“NEW BEGINNING” BY LEMYRE ART/WWW.LEMYREART.COM

Editors’ note: The following mini–case studies were submitted as part of the graduate course “The Nonprofit Sector: Concepts and Theories,” taught by Chao Guo, associate professor of nonprofit management in the Penn School of Social Policy and Practice at the University of Pennsylvania. Below is an introduction by Mark A. Hager, associate professor of philanthropic studies in the School of Community Resources and Development at Arizona State University. This article is featured in NPQ’s new, winter 2014 edition, “Births and Deaths in the Nonprofit Sector.”

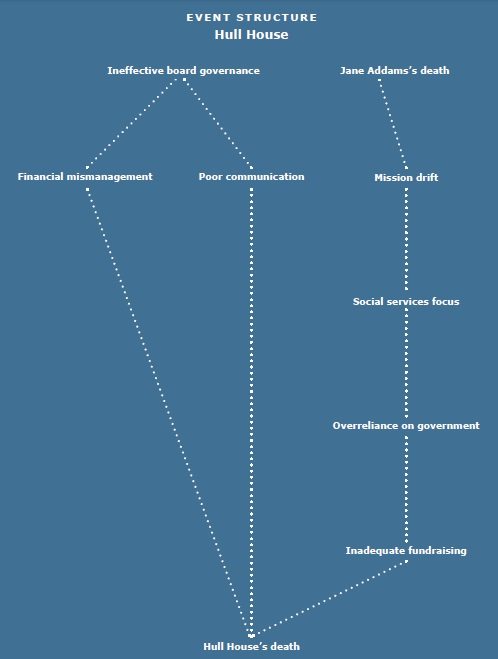

Organizational events are complicated, so we have to select the right tools to study and understand them. Statistical models are all the rage, but they are poor choices for studying intricate processes. The stories and the analytic tools we have to interpret them are better at capturing the complexity, but while stories by themselves can teach us a lot, they cannot show us the similarities or trends that run across an assortment of cases. One approach to understanding the trends in stories is called “event structure analysis.” Pioneered by Indiana University sociologist David Heise in the early 1990s, event structure analysis has been used to understand social movements, labor markets, firm growth, and organizational decline and dissolution, to name just a few areas where it has been applied.

The five cases in this article include “event structures” that are a hallmark of the method. You can think of them as a graphical representation of the events in the case, but they are more than that. The connecting lines do not just signal that one event led to another—they mean that the person studying the case believes that one event was actually involved in causing the subsequent event to happen. (This is not to say that the subsequent event had to happen, only that it did.) When we see events unfolding in similar ways across a variety of cases, we can build our understanding of how change processes unfold in nonprofit or other kinds of organizations.

The interpretations of the people who studied the cases (the individual authors of each case study) are important to the method. Authors or author teams used Heise’s program Ethno (available online) to document and create their event structures.* The first step is to boil the cases down to essential events, resulting in a terminal event (like closure or merger). A simple case might have only several events; a more complicated case might have several dozen. Once the events are listed, the analysts enter them one at a time into the computer program. Once entered, Ethno starts asking the analyst a series of questions about the relationships between events. Was Event A required for Event B to happen? Was Event B required for Event C? And so on. Analysts consider the situation and answer yes or no. Once Ethno understands all the logical relationships between chains of events, it can draw the event structure. Like the story, the event structure can be informative on its own; however, when coupled with other cases that went through similar or different processes, we can build broader understandings of organizational life and death.

Mark A. Hager

Arizona State University

*See www.indiana.edu/~socpsy/ESA/.

The Death of Hull House

by Daniel Flynn and Yunhe (Evelyn) Tian

Much has been written about the unexpected closure of Jane Addams’s Hull House in January of 2012. This venerable institution had served some of Chicago’s most vulnerable residents for over 122 years. Many have chalked up the closing to Hull House’s overreliance on government funding, and no doubt this is partially to blame. However, that diagnosis is, we feel, oversimplified—financial mismanagement, poor governance, and severe mission drift all contributed to Hull House’s untimely demise. We also wonder if perceived causes of turmoil, or even organizational death, cannot sometimes be in reality symptoms of a greater, more ravaging illness. Although the death of Hull House does not fully exemplify this phenomenon, the answer would appear to be yes.

