October 22, 2017; The Conversation

Our nation’s faux IRS “scandal” continues to have ramifications. An “EZ” form makes creating new nonprofits a little too “EZ.” Meanwhile, nonprofit sector oversight suffers overall. Can we finally just allocate to the IRS the resources it needs to do its job?

Earlier this month, NPQ reported on the release of a new report from the Treasury Department’s inspector general for tax administration that clears up the myth that the Internal Revenue Service was only targeting politically conservative nonprofits applying for tax exempt status. The report details that in addition to IRS staffers using keyword searches like “tea party” or “patriot” in its review, it was also targeting groups with the words “occupy” or “progressive” in the name.

Indeed, the real scandal seems to be in that some group’s applications were taking “an average of 574 days” to be processed, with the most egregious taking upwards of seven years.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

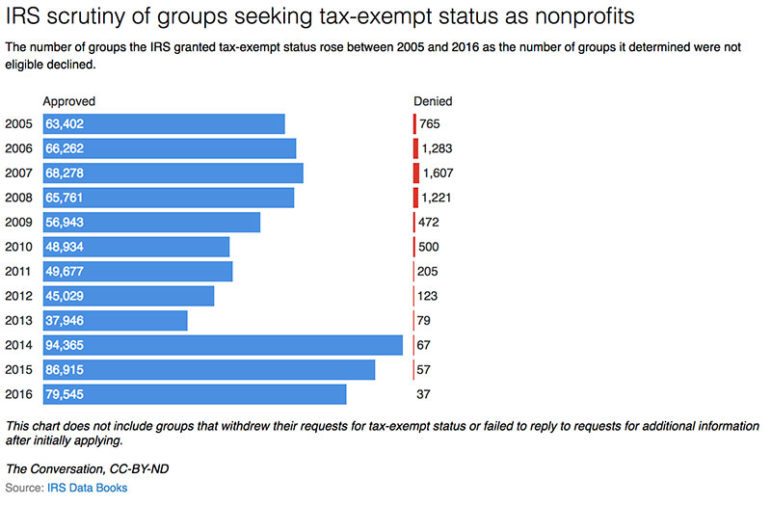

So, in what’s presumably an effort to ease the pipeline, the IRS offered the newer 1023-EZ route, allowing for automatic exemption for organizations with less than $50,000 a year in financial activity. And indeed, this has ushered in thousands of groups—but at what cost? The Taxpayer Advocate reports that 34 percent of the groups granted tax-exempt status this way in 2015 and 26 percent of those green-lighted in 2016 weren’t eligible. Further, the number of rejections for tax-exempt status plummeted from 1,607 in 2007 to merely 37 in 2016, and the number of approved groups rose from a low in 2013 of less than 40,000 to 94,365 the next year, 86,915 in 2015, and 79,545 in 2016.

What this suggests is an overcorrection, one probably fueled partly by political caution and partly budget constraints. In turn, that could lead to more abuse of the nonprofit form.

Still, there’s a good chance that some of these entities will simply never appear in practice, just because the bar is so low for entry. It’s worth keeping an eye on how this plays out in your local community; we’ll certainly continue reporting on the new system’s consequences.—Jeannie Fox and Ruth McCambridge