Click here to download this article as it appears in the magazine, with accompanying artwork.

Editors’ Note: This article comes from the Summer 2021 edition of the Nonprofit Quarterly, “The World We Want: In Search of New Economic Paradigms.”

We are two mothers, listening, learning, in a pandemic, writing to you from the United States, on unceded Nipmuc, Podunk, Tunxis, Wangunk, and Sicoag land on the East Coast. Here—and likely where you are—artists and culture bearers are innovating models for liberation. We tuck in our babies, hold their small hands through the virus and tear gas, and continue the intergenerational work. We are Nati Linares and Caroline Woolard—a cultural organizer and an artist—and we believe that every cultural worker should be able to feed their children and pay their rent. We believe that culture is the key to reimagining the collective vision of what’s possible. As you read this, we invite you to sense the heartbeats that flow through it. This is one effort among many. This is an invitation to join a long process of transformation—together.

Recently, in an Anticapitalism for Artists workshop,1 musician Clara Takarabe said: “I have asked, as you have probably asked: Is there a place in this world for me? Today, I would reframe that question as: Is this the world we deserve?”2 Takarabe reminds us that together we can join and organize the worlds we deserve—in the arts and beyond. In fact, the people who have been most harmed by our current system of neoliberal and racial capitalism are creating community-controlled, hyperlocal economies that move us beyond capitalism. The systems that artists want are not only possible, they already exist—and they can be strengthened and cultivated with intention.

There are many examples. A leading Native artisan co-op in the country, Qualla Arts and Crafts, has been led by culture bearers since 1946.3 In Boston, a democratically managed investment fund, Boston Ujima Project, places Black, Indigenous, and people of color (BIPOC) arts and cultural organizing at the heart of its work.4 A leading national community loan fund that invests in U.S. worker co-ops, The Working World, was started by artists.5 Artists in Belgium founded Smart, the co-op that gives 35,000 freelancers the benefits of full-time employees (including unemployment insurance).6 Smart’s model is now being piloted in the United States by the U.S. Federation of Worker Cooperatives’ Guilded.7

Why should culture and economic innovation go together? Because, right now, we have a superstar system in which the winners take all and the rest are left with crumbs. Because, just like art, housing and dignified work are human rights. Because artists are the original gig workers. Because culture making and political organizing go hand in hand. Because we want a world in which everyone’s needs are met, so that everyone can participate in the remaking of culture and society. Because an artist living in a community land trust in New York City will have twenty-seven hours a week to make art, compared to an artist in market-priced housing who will have four hours a week for artmaking.8 Because we must repair centuries of injustice.