A Brief History of Hull House

Hull House opened on September 18, 1889, at the corner of Halsted and Polk Streets, in a Chicago neighborhood heavily populated with recent immigrants. Jane Addams and Ellen Gates Starr founded this settlement house—one of the first in the United States, and eventually the country’s most famous—on the premise that “the dependence of classes on each other is reciprocal; and that as the social relation is essentially a reciprocal relation, it gives a form of expression that has peculiar value.”1 In practice, this looked like members of the middle and upper classes moving into not only a poor neighborhood but also the same house as their disenfranchised neighbors. Originally, these elites came to Hull House to address poverty through various education and cultural classes and activities. However, for many who stayed on and got to know those they came to help, “their class condescension evaporated and was replaced by democratic beliefs: outrage at the unjust conditions working people strove to overcome and eagerness to be their political allies in those struggles.”2 From its early days, Hull House exhibited a strong dualpronged mission: assist the impoverished and vulnerable of society with basic needs and cultural competencies, and advocate for the rights and dignity of each citizen.

Jane Addams remained at Hull House until her death, in 1935, and Hull House continued to change and evolve once Addams was no longer at the helm. By the time of her passing, Hull House had grown from one settlement home into thirteen houses that comprised the Hull House community. Hull House had also become a hotbed of political activity—hosting women radicals and academics seeking social reform, conducting research on societal injustices ranging from cocaine use to inadequate sanitation, and working with city officials to establish Chicago’s first public swimming pool, public gymnasium, public playground, and citizen preparation classes.3 In the 1960s, Hull House was displaced by expansion of the University of Illinois and lost its original settlement house structure, becoming instead a system of community and neighborhood centers around Chicago. And in the 1990s, the economic growth of the period encouraged the organization to reshape its operations to focus on foster care, child care, domestic violence counseling, and job training. The financial boom allowed Hull House to quadruple its budget and confidently enter the twenty-first century.

The Closing of Hull House

Unfortunately, the twenty-first century did not bring continued prosperity for Hull House. In mid-January of 2012, Hull House announced that it would be forced to close in March. In fact, it closed just one week after that announcement, on Friday, January 25. Nearly three hundred employees and upward of sixty thousand yearly clients received less than one week’s notice. The chairman of the board, Stephen Saunders, asserted that Hull House “hoped for a much more dignified closing” and that the organization had debt of “approximately $3 million and growing, owed to vendors and landlords all over Chicago.”4 There was simply not enough money to continue daily operations.

What caused the demise of such a famous and revered institution? How did it happen so abruptly, unforeseen by staff and with limited pleas to the public for support? Were there warning signs of impending death? And what can Hull House’s closure reveal about the death and dying process of nonprofit organizations?

Mismanagement

The death of such a well-established, iconic nonprofit organization inevitably raises many questions about mismanagement, especially given its extensive executive team and the many accomplished professionals—including at least five financial advisers, five attorneys, and several CEOs—who served on its board of trustees.5 The management failures at Hull House can be organized into two primary categories: financial negligence and poor governance.

Financial Negligence

The only financial documents available for Hull House span 1998 to 2010, but they show significant signs of economic distress over that thirteen-year period. By 2010, Hull House had entered the “‘zone of insolvency,’ a period of financial distress where […] the legal responsibilities of board members change from […] safeguarding their organization’s mission and assets, to safeguarding the interests of all of its stakeholders.”6 With better financial management, Hull House could have avoided this crisis, and simple financial analysis supports this claim.

First, basic financial analysis reveals revenue drops of nearly 19 percent between 2001 and 2002 ($40,567,863 to $32,932,988), as well as a continuous decrease in total revenue from 2007 to 2010, totaling 27.3 percent ($32,011,227 to $23,286,579).7 In addition, when looking at the various revenue sources and expense categories, one finds that almost 90 percent of Hull House’s revenue came directly from government payments, and this percentage peaked at 95.2 percent of total revenue in 2001. On average, less than 10 percent of revenue came from public contributions, and only about 1.5 percent of total expenses each year were spent on fundraising.8 The lack of diversified revenue, overreliance on government contracts, and poor fundraising performance were all substantial indicators of poor financial planning.

