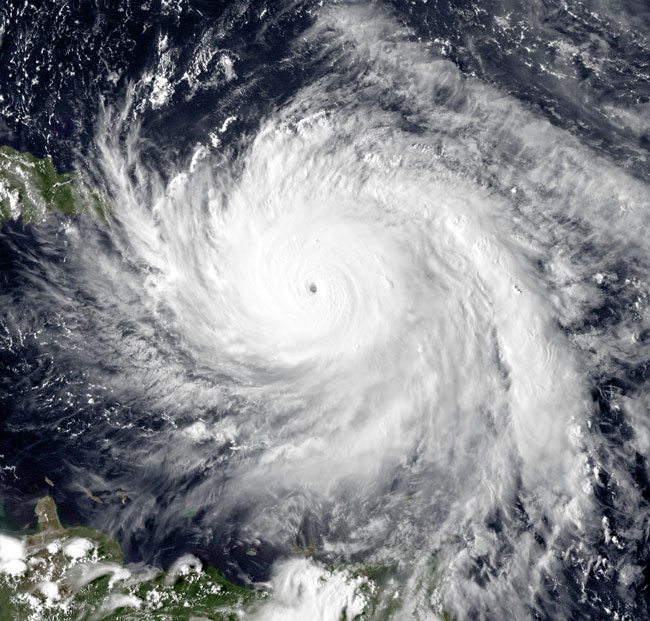

2017 Atlantic hurricane season: going beyond blowing hot air

The 2017 Atlantic hurricane season, which started on June 1st, is the costliest on record in the United States, with AccuWeather estimating the cost of Harvey and Irma to be $290 billion.[4] By comparison, the 2005 hurricane season cost $143 billion, including $108 billion for hurricane Katrina alone.[5] 2017 was also the first time on record that two Category 4 or higher hurricanes—Harvey and Irma—made landfall in the continental United States in the same year.[6] According to the National Weather Service, Hurricane Harvey set a rainfall record in the continental United States.[7] Hurricane Harvey also triggered the area’s 48 petroleum and chemical plants to release nearly as much pollution during the storm as released the entire previous year.[8] Hurricane Irma drove the release of 28 million gallons of sewage in 22 Florida counties.[9] Health risks from exposure to pollutants and sewage will only compound the loss of life and human suffering.

The record-setting 2017 Atlantic hurricane season has been both tragic and an inflection point for sustainable development practitioners and long-term-oriented corporations and investors.

A global standard for climate-related financial disclosure

The Task Force on Climate-Related Financial Disclosure (TCFD) was established in late 2015 when Bank of England Governor and Financial Stability Board (FSB) Head Mark Carney requested greater transparency on the risks that climate change may impose on the financial condition of companies.[10] In particular, he noted that there were approximately 400 initiatives to report on the risks, opportunities, and costs of climate change,[11] and he called for coordination. Supported by the G20 countries—an international forum for the governments and central bank governors from 20 major economies[12]—and chaired by Michael Bloomberg, TCFD issued recommendations on June 29th, 2017 on what types of financial disclosure help investors ascertain and respond to climate change risk.[13]

TCFD recommends that (i) preparers of climate-related financial disclosures provide such disclosures in their public annual financial filings, (ii) disclosures on climate-related governance, strategy, risk mitigation, and metrics and targets should be useful to investors in ascertaining opportunities and risks, and (iii) disclosures focus on an organization’s resilience in a number of climate-related scenarios, including a 2° Celsius (C) or lower scenario.[14] Including climate-related financial disclosure in annual financial filings would entail significant board and executive-level discussions of climate change-related risks and opportunities. By way of background, the 2°C scenario involved setting a ceiling for the increase in global average temperature at not more than 2°C above pre-industrial levels. It was originally proposed in the 1990s[15] to reduce the risks and impacts of climate change. Since 2009, the UN Framework Convention on Climate Change’s goal has been to ensure that the earth’s temperature does not exceed 2°C above pre-industrial levels. Indeed, one of the three keys aim of the Paris Agreement is “holding the increase in global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels.”[16]

Three hundred ninety investors representing more than US$22 trillion in assets called for the G20 to support and implement TCFD[17], and over 100 businesses have expressed support for the final TCFD recommendations.[18] The leading global proponent for responsible investment, the United Nations-supported Principles for Responsible Investment (PRI),[19] plans to update its reporting guidelines to include some, but not all, TCFD disclosures. The PRI has over 1,750 signatories, with roughly US$70 trillion in aggregate assets.[20] Requiring such a significant share of asset owners and managers to include increasing numbers of TCFD disclosures over time should accelerate its adoption. Widespread adoption should facilitate comparative analysis of corporate climate change risks, allowing investors to react to climate change.

On September 19th, ten companies in seven sectors become the first to commit to implement the TCFD recommendations within three years: Enagás; Aviva plc; Philips Lighting; Royal DSM; Ferrovial; Wipro Ltd; Iberdrola; Marks & Spencer; Sopra Steria Group; and WPP.[21]

More than just a drop in the ocean

This seemingly arcane financial disclosure guidance has broad implications. According to CDP research,[22] 100 fossil fuel companies have generated 71 percent of the global greenhouse gas emissions since 1988.[23] Ninety percent of these emissions are Scope 3 emissions, i.e., indirect emissions that result from downstream fossil fuel combustion.[24] The actions of these 100 companies are likely to have a significant impact on the trajectory global climate change.

