The pandemic and protests are creating uncertainty in almost every sector, including philanthropy. There are some big unknowns:

- How will COVID-related giving and the long-overdue focus on racial justice affect the funds we’ll raise from individuals in the coming years?

- What do the bold moves of foundations—such as Ford, Kellogg, and MacArthur—to increase payouts in the next three years portend?

- As corporations cut shareholder dividends, will they continue investing in the communities they serve?

With that much uncertainty ahead, it’s easy to go from handwashing to handwringing. And the challenge is that while historical trends, even recent ones, provide insights, it can be akin to trying to see the road ahead by looking in the rearview mirror.

What’s the alternative? One approach is called the Delphic Panel Approach, in which you ask a team of experts to consider future questions and offer their opinions on likely outcomes based on their experience and insight. That’s exactly what we did to look ahead down the highway. We selected 20 of the smartest fundraising experts in the United States and asked them what to expect for philanthropy over the next three years. They included the directors of development of some of the largest humanitarian, educational, cultural, and social service agencies in the US, as well as a sprinkling of the most experienced consultants.

Our goal was to help create a clearer picture of what the future might hold, based on their expert opinions.

Clues from 2019

Before diving into the results of our Delphic survey, we turned to a resource for excellent historical data on philanthropy that everyone in our profession can access. The longest-running, most comprehensive philanthropic survey is Giving USA: The Annual Report on Philanthropy, published by the Giving USA Foundation. The most recent installment was released in June. Key findings for 2019 include:

- Individual giving remains the largest source of contributions (69 percent), which totals 79 percent when you add bequests.

- Looking at growth in sources, corporate giving increased by 13.4 percent (though note this includes gifts-in-kind, not the most fungible of resources), and giving by individuals increased by 4.7 percent, driving an overall increase in giving of 4.2 percent.

- Recipient sectors who benefited most were ones where high-net-worth individuals tend to concentrate their giving, with public-society benefit increasing 13.1 percent, arts, culture, & humanities increasing 12.6 percent, and education increasing 12.1 percent.

- Philanthropy is often driven by underlying economic results, and 2019 was a strong year with the S&P 500 increasing by roughly 29 percent, personal income growing 4.4 percent, and gross domestic product growing by 4.1 percent. So, you could consider the longer term impact as the economy struggles in the next three years and beyond.

Predictions for 2020 and beyond

Next, we turned to our selected group of 20 experts—all veterans in the fundraising profession, ranging from the leaders of development operations for large multi-sector nonprofits to consultants who deal with nonprofits of a variety of sizes. All were able to take a national view. All completed the survey in June 2020. The results were remarkably consistent across the individuals and the different industries we surveyed.