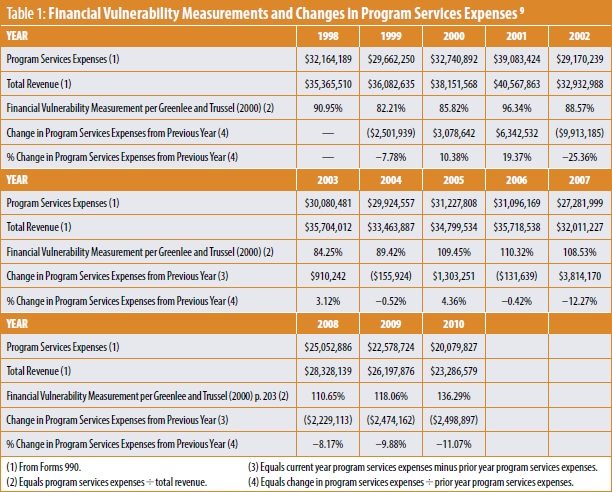

Second, there were also clear warnings of Hull House’s high level of financial unsustainability from the financial vulnerability measurement. This tool takes program service expenses divided by total revenue, and indicates whether or not an organization generates enough revenue to support its program functions (not even taking into account administration or fundraising expenses). As table 1 shows, Hull House consistently had vulnerability measurements near 90 percent, and, after 2005, yearly rates exceeded 100 percent. By the late 2000s, Hull House was unable to financially support its programs, and it never took drastic enough measures to overcome those deficits.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

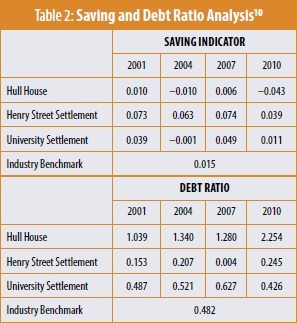

Third, ratio analysis comparing Hull House with other similar settlement houses and industry benchmarks further paints the picture of an organization in financial crisis (see table 2). The savings indicator, calculated by dividing net income by total expenses, measures what percentage of revenue an organization saves each year. The common industry benchmark for large human needs organizations is .015, and Hull House not only never reached this threshold during the 2000s but also was consistently outperformed financially by two other well-known settlement houses: Henry Street Settlement and University Settlement.

Likewise, as table 2 shows, the debt ratio also reveals Hull House’s poor financial performance. This indicator, calculated by dividing total liabilities by total assets, measures the riskiness of an organization’s debt structure. A lower result signals a healthier organization with less financial risk; Hull House’s industry benchmark is slightly below .5. Hull House again performs poorly, with debt ratios doubling, tripling, and even quadrupling this industry standard.

Nonetheless, despite poor debt ratios, this measurement only tells part of Hull House’s story. First, accounts receivables consistently made up as high as 40 percent of total assets, and these were mostly from government contracts that were often paid late.11 Therefore, there were deep cash- flow issues that the ratio does not reveal. More significantly, however, US GAAP principles do not require property to be listed at fair market value, and Hull House’s properties—many of which were bought decades prior and had been greatly depreciated—were listed at low values or had been removed completely from the balance sheet. For instance, despite owning numerous community centers around Chicago, Hull House’s 2010 Form 990 lists only $930,049 in land, buildings, and equipment, meaning that the organization had significantly more assets than were listed.12 Given the growing organizational debt, one must ask why Hull House did not choose to sell some of these valuable properties to cover its increasing liabilities.

A final indicator of Hull House’s financial distress was its exceedingly high leverage, both in terms of current and long-term liabilities. This is especially evident upon examining Hull House’s “other liabilities” presented in its 990s. This broad category of debt included loans from the Hull House Foundation, unfunded pension payments, checks drawn in excess of deposits, and government contract advances. Of special concern were the cash advances Hull House received on its government contracts for over $2 million on an annual basis, from 1998 to 2005, and for over $1 million from 2006 to 2010.13 Ultimately, these “other liabilities” reveal that Hull House remedied its cash flow and fundraising issues by “spending tomorrow’s funding to pay for yesterday’s expenses.”14 This irresponsible cycle could not last forever, and it contributed to organizational death.

The signs of financial mismanagement at Hull House seemed to be everywhere: decreasing and undiversified revenue, inability to fund program operations, lack of yearly surpluses, unrestrained debt growth, and poor debt management. There is little doubt that Hull House suffered a dearth of financial stewardship, yet this failure only caused such irreparable destruction because it was coupled with poor governance.

