May 2, 2014; Stateline

The payday lending industry is one tough player when it comes to lobbying against state regulations. In Louisiana recently, the legislature failed to move on a bill that would have regulated the industry there. Although payday lending advocates have all kinds of reasons for justifying their service to the poor as being fundamentally about providing lower-income people with a little money between paychecks, their critics take aim at payday lenders’ annualized interest rates, which can come close to 600 percent, and the trap of payday loans for people who end up stuck in repeated loan cycles. The payday lending industry complains that annualized interest rates don’t accurately reflect what borrowers typically do with their short-term loans.

Elaine Povich of Stateline writes that 12 million people turn to payday loans every year. For a more realistic picture of payday lending, Povich turned to research from the Pew Charitable Trusts (which funds Stateline), revealing that the average payday loan is about $375, the term is about two weeks, and the average fee per pay period is $55. Pew says that the average borrower keeps that $375 loan out for five months, which results in $520 in finance charges. For the working poor, paying as much as 40 percent more in fees than a short-term loan is worth is burdensome. It isn’t hard to imagine that payday loans that are neither average nor typical might be quite onerous for a lower-income borrower.

Facing off against the payday lending industry isn’t easy. It has been an active participant in campaign finance contributions to both political parties, especially in recent election cycles, as shown in this chart prepared by the Center for Responsive Politics:

|

Election Cycle |

Total Contributions |

Contributions from Individuals |

Contributions from PACs |

Soft/Outside Money |

Donations to Democrats |

Donations to Republicans |

% to Dems |

% to Repubs |

|

2014 |

$589,405 |

$274,805 |

$314,600 |

$0 |

$100,950 |

$488,455 |

17% |

83% |

|

2012 |

$3,282,300 |

$840,824 |

$1,201,476 |

$1,240,000 |

$490,440 |

$1,554,360 |

24% |

76% |

|

2010 |

$1,986,330 |

$917,605 |

$1,062,725 |

$6,000 |

$1,218,275 |

$761,255 |

61% |

38% |

|

2008 |

$1,418,501 |

$779,701 |

$638,800 |

$0 |

$901,180 |

$517,321 |

64% |

36% |

|

2006 |

$806,000 |

$655,000 |

$151,000 |

$0 |

$320,800 |

$484,950 |

40% |

60% |

|

2004 |

$888,745 |

$797,241 |

$91,504 |

$0 |

$328,732 |

$560,013 |

37% |

63% |

|

2002 |

$308,818 |

$152,690 |

$62,875 |

$93,253 |

$108,750 Sign up for our free newslettersSubscribe to NPQ's newsletters to have our top stories delivered directly to your inbox. By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners. |

$200,068 |

35% |

65% |

|

2000 |

$225,685 |

$139,184 |

$59,000 |

$27,501 |

$66,984 |

$158,701 |

30% |

70% |

|

1998 |

$62,041 |

$11,300 |

$50,741 |

$0 |

$22,000 |

$40,041 |

35% |

65% |

|

1996 |

$50,425 |

$18,250 |

$30,350 |

$1,825 |

$19,350 |

$31,075 |

38% |

62% |

|

1994 |

$60,225 |

$12,000 |

$48,000 |

$225 |

$37,750 |

$22,475 |

63% |

37% |

|

1992 |

$17,750 |

$5,750 |

$12,000 |

$0 |

$7,250 |

$10,500 |

41% |

59% |

|

1990 |

$5,000 |

$1,200 |

$3,800 |

$0 |

$1,700 |

$3,300 |

34% |

66% |

|

Total |

$9,701,225 |

$4,605,550 |

$3,726,871 |

$1,368,804 |

$3,624,161 |

$4,832,514 |

43% |

57% |

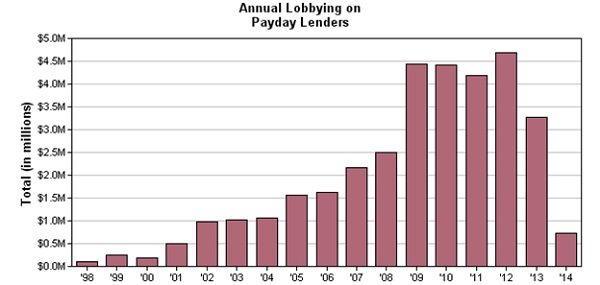

The industry also spends on lobbying, leading to results like Louisiana’s. This picture of the payday lending industry’s lobbying at the federal level sparks one’s imagination of how the industry might be spending on lobbying with state legislatures:

According to one source, the Community Financial Services Association—the payday lending industry’s trade association—spent more than $20 million in state-level campaign contributions over the last decade. That is a lot of financial prowess for nonprofit advocates to compete with and overcome, especially since 38 states have laws that specifically authorize payday lending and only four plus the District of Columbia prohibit payday lending. Regulations in the most states are weak, if they exist at all.

The story in Louisiana is telling. Nearly one out of every four households in Louisiana takes out a payday loan in a year. A coalition of church groups and consumer groups collaborated to promote a law, introduced by state senator Ben Nevers, to cap payday loan annual interest rates at 36 percent, far below the state average of 435 percent. As that idea failed to get sufficient support in the legislature, Nevers and his nonprofit allies came up with a different idea: to limit borrowers to no more than 10 payday loans a year. That idea also failed, against charges that Nevers and the advocates wanted to put the payday lending industry out of business in Louisiana.

The position of industry spokesperson Troy McCullen, speaking on behalf of the Louisiana Cash Advance Association, said that if payday lenders were to go out of business, borrowers would turn to the Internet for offshore sources or even go to loan sharks. In other words, if you think we’re thieves, just look at the criminals waiting for you at the end of the alley. The legislation proposed by Nevers never made it out of the legislature. Nevers contended that the payday lending industry, which he calls “nothing more than loan sharking,” spent “thousands, if not hundreds of thousands of dollars against this push to regulate this industry.”

The problem that makes reining in payday lending such a huge challenge for community coalitions like the one that came together in Louisiana behind the Nevers bill is that different states have levels of regulation that range from inadequate to nonexistent. This cacophony of state laws, combined with the campaign contributions of payday lenders, makes regulatory headway difficult. The solution may be in federal regulations that supersede state laws, particularly through the Consumer Financial Protection Bureau, a creation of the Dodd-Frank Act. That’s the position held by the nonprofit Consumer Federation of America, which supports the CFPB rules controlling payday lending. The Federation even maintains an online PayDay Loan Consumer Information resource with explanations of how payday loans work and what the states are or are not doing to put some clamps on the industry.

This is why nonprofit advocacy is so crucial. If the Consumer Federation of America and its state-level allies were not in this game, the payday lending industry would have even freer rein than it does now. –Rick Cohen