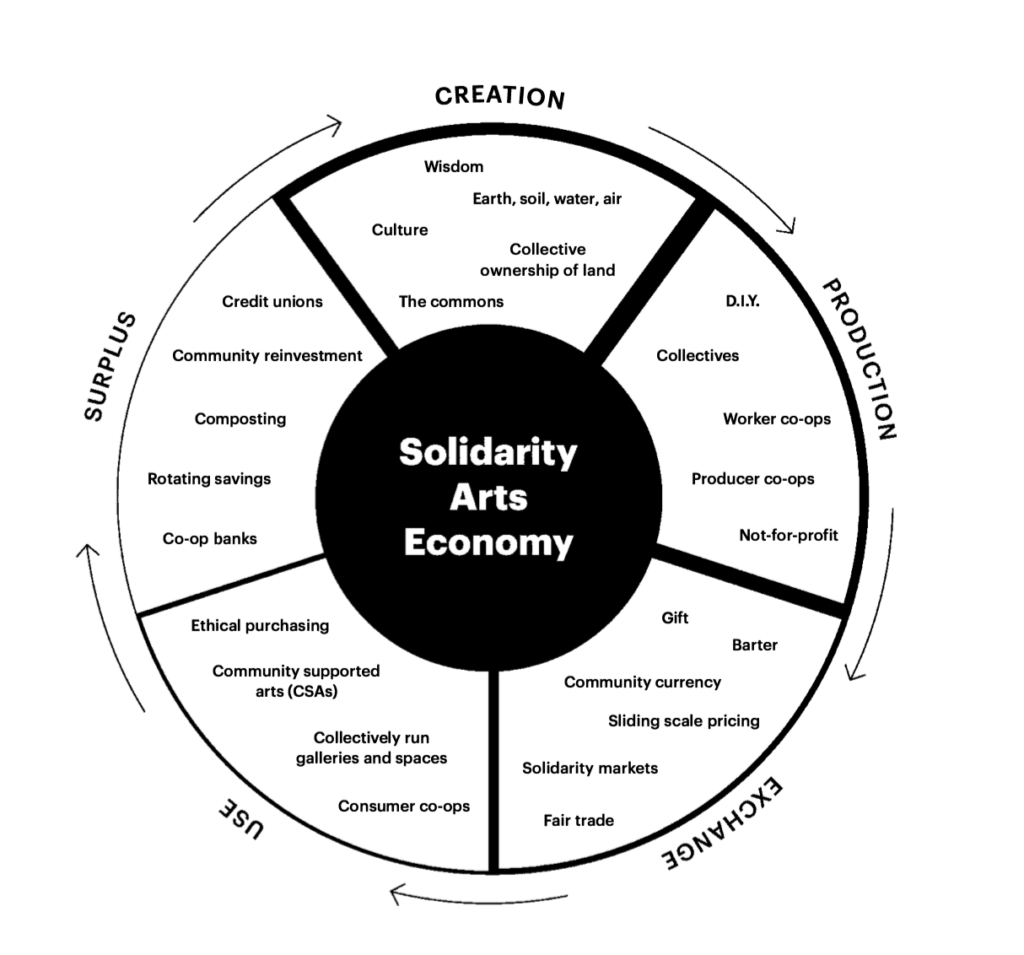

While practices of equitable and sustainable self-determination and community control are rooted in a myriad of ancestral and community norms, the term solidarity economy is relatively recent. The term emerged in Chile and France in the 1980s,9 gained popularity in Latin America in the 1990s as economía solidaria, and then spread globally as an interdependent movement after the first annual World Social Forum in Brazil, in 2001, which popularized the slogan “another world is possible.”10

The solidarity economy is now recognized internationally as a path to valuing people and the planet over profits and to uniting grassroots practices like lending circles, credit unions, worker cooperatives, and community land trusts to form a base of political power and transform our economy and world. Most people are aware of the discrete practices and models that comprise the solidarity economy, but do not know that there is a framework that holds these concepts together, or that these practices are supported holistically in other countries around the world.

The following are some examples of arts and culture groups and initiatives that are part of the solidarity economy in the United States. It is important to note that all networks and infrastructure in the solidarity economy—regardless of emphasis or not on arts and culture—aim to support artists and culture bearers.11

LAND AND HOUSING

Community Land Trusts: Community Arts Stabilization Trust; Oakland CLT; Cooper Square Community Land Trust

Permanent Real Estate Cooperative: East Bay Permanent Real Estate Cooperative

Housing Cooperative: Divine House

Cohousing/Intentional Community: MilePost 5

WORK AND LABOR

Worker Cooperatives: Rhythm Conspiracy; Resonate.Is; Akron Devil Strip; Happy Family Night Market; Design Action Collective; Surplus+

Producer Cooperatives: 200 million Artisans; Justseeds

Time Banking: Boston Ujima Project; Metasofa Arts Community; Kola Nut Collaborative

Mutual Aid: NDN Collective; Sol Collective

Barter Systems and Nonmonetary Exchange: O+ Festival

Organizing: Frontline Arts Buffalo; Solidarity Economy St. Louis

MONEY AND FINANCE

Participatory Budgeting: Boston Ujima Project; RUNWAY

Credit Union: Actors Federal Credit Union

Community Currencies: Giving circles; lending circles (Tandas)