Poor Governance

One of the key turning points for Hull House was when it hired Gordon Johnson, former director of the Illinois Department of Children and Family Services, to lead the organization. Johnson increased the annual budget of Hull House from about $9 million in the 1990s to $40 million in 2001, largely by relying on government funding, which has been discussed previously.15 When Clarence N. Wood succeeded Johnson, in 2001, he promised to bring more private funding to Hull House to offset the continuous cutting back of Illinois’s government budget for human services—$4.4 billion from 2002 to 2012.16 However, it is clear that Wood never achieved this goal, nor did he address any of the other emerging financial problems. Yet ultimate financial responsibility for a nonprofit does not lie with the executive director but, rather, with the board of trustees. Though the board claimed it did everything it could to save Hull House, fiduciary irresponsibility and poor communication—both internal and external—suggest otherwise.

One of the three legally required duties for nonprofit boards is the “duty of care,” a responsibility that requires board members to “participate in well-informed decisions on behalf of the nonprofit.”17 With such overt signs of financial distress in Hull House’s yearly financial statements, serious questions remain as to whether or not the Hull House board fulfilled this responsibility. One can posit that a board comprised of successful business people—a number of whom worked in the financial sector—would be able to accurately interpret basic financial documents. If this is the case, board members either did not take the time to carefully review these documents—which would mean they violated their duty of care—or failed to take sufficiently aggressive measures to improve the organization’s financial situation and correct bad financial practices. If, somehow, the board was financially illiterate, it had a responsibility to recognize and address this deficiency. The financial woes at Hull House ran deep, but with strong, active governance, these problems could have been identified and rectified before organizational death.

As suggested above, there is evidence that the Hull House board suffered from poor internal and external communication. Internally, an organizational cultural gap existed between the board members and the staff. According to Wood, some board members did not comprehend the idea of “living on the edge,” because their corporate backgrounds encouraged organizational abandonment over the struggle to survive. West reported that most staff members within Hull House were used to traditional social service models and life on the edge, and accused the board of not understanding how nonprofits really function.18 In the wake of organizational closure, board and staff blamed each other for ineffective governance and inaccurate information, respectively. In other words, there were different understandings about how to interpret the organizational situation (i.e., financial data) and how the board should address different problems (i.e., decision-making process) to achieve mutual agreement and commitment within the organization.

Externally, stakeholders criticized Hull House for not publicizing their financial problems earlier or louder and instead presenting a sugarcoated image of the organization. Upon closing, Hull House’s board chair Stephen Saunders noted that the organization had been holding six or seven fundraisers a year, and that board members had been reaching out to anyone they knew.19 Nonetheless, despite these efforts to raise additional funds, many around Chicago and beyond were stunned when the organization collapsed. By the time Hull House announced its closing, it was too late for the public to save the famous institution. The board’s reluctance to be transparent about Hull House’s true condition (or inability to recognize its precarious situation) exemplifies both a failure in its obligation to organizational stakeholders and a failure in strategic governance.

Mission Drift

Despite evidence of severe financial negligence and poor governance, one must consider the possibility that these woes were symptomatic of a different cause of Hull House’s death: mission drift. Any casual observer could note that the Hull House of 2012—in revenue sources, mission, operations, and physical structure—looked starkly different from Jane Addams’s original settlement house, and these divergences from the founding structure require further exploration.

Organizations cannot function or fulfill their missions without money, and Addams and Gates were keenly aware of this upon the founding of Hull House. In the early days, Hull House survived (in an era before tax deductions) through in-kind gifts and financial donations sought out by Addams. It was an arduous process, and she writes, “We were often bitterly pressed for money and worried by the prospect of unpaid bills, and we gave up one golden scheme after another because we could not afford it.”20 To help wealthy Chicagoans empathize with the settlement and its residents, Addams often brought donors to Hull House to share a meal with the guests or attend lectures, concerts, or other events.21 Fundraising from individuals was, for many years past Addams, the primary source of money for Hull House, yet by January 2012, 85 percent of Hull House’s revenues were from government contracts.22 Moreover, the organization struggled desperately to attract private contributions. Not only does this altered fundraising model significantly hinder the opportunity to bring together different social classes for mutual benefit—an original intent of the organization—but it also makes the key collaborative partnership not with the public but with an entity Addams viewed with suspicion: government. As Ivan Medina of the School of Social Work at Loyola University Chicago commented in an interview with Maureen West, “Jane Addams was about social change. She challenged government. [. . .] If you become an arm of government, you can’t protest government, its bad policies and unequal services.”23 Though a lack of diversified revenue sources contributed to Hull House’s closure, one must consider whether the dubious structure was not a direct cause of organizational death but rather a symptom of mission deviation.