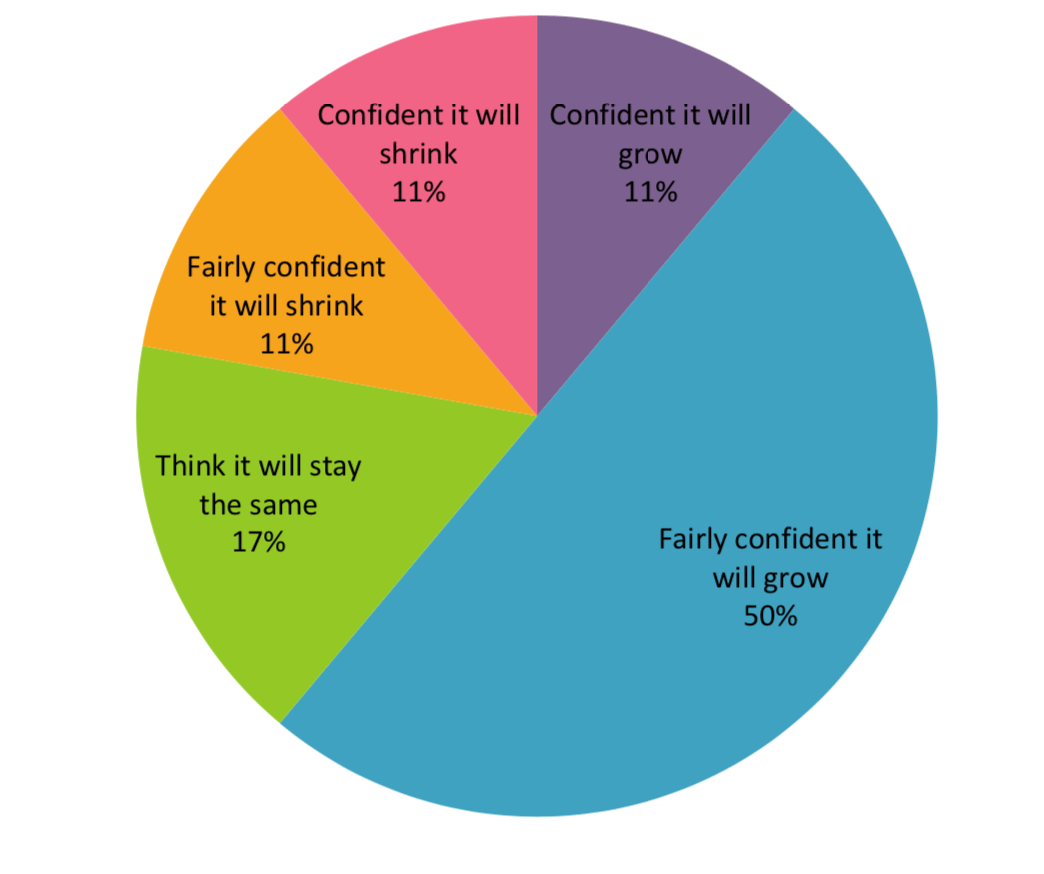

Expected growth for funds raised. Of those surveyed, 61 percent were reasonably confident that philanthropy overall would grow during the next three years. The spectrum of growth expectations is illustrated below.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

When we drilled down into percentage expectations of growth among our optimistic cohort these ranged between 5–15 percent. For the minority—22 percent—who foresaw a shrinking market, the average was five percent, though one pessimistic outlier was concerned about a possible 20 percent drop.

Surprised? Well during a crisis, you might imagine contributions would dramatically decrease, and stay there for a while. However, the long-term Giving USA data shows us even the steepest recent recessions tend to recover in five or fewer years (in current dollars). Our top respondents mostly agree: a decline in giving is not likely to be long-lasting and there is hope for growth.

What were the investment predictions?

We asked our top experts for their key investment predictions:

- The overwhelming majority (67 percent) of respondents suggested that their organizations or clients would be investing more in fundraising during the next three years, with only five percent indicating that their organization or client would spend less. The implication? Avoid austerity…

- However, there is more challenging news for fundraising jobs. Respondents were fairly evenly split regarding retaining fundraising staff and hiring more fundraisers. No one suggested their organization or client would have a net reduction in fundraising professionals over the period. So, despite the short-term news of layoffs, there should be opportunities in development.

- Regardless of the near-term impact of COVID, veteran fundraisers anticipate organizations adding more accelerant to the fundraising fire. If your board or senior managers recommend cutting investment or reducing development staff, our expert panel suggests the smart money is on the opposite.

Where will growth come from?

Another part of the survey explored where, specifically, growth would come from, in terms of channels and sources. Here’s a headline summary:

Individuals remain essential

- Respondents overwhelmingly agreed that growth in future fundraising revenues would come from individuals. Our senior fundraisers anticipate gains from bequests, major donors (>$15k), and regular/routine/sustainer donors.

No change or reduction in other streams

- Outside of Individuals, most other forms of fundraising were expected to remain the same or decline.

- Half of respondents predicted a drop in corporate giving, with only three individuals (15 percent) hoping for an increase.

- No surprise, the only component of individual giving expected to retreat was community/event fundraising.

- The importance of individual giving remains consistent with Giving USA’s four decades of research.

Drive acquisition with digital

In terms of investment in specific fundraising acquisition channels:

- Nearly all of our senior thinkers thought that their organizations or clients would be spending more on digital. (No one suggested that they would be spending less).

- Other growth areas identified by the survey include DM (direct mail), DRTV (direct response television), and a resurgence in telemarketing.

- Perhaps surprisingly, our experts were evenly divided on whether face-to-face fundraising, difficult in COVID settings, will continue to perform. We’re doing more work to study this.

- The one channel most clearly in retreat in everyone’s opinion is—no surprise—print advertising.

One further thought: several commentators suggested organizations need to develop a digital strategy—not just a digital presence. It’s not just COVID that is driving this—the changing tastes and preferences of donors, as well as the fluctuating state of our world, requires it. The interesting follow-up question is where to focus your digital dollars—anyone remember when Snapchat was invincible? And do you reject Facebook on ethical grounds or simply hold your nose and work with it? Anyone monetizing TikTok yet?

Agree/Disagree? Why not have your say?

A survey is just a survey. And opinions, even those offered by 20 super-smart and experienced people, are only opinions. So, we’re about to undertake the next phase of this work creating more detailed scenarios to aid planning. We’ll be sharing what we learn in the next few months.

We’d also love to know your opinion on growth opportunities. If you’d like to add your opinion, we’re looking for up to 100 respondents to participate in the same survey taken by our experts. If you reckon you’d like to add your view, you can access the survey here. As a bonus, if you share your views, you’ll gain access to the detailed outputs, which may be useful for your own peace of mind or to share with your board or senior colleagues.