Community Development Financial Institutions (CDFIs) Funds: The Working World; Seed Commons; First People’s Fund; Oweesta Corporation; Zebras Unite; Cooperative Fund of New England

Solidarity Philanthropy and Grantmaking: Center for Economic Democracy; The Weavers Project; AmbitioUS; NDN Collective; Intercultural Leadership Institute

ENERGY AND UTILITIES

Community Solar: Soulardarity

Community Broadband: Institute for Local Self Reliance’s MuniNetworks

Energy Democracy: UPROSE

FOOD AND FARMING

Community Gardens: All community gardens!

Community Supported Agriculture: All CSAs!

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Food and Farm Co-ops: Soul Fire Farm; Double Edge Theatre; Cooperative Food Empowerment Directive (CoFED); Acres of Ancestry Initiative/Black Agrarian Fund

Community Fridges: All community fridges!

MEDIA AND TECHNOLOGY

Worker-Owned Media: Media Reparations (Media 2070); Associated Press

Community Radio: KOJH 104.7 FM (Mutual Musicians Foundation, Kansas City, Montana)

Platform Cooperatives: Crux; Guilded; Ampled

Solutions Journalism: Solutions Journalism Network

Open Source: Mozilla; Wikipedia

Copyleft: Creative Commons

In this moment of crisis and uncertainty, more and more people are excited to learn about solidarity economy practices and institutions that artists and culture bearers are building to achieve resilience. Patricia Walsh writes in Artsblog that the top three needs for artists are “unemployment insurance, food/housing assistance, and forgivable business loans.”12 This is what all people need, including artists. According to the Brookings Institution, creative workers are experiencing historic precarity.13 What can be done? Forgivable loans, affordable housing, and dignified jobs—when structured as solidarity-based, cooperative institutions and networks—have been shown to withstand crises because they are built with self-determination and community response from the outset.14 These entities emphasize self-help, dignified livelihoods, and community well-being instead of profit for external shareholders, and they are underexplored in the United States.

THREE EXAMPLES OF SOLIDARITY ECONOMY SUPPORT

1. Concessionary Loans

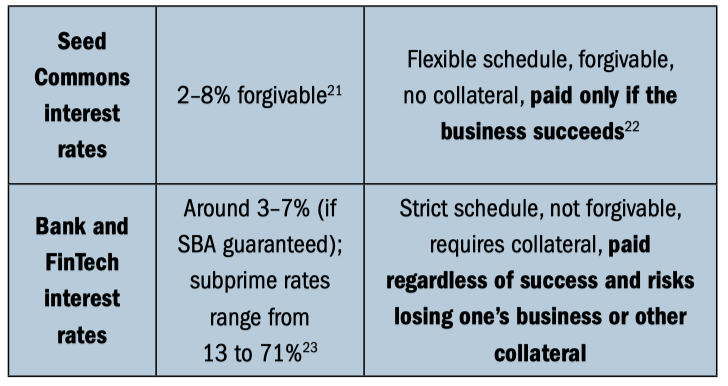

As unemployment soars and more and more small businesses—including artists and culture bearers—turn to predatory lenders to cover their basic needs, concessionary loans should be explored. These loans have terms that aim to achieve community benefit by offering low interest rates, generous grace periods, forgivable interest, and zero-collateral lending. Seed Commons, for example, collects donations and then uses them as a collective pool to offer loans well below market rate. Seed Commons acts as a partner with smaller funds, networks, and cooperative businesses, working out flexible but economically prudent loan terms with none of the draconian penalties of conventional finance (such as seizure of collateral). Seed Commons is a community wealth cooperative that takes in investment as a single fund and then shares that capital for local deployment by and for communities, lowering risk while increasing impact. Codirector Brendan Martin says that “each dollar invested in Seed Commons has generated more than $5 in revenues for communities, meaning a $1 million investment can result in over $5 million in income through to communities Seed Commons places capital in.”15