Furthermore, and perhaps most notably, the mission and operations of Hull House had changed drastically since the early days. At its closing, the organization was serving over sixty thousand people a year through social services such as foster care and domestic violence counseling. However, though Jane Addams is often regarded as the founder of modern social work, the early Hull House services and programs differed greatly from those of today’s social service agencies. A weekly program from 1892 displays a diverse set of programs and activities, including the “Working People’s Social Science Club,” “Women’s Gymnastic Classes,” “Electricity—With Experiments,” and “Hull House Debating Club,” among many others.24 Hull House’s original approach to helping people meet their basic needs or gain life skills only faintly resembled current notions of social services. Furthermore, these “services” offered by Hull House were never central to the settlement’s mission; rather, as Florence Kelley, an early resident of Hull House eloquently put it, “The House may seem to exist chiefly for its mass of detail work, yet as the years go by the truth grows clearer, that much of this has been chiefly valuable for the fund of experience it yields as a basis for wider social action.”25 Hull House was instrumental in advocating for reforms ranging from the creation of public spaces and organizations to new labor protection laws to better sanitation services for poor neighborhoods. Eventually, the organization became not a political challenger seeking social change but instead a political instrument implementing government programs. By the time of Hull House’s untimely demise there was little question of how far the organization had strayed from its initial purpose and role in the Chicago community.

A final significant difference in the modern Hull House and its founding version was its physical structure. As was briefly discussed, Hull House was forced to sell its properties in the 1960s because of university expansion (the original Hull House home was preserved as the Jane Addams Hull-House Museum), and rather than retain a similar model with various properties in the same neighborhood—and even the same block—Hull House opted to decentralize, and instead became an expansive, often disjointed network of neighborhood centers around Chicago.26 This signaled the end not only of a single community focus but also of the cohabitation of different social classes. The Hull House Association, as it was renamed after this shift, resembled a traditional nonprofit organization more than a settlement house.

This restructuring, however, was not unique to Hull House, and nor were the drastic changes in revenue sources and operations; in fact, they were quite the opposite. Many comparable organizations underwent similar transitions: settlement houses morphed into neighborhood centers; resident social workers ceased to live in the neighborhoods they served; staff was professionalized and relied less on volunteer labor; and donations were replaced by government funds as the primary source of revenue.27 If anything, this restructuring was the norm for settlement houses, and though many organizations founded in the original settlement model have closed, many others, including Toynbee Hall in London, Henry Street Settlement in New York City, and University Settlement in Cleveland, continue to thrive today. Thus, despite Hull House’s vastly different revenue structure, mission, operations, and physical layout from its original form, it seems imprudent, given the many analogous settlement houses that experienced the same transitions, to declare mission drift the sole underlying cause of the organization’s demise.

• • •

Rather than playing the role of medical provider who establishes the illness prior to death, this study acts as a coroner who seeks to identify the cause of death after the organization’s passing. However, an “organizational autopsy” does not have the advantage of examining a deceased body; rather, it must analyze the actions and reactions of an organization when it was alive. In the case of Hull House—and many other nonprofits—this causes a conundrum: how does one distinguish between symptoms of an illness and the underlying illness itself?

If there were a single devastating cause of death for Hull House, what might that be? A compelling argument could be made that Hull House suffered from “reverse founder’s syndrome”: no subsequent leaders at Hull House possessed the prophetic vision of Addams, and the organization’s operations and integrity suffered as a result. Financial mismanagement and poor governance were merely symptoms of a sharp mission divergence at Hull House since Addams’s death. However, though a “mission purist” might prefer this argument overall, it seems to lack conclusive evidence. Other settlement houses formed with a spirit and mission comparable to that of Hull House and evolved over the years in a similar fashion as Hull House, yet these developments did not bring about financial distress or ineffective board leadership. Moreover, nonprofit missions should evolve as the organization and times demand, and Hull House thrived for many years after its mission had deviated from Addams’s original settlement-house model. Ultimately, the cause of death for Hull House was a three-pronged attack—financial mismanagement, poor governance, and mission drift—that ravaged all facets of the organization. If Hull House had managed one or two of these areas more effectively, perhaps it could have staved off death and even paved the path to recovery. Sadly, it succumbed to all three conditions.

Notes

- Jane Addams, Twenty Years at Hull-House, ed. Victoria Bissell Brown (Boston: Bedford/St. Martin’s, 1999), 80. Abridged reprint of 1910 edition, with related documents.

