![]() Judeo-Christian traditions offer complicated answers to the question of whether it’s better to give anonymously or publicly. And what we believe as a society affects public policy around philanthropy.

Judeo-Christian traditions offer complicated answers to the question of whether it’s better to give anonymously or publicly. And what we believe as a society affects public policy around philanthropy.

“Historic YMCA” Conflicts with Modern YMCA Over St. Petersburg Building

Buy the building and keep the name? The YMCA begs to disagree.

Buy the building and keep the name? The YMCA begs to disagree.

Now You See It; Now You Don’t: $188,981.03 Donation a Mistake

Thousands of dollars were willed to an animal shelter in Collinsville. Which one? Now that’s the doggone problem.

Thousands of dollars were willed to an animal shelter in Collinsville. Which one? Now that’s the doggone problem.

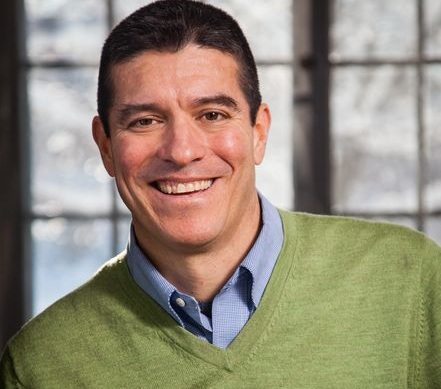

Coaching as a Capacity-Building Tool: An Interview with Bill Ryan

FROM THE ARCHIVES:

For-profits tend to accept the benefits of coaching as a given. Nonprofits, on the other hand, question whether or not coaching actually works, and are more concerned with return on investment. But, as Bill Ryan explains, rather than asking “Does coaching work?,” nonprofit organizations invested in the practice would be better served figuring out how to make it work in their particular situation.

A “Dirty Dozen” Nonprofit Tax Scam Surfaces for Gomez

Massachusetts Senate candidate Gabriel Gomez has a lot going for him. But he stands accused of trying to avoid tax payments using a pretty shady trick.

Massachusetts Senate candidate Gabriel Gomez has a lot going for him. But he stands accused of trying to avoid tax payments using a pretty shady trick.

Money Laundering and Art: Ever a New Twist

Criminals are increasingly using the “famously opaque art market” to launder and transfer illegally obtained cash around the world.

Criminals are increasingly using the “famously opaque art market” to launder and transfer illegally obtained cash around the world.

Congress Probes Tax Noncompliance by Colleges and Universities

![]()

![]() The IRS’s inquiry into higher education has compliance implications for all nonprofits.

The IRS’s inquiry into higher education has compliance implications for all nonprofits.

Pope Calls Nuns to Engage in “Fertile Chastity”

Bad choice of words, or unguarded and exuberant misogyny?

Bad choice of words, or unguarded and exuberant misogyny?

State Supreme Court Rules School Voucher Plan Unconstitutional

Louisiana Governor Jindal’s plan to use public dollars to send students to private schools has been ruled unconstitutional.

Louisiana Governor Jindal’s plan to use public dollars to send students to private schools has been ruled unconstitutional.

Safety Net Nonprofits as “Whacked Moles”

In Frederick, MD, says one advocate, money is being shifted from need to need, leaving problems to pop up again and again as funding is advanced and withdrawn.

In Frederick, MD, says one advocate, money is being shifted from need to need, leaving problems to pop up again and again as funding is advanced and withdrawn.

IRS Targeting of Conservative Groups a Threat to Nonprofit Sector

By its own admission, between 2010 and 2012, the IRS subjected groups to extra scrutiny based on buzzwords like “tea party” and “patriot” in their names. We would love to hear from you on this turn of events. What should be the nonprofit sector’s response?

By its own admission, between 2010 and 2012, the IRS subjected groups to extra scrutiny based on buzzwords like “tea party” and “patriot” in their names. We would love to hear from you on this turn of events. What should be the nonprofit sector’s response?

Jewish Congregations Gain Strength by Merging Across Divides

Can there be greater strength in fewer numbers for Jewish communities that are no longer able to support separate houses of worship for each of their sharply divided denominations?

Can there be greater strength in fewer numbers for Jewish communities that are no longer able to support separate houses of worship for each of their sharply divided denominations?