![]() The Wikipedia end-of-year fundraising strategy was built on the basic collective culture around which the whole organization is built. And—wow—did it work!

The Wikipedia end-of-year fundraising strategy was built on the basic collective culture around which the whole organization is built. And—wow—did it work!

Thousands across the Continent Take the Plunge—Yikes!—for Charity

![]() The ritual charitable freeze-your-butt-off event of the year took place in hundreds of communities across the continent on Sunday.

The ritual charitable freeze-your-butt-off event of the year took place in hundreds of communities across the continent on Sunday.

How Do You Want Your Toast? Whole Wheat or NRA-Logoed?

Montana Supreme Court: Citizens United Doesn’t Apply in State and Local Elections

A conservative, Washington, DC-based 501(c)(4) tried to overturn Montana’s 100-year-old law prohibiting direct corporate expenditures for political candidates and political committees on the grounds that it violated the U.S. Supreme Court’s Citizens United decision. The Montana Supreme Court said that Citizens United may be OK for Washington, but it doesn’t apply to state and local elections in the Big Sky state.

Ho! Ho! Ho! The 1 Percent Talks Back to Its Critics—and Forms a Nonprofit

Bah humbug! Did the ghosts of Christmas Past, Present, and Yet to Come visit Bernard Marcus of Home Depot, Jamie Dimon of JP Morgan Chase, and Tom Golisano of Paychex to suggest a new, feisty, pull-no-punches strategy with the critics of the 1 percent? And form a nonprofit for the 1 percent message?

Ron Paul’s Unusual Nonprofit Support Structure

Ron Paul isn’t much different than the politicians he claims he isn’t, arrayed with closely aligned nonprofit entities that look suspiciously like their campaign operations. In Paul’s case, it’s not just that they blur the lines between a campaign organization and an ostensibly independent 501(c)(4) nonprofit, but they have some explaining to do about some of Ron Paul’s newsletters and supporters.

Does My Nonprofit Need to Pay Tax? Understanding Unrelated Business Income Tax

While nonprofits are, generally, tax-exempt, they must pay income tax when operating outside the scope of their exempt purposes. But determining what are an organization’s exempt purposes is not always as clear as one might think, and distinguishing between related and unrelated activities can be tricky. There are clear rules, as well as several exceptions to those rules, that can help guide an organization in the right direction. But, as Kupfer underscores, while this article outlines key concepts of UBIT, “specific advice should always be sought from a competent tax counsel.”

Social Entrepreneurship and Social Innovation: Are They Potentially in Conflict?

When implemented wisely, social innovation is a positive approach to nonprofit growth; but most current practice falling under that rubric tends to invest primarily in one organization or program. Wouldn’t investment in infrastructure be far more valuable to development of the sector overall?

When implemented wisely, social innovation is a positive approach to nonprofit growth; but most current practice falling under that rubric tends to invest primarily in one organization or program. Wouldn’t investment in infrastructure be far more valuable to development of the sector overall?

An Executive Director’s Guide to Financial Leadership

AN NPQ CLASSIC:

There is a world of difference between financial management and financial leadership, and refocusing your approach from fiscal management to fiscal sustainability gets you there. Outlined in this expert guide are such essential steps as: transforming your annual budget analysis; deciding whether or not income diversification is the way to go; achieving a robust reserve; and equipping your board for effective financial governance.

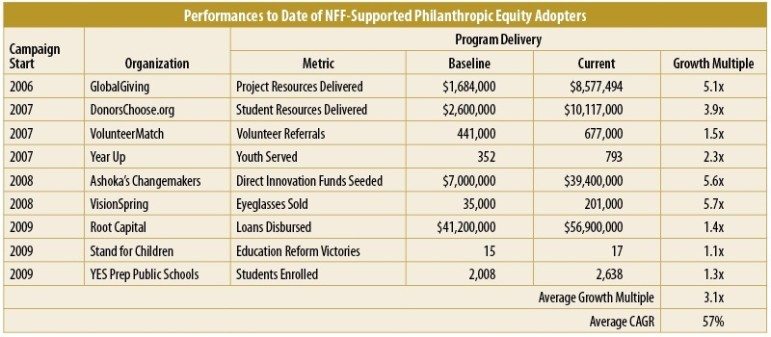

Philanthropic Equity: Promising Early Returns

Practitioners agree that regulatory support is essential to Philanthropic Equity’s survival, but even if common standards and IRS guidance are put into play, PE is not for everyone. As the author explains, “Philanthropic Equity is about making sizable bets on plans and teams whose success is uncertain.” But he continues: “If only 1 percent of the funds currently flowing to U.S. nonprofit organizations were in the form of Philanthropic Equity, it would be sufficient to radically alter the growth trajectories of many of the highest-potential organizations in the social sector.” What do you think?

Thinking Back, Looking Forward, Holiday Thoughts from Nonprofit Quarterly!

![]() NPQ is taking a small break after today but…

NPQ is taking a small break after today but…

Committees . . . Love Them or Hate Them

I actually like committees. Well, let me rephrase that statement: I like effective committees. And I believe it’s the staff’s job to make committees effective. Staff enables committees to function effectively, productively, and successfully. So here are some of my favorite thoughts about committees.