Seed Commons offers concessionary loans for solidarity economy institutions and networks. Interest rates offered by banks and online lenders for small business loans today typically range from 3 to 7 percent—if you can get them. Many pay subprime lenders far greater interest rates.16 And these loans carry a high risk of losing one’s business if the strict payment schedule can’t be met, while interest at Seed Commons is only due if and when the business is profitable—and even then tops out at a rate ranging from 2 to 8 percent. This means that for Seed Commons loans, “no greater return than the wealth generated is ever taken, even if that is a negative return.” 17

Further, the movement for nonextractive finance holds the principles of participatory democracy, intersectional equity, sustainability, and pluralism. 18 Seed Commons is part of a growing movement for community-controlled finance that includes the Boston Impact Initiative, The Working World, RUNWAY, Boston Ujima Project, Zebras Unite Co-Op, and the Cooperative Fund of New England. 19 The Working World, which is the oldest cooperative and nonextractive venture capital firm in the United States, was started by artists and inspired by a film.20

Further, the movement for nonextractive finance holds the principles of participatory democracy, intersectional equity, sustainability, and pluralism. 18 Seed Commons is part of a growing movement for community-controlled finance that includes the Boston Impact Initiative, The Working World, RUNWAY, Boston Ujima Project, Zebras Unite Co-Op, and the Cooperative Fund of New England. 19 The Working World, which is the oldest cooperative and nonextractive venture capital firm in the United States, was started by artists and inspired by a film.20

Rural, economically disadvantaged, immigrant, and BIPOC communities have a long history of developing collective finance practices as a survival strategy, including susus, rotating loan funds, and mutual aid. The self-help movement laid the groundwork for Community Development Financial Institutions (CDFIs). At least 60 percent of CDFI financing activities serve one or more low- and moderate-income population or underserved community.24 Since the Great Recession, credit unions have increased their share of mortgage originations fourfold, from 1.9 percent of the market in 2007 to over 8 percent by 2018 (while bank mortgage originations have continued to decline)—and small business lending growth has dramatically outpaced that of banks.25 The success of the solidarity economy sector depends upon flexible financial vehicles, because these entities often have thin margins, prioritizing low-cost, affordable goods and services and living wages for workers. Worker cooperatives, for example, while being more likely to succeed than conventional enterprises,26 are often slower to become self-sustaining. On the other hand, SE entities internationally have demonstrated that they are more likely to repay loans than traditional firms.27

2. Affordable Space

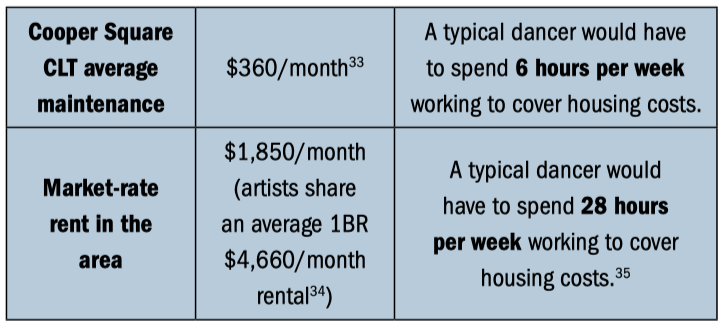

Both affordable space and housing assistance are a perennial need for the arts and culture sector. In twenty-five cultural districts nationally, artists and those working in the arts field are rent-burdened, with 30 to 50 percent of their income going to cover rent.28 For example, in 2019, the average monthly rent within a half-mile radius of Fourth Arts Block in the Lower East Side of New York City was $4,660 per month.29

