July 31, 2014;MSNBC

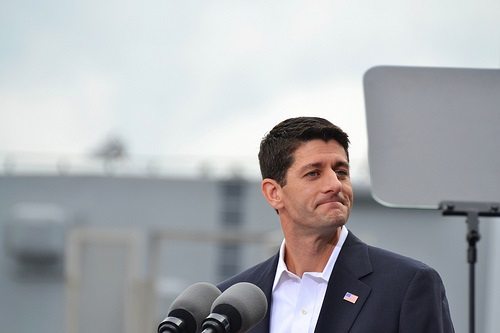

Give Representative Paul Ryan some credit. During his vice-presidential campaign, Ryan was notable as the one candidate willing to talk—and talk frequently—about issues of poverty, while the other presidential and vice-presidential candidates hewed to a rigid commitment to talking only about the middle class. As we wrote about Ryan’s poverty ideas during the campaign, we sort of guessed at who might have advised Ryan to address issues of poverty, notably Bob Woodson of the Center for Neighborhood Enterprise. In Ryan’s political party, discussing the poor in terms that don’t simply blame the victim and raising potential solutions that require national commitment are high-risk maneuvers.

Recently, Ryan pitched a new version of his anti-poverty solutions. Its core component combines several federal programs, including food stamps, home heating assistance, housing vouchers, and childcare assistance, into a massive block grant to be delivered to and ostensibly through state governments to nonprofits on the front lines of fighting poverty. His belief is that these funds, combined with other public sector dollars, will leverage charitable resources and empower nonprofits to not only “relieve the pain of poverty [but] give people the means to get out of poverty.”

Here are some of the specifics from Ryan’s House Budget Committee about the proposal:

- The Opportunity Grant: “In participating states, the federal government would consolidate a number of means-tested programs into a new Opportunity Grant (OG) program. The largest contributions would come from SNAP, TANF, childcare, and housing-assistance programs, and the funding would be deficit-neutral relative to current law…. The federal government would require each participating state to develop and submit for fast-track approval a concrete plan to develop a new aid program. To get approval, the plan would have to meet four conditions. First, the plan must demonstrate how the funds would be used to move people out of poverty and into independence. The state could not use the Opportunity Grant to fund other priorities, such as highways. And the plan must, at a minimum, direct assistance first toward people below the poverty line. Second, the new program would have to require all able-bodied recipients to work or engage in work-related activities in exchange for aid. The elderly and the disabled would be exempt from this requirement. Third, the state would need to use some funds from the consolidated programs to encourage new approaches by innovative groups as well as non-governmental organizations with a proven track record. It would also need to show how it would give low-income Americans more service providers to choose from. And fourth, the state and the federal government would have to agree on measures of success and evaluation by a third party to conduct an objective assessment of the plan.”

- Earned Income Tax Credit: “This proposal would expand the credit for childless workers. Specifically, it would double the maximum credit, phase-in, and phase-out rates for childless adults, and it would lower the eligibility age for workers from 25 to 21, assuming they are not a dependent or qualifying child for another taxpayer.”

- Early Childhood Education: Incorporate the Child Care Development Fund into the Opportunity Grant and “convert Head Start into a block grant.”

- Elementary and Secondary Education: “This proposal would convert Title I-A [of the Elementary and Secondary Education Act, which originated as part of the War on Poverty] funding into a flexible block grant, on the condition that states spend the money on low-income children…. This proposal would [also] consolidate the remaining programs authorized under ESEA and not eliminated under the House-passed reauthorization of that law into a second flexible allotment directed to states.”

- Job training: “Consolidate duplicative job-training programs into a flexible block grant. Three programs, Workforce Investment Act—Adult, Wagner–Peyser Employment Service and Senior Community Service Employment Program, would be reformed into a flexible allotment to states. States would use this funding—nearly $1.9 billion in fiscal year 2014—to design their own programs and provide different types of aid, such as career scholarships, to those seeking job training. In exchange for greater flexibility, states would have to show results. States would have to report to the Department of Labor what types of training they provide, how much each trainee costs, what type of employment each trainee secures, whether that trainee secures a job in his or her preferred field, how many trainees gained work within 60 days of enrollment, and how many were still employed after 180 days. States could also request to consolidate funding for WIA Youth, Job Corps, and State Vocational Rehabilitation Grants into this stream of funding.”

Other provisions of the Ryan proposal concern making higher education support through Pell grants and other programs more flexible and adopting reforms in prison sentencing, but the key parts for many nonprofits are the major proposed changes on funding streams concerning the conversion of longstanding programs into block grants—without really any increase at all in the amount of funding that the federal government would provide.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

It is certainly good to hear a politician talking about rather than ducking the issue of poverty, as well as to note that a politician understands that there are nonprofits out there taking on these issues day in and day out. But the Republican from Wisconsin misses a major aspect of what it takes for nonprofits to do their jobs. Even Catholic Charities, which Ryan touts as his model poverty-fighting nonprofit, depends significantly on government funding to do their work (Catholic Charities USA gets about half of its funding from government)—and government money for social issues has been shrinking in comparison to the expanding needs of America’s poor and America’s long-term unemployed, neither of which have fared well in the nation’s economic recovery. Nonprofits are promised no new moneys in the Ryan anti-poverty proposals, and given recent federal budget trajectories, the likely scenario is for even less.

That isn’t the whole story, however, about the inherent problem in the Ryan proposal. State and local governments, the intended recipients of the Ryan block grants, often fail to compensate nonprofits for the full value of the services they deliver. In addition, many state policies call for nonprofits to share the costs of contracted services by devoting part of their charitable fundraising to pay for the government shortfalls. The case management capacities of nonprofits such as Catholic Charities that Ryan touts as key to the more effective use of these block grant dollars cannot undo the effects of resources that are simply too little to meet the need.

“Churches and faith-based groups—it’s not through magic they perform miracles,” said Tim Delaney, the president and CEO of the National Council of Nonprofits. “They have to have the wherewithal to get things done. The notion that any organization or any individual can do it on a sustainable basis without required basic resources, it just doesn’t fly in the face of reality.”

But the biggest problem is what would go into and come out of the state block grants. As states have cut back on their own staffing and programming, it isn’t difficult to imagine that they would clip some parts of these block grants for their own purposes or, as Bob Greenstein, the president of the Center for Budget and Program Priorities, suggests, to supplant their own social spending commitments.

An additional concern of ours is that the Ryan block grant combines programs that provide direct, means-tested assistance to poor people—housing vouchers, for example—with other nonprofit programs, under the rubric that nonprofits will be able to use the resources in an intensive case management approach. Block grant experience in the past is that the resource pool shrinks; at the least, it certainly doesn’t keep up with the growth of need. Not only do states and other levels of government shave the totals to fund their own operations, portions of the block grant funding at the federal get earmarked for various functions, reducing the total block grant resources more than the public knows.

The problem isn’t just that government doesn’t fully fund nonprofits for the services it contracts for, or that governments will likely divert anti-poverty block grant funds for other purposes. It is that the Ryan anti-poverty plan is built on the substructure of the Ryan budget plan, which does little to reduce tax inequities or to reverse the long downward tailspin of social programs in the federal budget. The combination of Delaney’s and Greenstein’s concerns and the fact that Ryan’s overall federal budget assumptions remain intact suggests that Ryan has elevated discussion of the concept of fighting poverty but done little to advance the substance or the needed wherewithal to do the job.—Rick Cohen