- Louise W. Knight, “As Chicago’s Hull House Closes Its Doors, Time to Revive the Settlement Model?,” The Nation, January 25, 2012.

- Rick Cohen, “Death of the Hull House: A Nonprofit Coroner’s Inquest,” Nonprofit Quarterly, August 2, 2012, dev-npq-site.pantheonsite.io/management/20758-death-of-the-hull-house-a-nonprofit-coroners-inquest.html.

- Cheryl Corley, “Jane Addams Hull House to End Immigrant Services,” NPR, January 27, 2012, www.npr.org/2012/01/27/145950493/jane-addams-hull-house-to-close; Maureen West, “Some Fear Hull House Closure Is an Omen for Struggling Charities,” Chronicle of Philanthropy, February 2, 2012.

- Shia Kapos, “Nonprofit World Wonders How Hull House Failed Given Executives on Board,” Crain’s Chicago Business, January 27, 2012.

- Barbara Clemenson and R. D. Sellers, “Hull House: An Autopsy of Not-for-Profit Financial Accountability,” Journal of Accounting Education 31, no. 3 (September 2013): 255.

- Data retrieved from “Form 990: Return for Organization Exempt from Income Tax,” FY2001–2002, 2007– 2010, Hull House Association, 01-02 filed 11/05/2002, 06-07 filed 12/14/2008, 07-08 filed 12/12/2009, 08-09 filed 05/17/2010, 09-10 filed 10/12/11, accessed September 27, 2014, www.guidestar.com.

- Clemenson and Sellers, “Hull House,” 252–93.

- Ibid., “Table 1: Financial and vulnerability measures per Greenlee and Trussel (2000), 203 and changes in program service expenses,” 258.

- Data retrieved from “Form 990: Return for Organization Exempt from Income Tax,” FY2001, 2004, 2007, 2010, Hull House Association, Henry Street Settlement, and University Settlement (authors unable to confirm file dates), accessed October 13, 2014, www.guidestar.com; industry benchmarks retrieved from Clemenson and Sellers, “Hull House,” 260

- Clemenson and Sellers, “Hull House,” 279.

- “Form 990: Return for Organization Exempt from Income Tax,” FY2010, Hull House Association.

- Clemenson and Sellers, “Hull House,” 267.

- Ibid, 266.

- Suzanne Strassberger, “Did Hull House Make a Mistake by Aggressively Pursuing Government Dollars?,” JUF News, January 28, 2012 , www.juf.org/news/blog.aspx?blogmonth=1&blogyear=2012&blo gid=13570.

- Ibid.

- Mary Tschirhart and Wolfgang Bielefeld, Managing Nonprofit Organizations (San Francisco: Jossey- Bass, 2012), 204.

- West, “Some Fear Hull House Closure Is an Omen for Struggling Charities.”

- “Fox Chicago Sunday: Stephen Saunders on Hull House Closing,” video, 5:01, from a news segment televised earlier by Fox News, posted January 27, 2012, www.myfoxchicago.com.

- Addams, Twenty Years at Hull-House (1999), 105.

- Knight, “As Chicago’s Hull House Closes Its Doors, Time to Revive the Settlement Model?”

- Shanta Premawardhana, “Learning from Jane Addams and the Closing of Chicago’s Hull House,” Scupe (blog), February 6, 2012, scupe.org/learning-from-jane-addams-and-the-closing-of-chicagos-hull-house/.

- West, “What Would Founder Jane Addams Think of Hull House Demise?,” Chronicle of Philanthropy, February 2, 2012.

- Addams, Twenty Years at Hull-House (1999), 208-213.

- Ibid., 224.

- Cohen, “Death of the Hull House.”

- Barbara Trainin Blank, “Settlement Houses: Old Idea in New Form Builds Communities,” New Social Worker 5, no. 3 (Summer 1998).

Daniel Flynn is a graduate student in the Nonprofit Leadership program in the Penn School of Social Policy and Practice at the University of Pennsylvania. Flynn has worked for the Jesuit Volunteer Corps and the Health Federation of Philadelphia, among other nonprofits. Yunhe (Evelyn) Tian is a graduate student in the Nonprofit Leadership program in the Penn School of Social Policy and Practice at the University of Pennsylvania. Tian holds a practicum position as assistant to the executive director at Weavers Way Community Programs, a nonprofit committed to strengthening the connection between agricultural sustainability and healthy living.