This need not be the case. Artists and culture bearers across the country are innovating models for community land trusts: community-based organizations that create affordable housing and commercial space in perpetuity by owning land and leasing it to community members who use spaces on that land. According to Mihaela Buzec, artists are rent-burdened in 80 percent of cultural districts across the United States, with “a rent-to-income ratio of 50% or higher,” and half “bearing a rent burden of over 60%.”30 Supporting community land trusts can enable artists to afford to remain in their communities and engage in artistic production for generations. A “typical dancer/ choreographer,” for example, “who makes $31,200, the annual average earnings for their field before COVID-19 hit,31 will only have to spend six hours a week to cover their housing costs in a community land trust, compared to the twenty-eight hours a week it would take to cover a market-rate rental in the same area.”32

Arts ecosystem-wide support for permanently affordable housing and commercial space should be explored. The community land trust model is currently being used to support space for artists and arts organizations in the East Bay Permanent Real Estate Cooperative, in Oakland, California, and is a solution to housing insecurity.36 During the Great Recession, homeowners living in homes they owned on community-land-trust–held property were ten times less likely to be in foreclosure proceedings and 6.6 times less likely to be at least ninety days delinquent, compared with homeowners in the conventional market.37 The community land trust model is one of many solidarity economy models that are both resilient in crisis and championed by BIPOC artists and culture bearers today.

3. Dignified Work

Artists and culture bearers are increasingly turning to worker and producer cooperatives—businesses that are owned and managed by the workers—because they provide job security and a meaningful work environment.38 Evidence shows that cooperatives are more efficient than traditional firms and have fewer layoffs during economic crises,39 because they are able to call upon their community for support, and workers can decide to adjust the hours worked by all employees rather than reducing the number of employees.40 Cooperatives often succeed where traditional corporations fail because they are developed intentionally in dialogue with their customers and with the community.41 Cooperative businesses also tend to have lower failure rates than traditional corporations and small businesses.42 And research suggests that worker and producer cooperatives are better able to weather crises.43

Worker cooperatives also provide better and more equitable wages. In many, “the average ratio between the highest and lowest pay is 2:1 compared with 300:1 in large corporations.”44 In 2019, the U.S. Federation of Worker Cooperatives reported that the average entry-level wage paid at all reporting worker cooperatives was $19.67 per hour. This figure is more than $7.00 higher than the minimum wage in the thirteen states with the most worker co-ops.”45 Further, cooperatives advance gender equity at work.46 Worker cooperatives today employ more women and pay women at better wages than conventional businesses.47

A recent survey of worker cooperatives in the United States found that “58.8 percent of people employed at worker co-ops identify as people [of] color [and] 62.5 percent of workers identify as female and 1.7 percent identify as non-binary.”48 Worker cooperatives provide a pathway for more diverse and equitable working arrangements because these arrangements are determined by the workers themselves. Currently, Latinx women earn 55 cents for every dollar that white men make,49 Black women earn 63 cents for every dollar that white men make in the workforce,50 and women artists of any race earn 77 cents for every dollar that male artists of any race earn.51 As is often cited, providing equal pay to women in the workforce would cut the poverty rate for all working women in half, and the number of children with working mothers living in poverty would be cut nearly in half.52 Cooperatives offer a promising model for economic justice when cultivated with intentionality.53

Scholars predict that the desire for cooperatives will continue to increase due to demographic, cultural, and technological shifts in the labor force.54 In December 2020, New York City launched “Employee Ownership NYC, the nation’s largest municipal initiative for education and technical assistance around employee ownership and conversion.”55 This addresses the need for increased local jobs as well as the needs of business owners who want to retire. Almost half of all business owners are fifty-five years of age or older; according to California Association of Business Brokers, baby boomer retirees (people born between 1946 and 1964) will cause more than $10 trillion in business assets to change hands over the next twenty years, as an estimated 70 percent of privately held businesses will be sold or closed.56

To support the solidarity economy with integrity in the United States and beyond, a slow process of relationship building between culture bearers, solidarity economy organizers, public sector workers, and arts and culture grantmakers must begin. Lasting impact will not be made if (1) solidarity economy becomes a buzzword, popular only for a short time, or (2) if newcomers with visibility are supported instead of community-based groups who have been doing this work for decades.