Investors own 41 percent of the 635 gigatons of carbon dioxide greenhouse gas emissions from these 100 fossil fuel producers. [25] Pensions own three quarters of the US stock exchange market capitalization.[26] These pension funds invest for multiple generations and have a long-term horizon.[27] Reflecting the long-term interests of savers[28] entails considering the risk that changing consumer preferences for renewable energy and climate-related regulatory requirements may diminish the value of fossil fuel reserves, creating stranded assets. It also involves analyzing the potential impact of increased climate risk, such as severe storms and rising temperatures[29] and sea levels. These considerations are likely to influence investment decisions in the long run, although fossil fuels may generate favorable returns in the short- and medium-run. The speed at which investors absorb and apply the data released by companies implementing TCFD’s recommendations is likely to be a driver of the fortunes of these 100 companies and therefore a driver of the fate of the planet. Naturally, for pure mainstream investors and risk-oriented mainstream investors who perceive that sustainability issues are becoming more pronounced, the data released by companies that are implementing TCFD’s recommendations must become more robust.[30] In other words, the data would ideally be inclusive of downstream impact and other indirect emissions, presented via a standardized methodology in a standardized format, focused on issues that are most material to the company and its stakeholders, and independently verified or audited, inter alia.[31] Naturally, the issues that are most material vary by sector and by geography.

As Atlantic hurricane season approaches its November 30th end, much more needs to be done with respect to sustainable development. Let’s join the people of Texas, Florida, and Puerto Rico in hoping for greater focus of asset owners on the long-term and strict compliance of companies with TCFD guidance. With climate change, no man is an island. The bell tolls for us all.

[1] http://siteresources.worldbank.org/INTEAPREGTOPURBDEV/Resources/Primer_e_book.pdf

[2] http://fortune.com/2016/01/26/rea-estate-global-economy/

[3] https://assets.rockefellerfoundation.org/app/uploads/20141230000615/Urban-resilience-exec-sum-WEB-FINAL-11.25.pdf

[4] https://www.nytimes.com/2017/09/19/us/hurricanes-irma-harvey-maria.html?mcubz=0

[5] https://weather.com/storms/hurricane/news/2005-hurricane-season-by-the-numbers

[6] https://www.accuweather.com/en/weather-news/accuweather-predicts-economic-cost-of-harvey-irma-to-be-290-billion/70002686

[7] https://twitter.com/AP/status/902640282302369794

[8] https://www.buzzfeed.com/nidhisubbaraman/tropical-storm-harvey-emissions-pollution?utm_term=.nlRaJRK3g#.oxWzpQ2Ze

[9] https://newrepublic.com/article/144798/floridas-poop-nightmare-come-true

[10] http://www.shell.com/sustainability/sustainability-reporting-and-performance-data/performance-data/greenhouse-gas-emissions/taskforce-for-climate-related-financial-disclosures.html

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

[11] http://www.bankofengland.co.uk/publications/Pages/speeches/2015/844.aspx

[12] Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, United Kingdom, United States, and the European Union

[13] https://www.sasb.org/supporting-work-tcfd/

[14] https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-TCFD-Report-062817.pdf

[15] http://www.eesi.org/articles/view/behind-the-2-degree-scenario-presented-at-cop21

[16] http://unfccc.int/files/essential_background/convention/application/pdf/english_paris_agreement.pdf

[17] https://www.ceres.org/sites/default/files/Global-Investor-Letter-to-G20-Governments.pdf

[18] https://www.forbes.com/sites/dinamedland/2017/06/29/banks-and-insurers-support-task-force-recommendations-on-climate-related-financial-disclosure/#2f64dd0b5c0e

[19] https://www.unpri.org/about

[20] https://www.unpri.org/about

[21] http://www.cdsb.net/press-room/task-force/722/global-leading-companies-commit-disclose-climate-risks-within-three-years

[22] CDP is a UK-based non-profit that works with shareholders and corporations on corporate greenhouse gas emissions disclosure

[23] https://www.theguardian.com/sustainable-business/2017/jul/10/100-fossil-fuel-companies-investors-responsible-71-global-emissions-cdp-study-climate-change

[24] Dr. Paul Griffin: “The Carbon Majors Database: CDP Carbon Majors Report 2017.” CDP. July 2017, page 5.

[25] Dr. Paul Griffin: “The Carbon Majors Database: CDP Carbon Majors Report 2017.” CDP. July 2017, page 8.

[26] https://www.mckinsey.com/business-functions/sustainability-and-resource-productivity/our-insights/business-society-and-the-future-of-capitalism

[27] http://www.schroders.com/en/sysglobalassets/global-assets/english/pdf/91734-fclt-write-up-11.7.2017_-12.07.2017_v2-for-upload-final.pdf

[28] http://www.fcltglobal.org/docs/default-source/default-document-library/fclt-understanding-the-investment-value-chain.pdf?sfvrsn=ae7b258c_0

[29] https://assets.rockefellerfoundation.org/app/uploads/20141230000615/Urban-resilience-exec-sum-WEB-FINAL-11.25.pdf

[30] Daniel C. Etsy and Todd Cort “Corporate Sustainability Metrics: What Investors Need and Don’t Get,” Journal of Environmental Investing 8, No. 1. 2017, pages 25-27.

[31] Daniel C. Etsy and Todd Cort “Corporate Sustainability Metrics: What Investors Need and Don’t Get,” Journal of Environmental Investing 8, No. 1. 2017, pages 28-43.