May 31, 2020; New York Times, Washington Post, and CNN

“American households were struggling with rent long before the economy went into free fall” notes Conor Dougherty in the New York Times. Now, surveys find that many tenants are putting rent on their credit cards.

Nearly four in ten renter households, according to an Urban Institute report, are struggling to pay for food. Relatedly, Tami Luhby and Danielle Diaz of CNN, citing a Brookings Institution survey, report that, “More than 40 percent of mothers with children age 12 and under said in April that the food they bought didn’t last.”

All told, the picture is increasingly dire. Renae Merle in the Washington Post indicates that Amherst, a real estate data analytics firm, estimates that up to 28 million renters, or 22.5 percent of all US households, are at risk of eviction or foreclosure. All told, the Post estimates that 40 million households rent nationally.

To date, stimulus checks, unemployment insurance, and, in most states, eviction moratoria, have avoided the worst, and have kept people in their homes. Even so, in May, deferrals and partial payments appear to be increasing and have been key to keeping many tenants housed. Apartment List, a rental listing service, said 31 percent of respondents failed to make their full May payment on time.

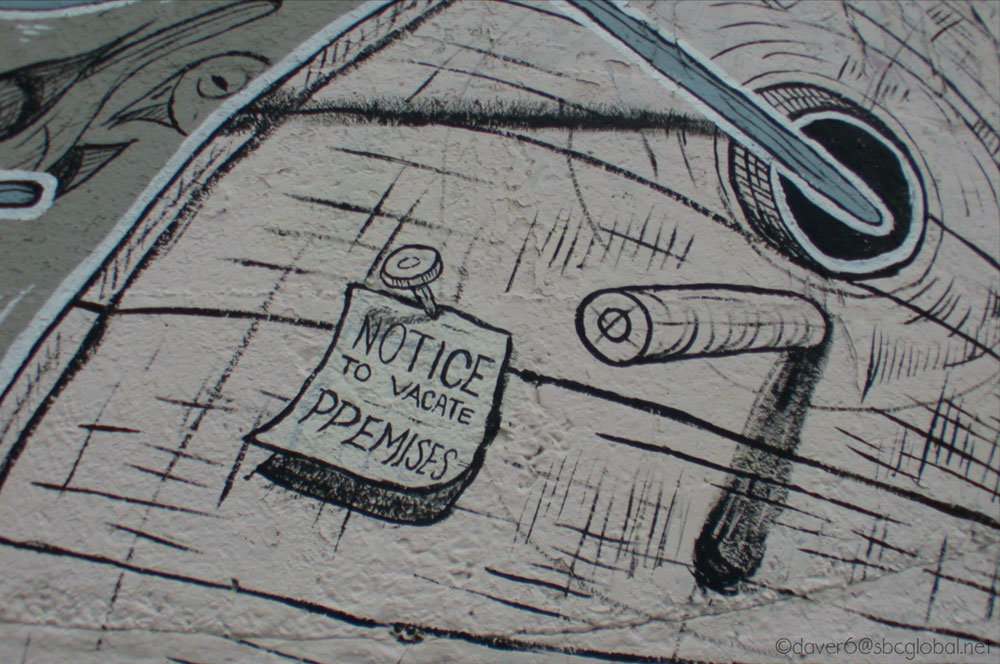

And that’s just the beginning of the problems. Government stimulus checks don’t last long, and enhanced unemployment benefits are slated to end on July 31st. On top of that, Kelly Mina for CNN notes that, “As states reopen, tenants are facing the end of freezes on rent payments and evictions put in place at the start of the pandemic.” Worse, because the eviction freezes didn’t cancel payments, some renters may suddenly owe three months’ rent to cover April and May as well as June.

Nationally, about 30 percent of renters are covered by a moratorium in the CARES Act for properties that receive federal assistance or have loans backed by the government-controlled mortgage companies, Fannie Mae and Freddie Mac. But this protection too will end July 25th.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Meanwhile, about half of the states have started to lift eviction moratoriums, according to Emily Benfer, a housing expert and visiting law professor at Columbia Law School. “Already, renters are incurring debt to stay housed, paying rent on credit cards, taking out loans, drying up what limited savings they have,” Benfer tells Mina.

For example, Texas ended statewide tenant protections on May 18, and already almost 1,000 eviction cases have been filed in Harris County (county seat Houston). In Milwaukee, Wisconsin, the Journal-Sentinel reports that landlords lined up to file eviction actions hours before the statewide ban was scheduled to expire.

Increasingly, many tenants have unified around a call to #CancelRent. As NPQ has covered, a growing number have also engaged in rent strikes. Representative Ilhan Omar (D-MN) has introduced a bill that calls for rent to be cancelled.

Additionally, in May, the US House of Representatives passed the $3 trillion HEROES Act, which, in addition to extending the CARES Act boost to unemployment insurance and offering another round of stimulus checks, would make available $100 billion in rental assistance. While many Republicans in the US Senate have vowed to block passage of the HEROES Act, rent protection has a chance of getting passed into law.

“Small landlords and renters depend on each other, and both need emergency assistance to stay afloat during this time,” Diane Yentel, CEO of the National Low-Income Housing Coalition, tells Dougherty.

David Dworkin, CEO of the National Housing Conference, concurs, noting that the federal government must either get ahead of the problem and establish a rental assistance program now, or it will face a human catastrophe. If it waits, the resulting crisis, Dworkin tells Merle, will cost “much more money as well as the personal and community-wide devastation that comes with it.”—Steve Dubb