It’s clear that artists need a solidarity economy if we are to overcome our status as exploited workers. Likewise, the solidarity economy movement needs artists if it is to prevail. We believe that culture—visual arts, music, culinary arts, sports, video games, literature, theater, television, Web content, TikToks, and more—is the key to sparking the collective imagination of what’s actually possible when there is community control of our economies and resources. There have never been radical movements without radical artists and creators at the helm—so let’s get busy resisting, building, and creating.

Notes

- See YouTube channel, accessed May 17, 2021.

- “A4A Launch Event: Organizing Artists Today,” Anticapitalism for Artists YouTube channel, video, 1:20:58, March 26, 2021.

- See Qualla Arts and Crafts Mutual, Inc., accessed May 17, 2021.

- “Organize,” Boston Ujima Project, accessed May 17, 2021.

- “Investing in the workers who are transforming our world.,” The Working World, accessed May 17, 2021.

- See Annalisa Murgia and Sarah de Heusch, “It Started with the Arts and Now It Concerns All Sectors: The Case of Smart, a Cooperative of ‘Salaried Autonomous Workers,’” Pathways into Creative Working Lives, Stephanie Taylor and Susan Luckman, eds. (London: Palgrave Macmillan, 2020), 211–30; and “What is Smart?,” Smart, February 2019, accessed May 28, 2021.

- “Guilded Freelancer Cooperative,” United States Federation of Worker Cooperatives (USFWC), accessed May 17, 2021.

- Nati Linares and Caroline Woolard, Solidarity Not Charity: Arts & Culture Grantmaking in the Solidarity Economy—A Rapid Report (New York: Grantmakers in the Arts, March 2021), 107–112.

- Jean-Louis Laville, Benoît Lévesque, and Marguerite Mendell, The social economy: Diverse approaches and practices in Europe and Canada (Washington, D.C.: Organisation for Economic Co-operation and Development [OECD], 2006), 7; and Esteban Romero, “The meaning of Solidarity Economy: Interviews with Luis Razeto Migliaro,” March 2011.

- Marcos Arruda, “Solidarity Economy and the Rebirth of a Matristic Human Society” (paper presented at World Social Forum 4, Mumbai, January 20, 2004), 2.

- See “Solidarity Not Charity—Grantmaking in the Solidarity Economy,” Art.coop, accessed June 11, 2021.

- Patricia Walsh, “You Can Survive Unemployment in the Arts,” Artsblog, Americans for the Arts, November 30, 2020.

- Richard Florida and Michael Seman, “Lost art: Measuring COVID-19’s devastating impact on America’s creative economy,” Brookings, Metropolitan Policy Program, August 11, 2020.

- Sara Stephens, “Worker Cooperatives: Performance and Success Factors,” Co-opLaw.org: Resources for Worker Cooperatives, Sustainable Economies Law Center, accessed May 28, 2021.

- Brendan Martin, codirector of Seed Commons, founder and director of The Working World, a cooperative financial institution and business incubator based in Argentina, Nicaragua, and the United States, in discussion with the authors, February 16, 2021.

- Justin Song, “Average Small Business Loan Interest Rates in 2021: Comparing Top Lenders,” ValuePenguin, last modified March 15, 2021. Regarding personal loan rates, see Liz Knueven, “The average personal loan interest rate by state, lender, and credit score,” Insider, October 8, 2020.

- Brendan Martin, in discussion with the authors.

- Emily Kawano and Julie Matthaei, “System Change: A Basic Primer to the Solidarity Economy,” Nonprofit Quarterly, July 8, 2020.

- See also “Co-Op Leadership,” Zebras Unite Co-Op, accessed May 28, 2021; and “U.S. Department of the Treasury, Community Development Financial Institutions Fund,” in Affordable Mortgage Lending Guide, Part I: Federal Agencies and Government Sponsored Enterprises (Washington, D.C.: FDIC), 79–82, accessed January 15, 2021.

