “Healthy Holly” scandal. In addition to Hogan’s appointments, Maryland Senate President Thomas V. Mike Miller (D) and Maryland House of Delegates Speaker Adrienne A. Jones (D) each appointed one Board member, for a total of 13 new board members. The disclosure forms on file reveal that two of these new members do have business ties with UMMS.

These two individuals are Elisa Basnight, senior vice president of supply chain for the American Red Cross, and Kathleen A. Birrane, partner at DLA Piper law firm, formerly a top lawyer at the Maryland Insurance Administration.

Basnight disclosed over $20 million in business between the Red Cross and UMMS, including payments for costs of providing blood to the health system. In a statement regarding these transactions, a Red Cross representative stated that the blood itself is not a recovered cost, but rather “costs associated with the recruitment and screening of potential donors, the collection of blood by trained staff, the processing and testing of each unit of blood in state-of-the-art laboratories, and the labeling, storage and distribution of blood components.” The Red Cross also made clear that Basnight has never been personally involved with “procurement, activation, or oversight of blood products or services to UMMS.”

Birrane disclosed that UMMS had used DLA Piper for legal services, for which it paid the firm $12,260. Others at DLA Piper did this work and UMMS was billed before she joined the board. .

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

One holdover board member, Korkut Onal, also listed business with UMMS. a contract with the health system that paid out a commission over $20,000. Onal is a managing partner of Jones Birdsong, an insurance firm. During the time period subject to the disclosures, July 1, 2018 to June 30, 2019, Onal reported a 10-percent commission on $207,000. Onal also serves as chairman of the board at University of Maryland Baltimore Washington Medical Center in Glen Burnie, a member of UMMS. He declined to comment on the Sun’s story, and Michael Schwartzberg, a spokesman for UMMS, noted that this transaction was “a one-time expense” that was “appropriately and timely disclosed in accordance with HSCRC requirements.” Additionally, Schwartzberg stated that the insurance firm, Jones Birdsong was the insurance broker, not insurer, and the pricing was “competitive” and “the lowest priced policy was purchased.”

More recently, Hogan appointed four more board members, who will need to file their disclosures by December. Disclosures were also filed for holdover and former board members (except Pugh, who was legally released from doing so after returning the money she had received) for the fiscal year that ended on June 30th, which show not only the deals previously reported, but also new contracts between UMMS and other organizations and businesses with connections to the Board members. Many of these disclosures are available online.

Schwartzberg notes that UMMS has required Board members at “corporate and affiliate” levels to disclose membership on other boards, “even where the board member has no financial interest.” Board members were asked to disclose any business deals with UMMS worth over $10,000, and if so, they had to file a separate disclosure describing those deals.

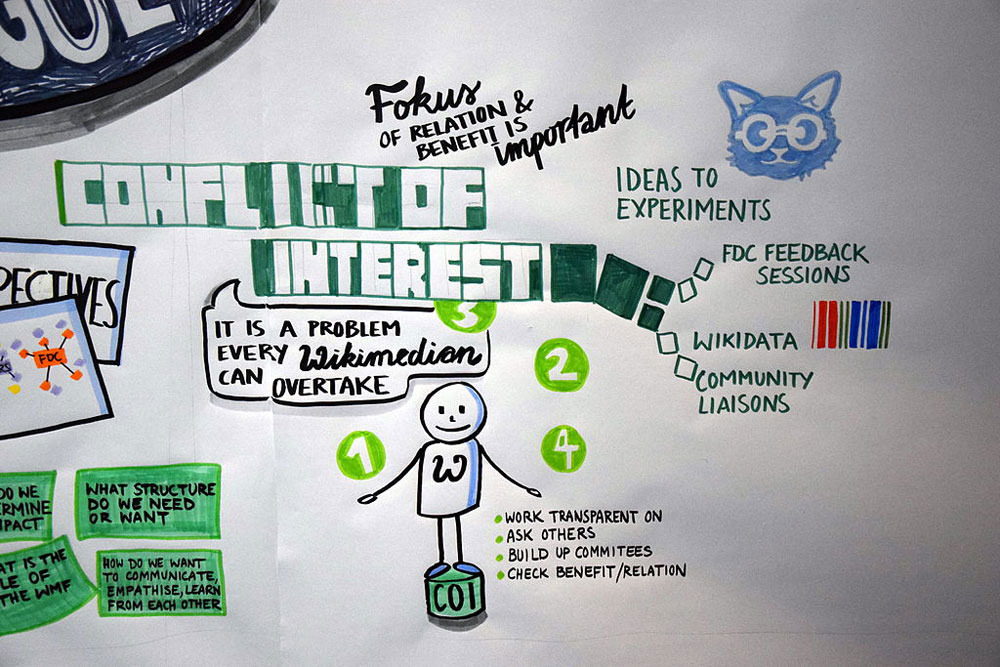

Of course, it is fairly likely board members of a well-connected and large health system will have some sort of prior business or nonprofit connection. Disclosure is an important first step, but as Vernetta Walker recently wrote in NPQ, while nonprofits “cannot possibly avoid conflicts,” what is critical is “to have clear rules, policies, and guidelines to follow” when conflicts arise.

“Conflict-of-interest policies are a start,” Walker notes, “but the real work involves thoughtful deliberations and decision making.” What will be important to watch in the years ahead is not simply whether board members at UMMS complete their disclosure forms, but whether, as Walker puts it, they can maintain a “culture of integrity” that’s “worthy of the public trust.”—Kristen Munnelly