Sometimes power is wielded in the most penny ante (but destructive) ways in nonprofitland. When does the wielding of positional power become an abuse and what should you do about it? The Nonprofit Ethicist is here to answer even the most mundane and sordid of questions.

Sometimes power is wielded in the most penny ante (but destructive) ways in nonprofitland. When does the wielding of positional power become an abuse and what should you do about it? The Nonprofit Ethicist is here to answer even the most mundane and sordid of questions.

“Poorly Written E-mail Tirades” and Nonprofit Consultant Quandaries: The Ethicist Weighs in

Few things are more loathed by the public than taxes, and our cultural models encourage us to view government as something to be resisted and our tax system as a faulty or rigged vending machine. So how do we change these entrenched ways of thinking? The FrameWorks Institute has some ideas.

Few things are more loathed by the public than taxes, and our cultural models encourage us to view government as something to be resisted and our tax system as a faulty or rigged vending machine. So how do we change these entrenched ways of thinking? The FrameWorks Institute has some ideas.

Do you think the grass is greener on the for-profit side of the fence? When it comes to employee compensation this report would lead you to believe differently…but look a little deeper.

Do you think the grass is greener on the for-profit side of the fence? When it comes to employee compensation this report would lead you to believe differently…but look a little deeper.

Despite talk of risk assumption by foundations, we don’t necessarily see compelling evidence.

Despite talk of risk assumption by foundations, we don’t necessarily see compelling evidence.

Are Philanthropists overstepping their bounds and using their donations to steer policy rather than simply fund good ideas?

Are Philanthropists overstepping their bounds and using their donations to steer policy rather than simply fund good ideas?

NPQ puts three of TIME’s top 100 on pedestals to show off their philanthropic chops.

NPQ puts three of TIME’s top 100 on pedestals to show off their philanthropic chops.

The story of two healthcare providers and their quest for unification has a lesson to teach about the sway that public relations can have over financial dealings.

The story of two healthcare providers and their quest for unification has a lesson to teach about the sway that public relations can have over financial dealings.

When it comes to taxation, our country isn’t broke, just twisted—with a system skewed to favor the super-rich. What can nonprofits do to help? The author proffers seven ways to promote tax progressivity.

When it comes to taxation, our country isn’t broke, just twisted—with a system skewed to favor the super-rich. What can nonprofits do to help? The author proffers seven ways to promote tax progressivity.

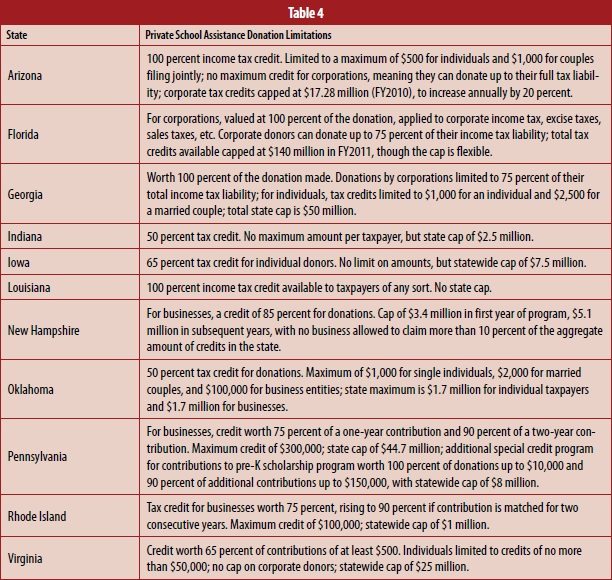

In order to weigh in on tax reform, nonprofits must first understand how states raise their money—which, thanks to murky documentation, is no easy feat. This investigative report delves into state taxation schemes and how they affect the nonprofit sector.

In order to weigh in on tax reform, nonprofits must first understand how states raise their money—which, thanks to murky documentation, is no easy feat. This investigative report delves into state taxation schemes and how they affect the nonprofit sector.