- The movie, called The Take, is about the worker-led social movement. See The Take, directed by James Watkins (Netflix, 2016). Brendan Martin, codirector of Seed Commons, founder and director of The Working World, a cooperative financial institution and business incubator based in Argentina, Nicaragua, and the United States, in discussion with the authors, February 16, 2021.

- Brendan Martin, in discussion with the authors, February 16, 2021.

- “Seed Commons’ Approach to Non-Extractive Finance,” Seed Commons, accessed May 31, 2021.

- Song, “Average Small Business Loan Interest Rates in 2021”; and see Knueven, “The Average Personal Loan Interest Rate by State, Lender, and Credit Score.”

- CDFI Program & NACA Program: SF-424 & TA Application Guidance, CDFI Fund (Washington, D.C.: U.S. Department of the Treasury, February 2021), 26; and see “U.S. Department of the Treasury, Community Development Financial Institutions Fund.”

- Dan Ennis, “Credit unions top Fed survey of small-business lending satisfaction,” Banking Dive, February 5, 2021.

- Statistical Data: United States Credit Union Statistics 1939- 2002 (Madison, WI: World Council of Credit Unions, 2003), noted in Richard C. Williams, The Cooperative Movement: Globalization from Below (Burlington, VT: Ashgate Publishing Company, 2007); Jessica Gordon Nembhard, “10 Facts About Cooperative Enterprise,” Grassroots Economic Organizing, May 5, 2014; and Jessica Gordon Nembhard, “The Benefits and Impacts of Cooperatives,” Grassroots Economic Organizing (GEO), May 1, 2014.

- “As an example, we can cite the case of Banca Etica, an Italian bank specialized in addressing the financial needs of SSE organizations. At the end of 2017 Banca Etica registered a net nonperforming loan rate of 0.89% (it was 1% in 2016) and a gross rate of 2.99% (3.04% in 2016). Both figures are much lower than the corresponding nonperformance rates for the Italian banking system, which had a 3.7% net ratio in 2017. This trend has been fairly stable over the years: in 2013, for instance, Banca Etica had 2.02% of nonperformance loans compared to the 7.7% average of the banking system,” in Samuel Barco Serrano et al., Financial Mechanisms for Innovative Social and Solidarity Economy Ecosystems (Geneva: International Labour Organization, 2019), 35 n19; and, “Moreover, Third Sector loans have a lower default rate compared to other sectors,” in Serrano, Financial Mechanisms for Innovative Social and Solidarity Economy Ecosystems, 68.

- Mihaela Buzec, “The Hidden Cost of an Arts Career—Artists Are Rent-Burdened in 80% of Cultural Districts,” RENTCafé Blog, March 13, 2019.

- Ibid.

- Ibid.

- Artists and Other Cultural Workers: A Statistical Portrait (Washington, D.C.: National Endowment for the Arts, April 2019), xi.

- Linares and Woolard, Solidarity Not Charity, 65, 107–112.

- Ibid., 65; and see Amy Holodak, Jessica Lowing, and Melanie Breault, Community Land Trusts & Mutual Housing Associations: Introduction to Policy Processes (research paper, May 20, 2016).

- Ibid., 110; and see Buzec, “The Hidden Cost of an Arts Career.”

- Ibid., 110.

- Nicholas Shatan and Olivia R. Williams, A Guide to Transformative Land Strategies: Lessons from the Field (Cambridge, MA: MIT CoLab, June 2020).

- Emily Thaden and Greg Rosenberg, “Outperforming the Market: Delinquency and Foreclosure Rates in Community Land Trusts,” Land Lines 22, no. 4 (October 2010): 2–7. And see “Survey finds low foreclosure rates in community land trusts,” Lincoln Institute of Land Policy, press release, March 17, 2009.

