In March, Congress passed a law, one section of which allocated $350 billion in COVID-19 recovery funds for state, local, tribal nation, and territorial governments to provide “assistance to households, small businesses, and nonprofits, or to aid impacted industries.” [Emphasis added.] That law, the American Rescue Plan Act (ARPA), and the Treasury Department’s rules and guidance to implement it, make clear that those governments may use the federal funds both to pay nonprofits to deliver services and to help nonprofits recover from COVID-19 and its economic aftermath.

Yet three months later, many on Capitol Hill are trying to claw back much of the $350 billion.

Why?

Negotiations are underway right now on how to pay for an elusive infrastructure bill. The proposed American Jobs Plan calls for both reshaping the economy for a future that is already upon us and helping everyone participate in the recovery. It includes ways to help US workers and families with expanded and affordable childcare, housing, nutrition, and other vital services often provided by nonprofits. This type of full infrastructure is needed for every industry to perform well and the economy to be robust.

The infrastructure negotiations, however, have narrowed to focus now primarily on the “hard” infrastructure of concrete and steel in transportation-related infrastructure like road and bridge construction. And to pay for it, a bipartisan group of 21 senators appears willing to take back much of the $350 billion in ARPA funds already promised to state, tribal nation, and local governments that expressly authorize spending the money to support nonprofits recovering from the pandemic and providing needed aid in their communities.

In short, many on Capitol Hill want to enact a bill that is no-gain, all-pain for charitable organizations. But that outcome is not preordained. Nonprofit professionals everywhere can and should take two simultaneous actions to support the wellbeing of their organizations and communities: (1) advocate against the clawing back of state and local funds, and (2) make the case to government officials in your state that charitable nonprofits are critical partners for the new ARPA funds.

Protecting ARPA Funds

The first order of business is to push back against efforts to take the ARPA money. Last week, the National Council of Nonprofits sent a letter to congressional leaders expressing our strong objection to any proposal to claw back already allocated ARPA funds. Our letter explains, “None of the ‘hard’ infrastructure proposals currently under discussion address the unmet needs of charitable nonprofits and the people they serve; only the State and Local Fiscal Recovery Funds provide the potential for that relief.” It concludes, “Therefore, it is imperative that you reject any attempt to claw back or reclaim ARPA funds at the devastating expense of charitable nonprofits serving your constituents and all Americans, every day.”

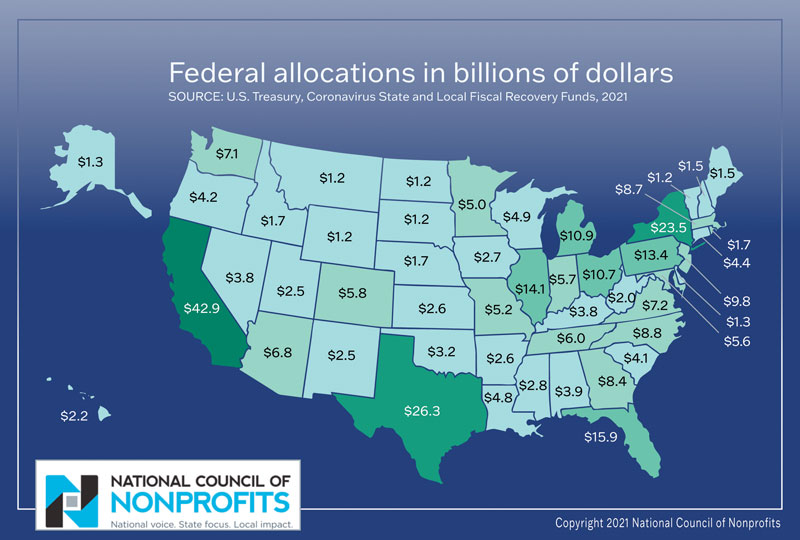

Nonprofits are not alone in this effort. National associations of local governments recently sent their own letter expressing opposition to repurposing these funds. But do the elected officials, media, and public in your state know about the clear and present danger of losing their allocation of federal dollars? Check this chart for the amounts at risk, and then notify them immediately about the threat—negotiations in the US Senate can conclude at any time. We all must act now, together.

Investing ARPA Funds in Nonprofits

Preserving the original purpose of the $350 billion is just the first hurdle. The second involves answering these questions from government officials: “can we invest those ARPA funds in nonprofits,” “why should we,” and “how should programs be structured?”

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

To answer these questions and more, we just published a report that offers guidance to governments and information for nonprofits seeking funds. This report, Strengthening State and Local Economies in Partnership with Nonprofits, also includes a map with dollar allocations to your state, county, and city governments, and unincorporated areas so you can alert elected officials and media about how much federal funding would be lost if Congress claws back the ARPA funds.

A reasonable early question a public official may ask is whether governments are authorized to use these funds to support charitable nonprofits and their work in communities. The answer from Congress and the Treasury Department is yes.

Addressing “why,” the report offers these key principles: (1) prioritize equity from the outset to improve the quality of life for all residents; (2) invest in economic multipliers; (3) implement quickly, yet fairly; and (4) promote accountability via reasonable documentation and transparency. Governments applying these four principles are highly likely to turn to nonprofits as partners and problem solvers.

The recommendations about “how” programs should be structured draw on recent experiences at the state and local levels with respect to the more restrictive CARES Act funding. Those insights can avoid burdens and barriers that nonprofits ran up against last year and help shape future partnerships for relief, recovery, and impact.

The section on successful models of nonprofit relief from around the country identifies recent examples of proven solutions from elsewhere that can be adapted and improved to meet communities’ greatest needs and promote constituents’ wellbeing. Call it a menu, a hit parade, or—our favorite—a box of chocolates, the section shares 43 successful programs from which you and your elected officials can pick and choose to import and customize for your community. Or use them as inspiration for ideas that can be shaped to be even better solutions that meet your community’s unique needs. Plus, you can cite the experiences from elsewhere to show third-party validation.

Those proven models are grouped into four categories:

- Relieving nonprofit employers of unemployment insurance burdens.

- Creating relief and recovery funds and grants for nonprofits to use in their communities.

- Streamlining government grants and contracts for nonprofits.

- Expanding and replicating innovative nonprofit programs to help communities respond, adapt, and recover.

As you look at these examples, think about how nonprofits and local governments in your state can use ARPA funds to advance your missions. And then contact your Senators and Representative in Congress to tell them to keep their hands off the funds that they already approved.

But do not stop there. Let your state and local officials know about the positive opportunities to partner with nonprofits; after all, you serve the same constituents as they do. Follow the lead of nonprofit leaders who have written articles in Delaware and Nebraska and letters in Massachusetts, Minnesota, and Utah, to name a few, to make the compelling case for governments to dedicate ARPA funds to support the recovery work of nonprofits in their communities. When we all work together, we all win.

Tim Delaney is President & CEO and Tiffany Gourley Carter is Policy Counsel of the National Council of Nonprofits in Washington, DC.