- “…the SSE has significant potential for the creation of employment in new or emerging sectors. This is true in particular—as stated above—of care services, education and cultural services, and in general of jobs with a high relational content. In other words, in the face of the transformations that are reshaping the world of work, the SSE provides a stronghold for all of those activities that are more markedly social and empathic in nature,” in Serrano et al, Financial Mechanisms for Innovative Social and Solidarity Economy Ecosystems, 16.

- Katherine K. Chen and Victor Tan Chen, “Cooperatives can make economies more resilient to crises like COVID-19,” FORTUNE, May 19, 2021.

- Immaculada Buendía-Martínez, Augustin Álvarez-Herranz, and Mercedes Moreira Menéndez, “Business Cycle, SSE Policy, and Cooperatives: The Case of Ecuador,” Sustainability 12, no. 13 (July-1 2020).

- Erik K. Olsen, “The Relative Survival of Worker Cooperatives and Barriers to Their Creation,” in “Sharing Ownership, Profits, and Decision-Making in the 21st Century,” ed. Douglas Kruse, Advances in the Economic Analysis of Participatory & Labor-Managed Firms 14 (December 2013), 83–108.

- Williams, The Cooperative Movement, 7–35, 139–48.

- Nembhard, “The Benefits and Impacts of Cooperatives.”

- Working with Small Business Cooperatives: What, Why, When and How (Anchorage, AK: Business Enterprise Institute, and Oakland, CA: Democracy at Work Institute, 2020), 2.

- Worker Cooperatives in the United States (Oakland, CA: Democracy at Work Institute and San Francisco, CA: United States Federation of Worker Cooperatives, 2019), 2.

- Lisa Schincariol McMurtry and JJ McMurtry, Advancing gender equality: The co-operative way (Geneva: International Labour Organization, 2015), 20.

- Genna R. Miller, “Gender Equality in Worker Cooperatives,” Grassroots Economic Organizing (GEO), April 7, 2011.

- Worker Co-Ops: Weathering the storm of Covid-19 and Beyond (Oakland, CA: Democracy at Work Institute, and San Francisco, CA: United States Federation of Worker Cooperatives, 2020), 2.

- “Latinas and the Pay Gap,” AAUW, accessed May 28, 2021.

- “Black Women & the Pay Gap,” AAUW, accessed May 28, 2021.

- “In 2012–2016, women in the U.S. labor force (working full-year/full-time) earned $0.79 for every dollar men earned. Among artists, the ratio was slightly lower—$0.77.… As women age, they earn progressively less than their male counterparts. For example, women artists aged 18–24 earn $0.97 for every dollar earned by men artists in that age group. But for women who are 35–44, the ratio drops to $0.84. By the time they reach ages 55 to 64, women artists earn just $0.66 for every dollar male artists make.” See Artists and Other Cultural Workers, 28; see also “Get the Facts: Learn about gender inequity in the arts with some eye-opening facts,” National Museum of Women in the Arts, accessed May 28, 2021.

- Jessica Milli et al., The Impact of Equal Pay on Poverty and the Economy, IWPR #C455 (Washington, D.C.: Institute for Women’s Policy Research, April 2017).

- Jessica Gordon Nembhard, “Racial Equity in Co-ops: 6 Key Challenges and How to Meet Them,” Nonprofit Quarterly, October 21, 2020.

- Ibid.

- “Sell your business to the people who care most,” Owner to Owners, accessed May 29, 2021.

- California Association of Business Brokers, “Baby Boomers: Incredible Numbers are Buying and Selling Businesses (Part 1 of 2),” accessed June 14, 2021. And see Dorian Gregory et al., The Lending Opportunity of a Generation: FAQs and Case Studies for Investing in Businesses Converting to Worker Ownership (Watertown, MA: Cooperative Fund of New England; San Francisco, CA: Project Equity; and Oakland, CA: Democracy at Work Institute, 2016), 5.