Two Navy SEALs foundations have declined to accept donations from sales of the book about the killing of Osama Bin Laden, and a third is pondering its response.

Two Navy SEALs foundations have declined to accept donations from sales of the book about the killing of Osama Bin Laden, and a third is pondering its response.

Second Charity Turns Down Navy SEAL Author’s Donations

Two Navy SEALs foundations have declined to accept donations from sales of the book about the killing of Osama Bin Laden, and a third is pondering its response.

Two Navy SEALs foundations have declined to accept donations from sales of the book about the killing of Osama Bin Laden, and a third is pondering its response.

After a slew of stories have surfaced in New York about politicians using nonprofits in questionable or illegal ways, the state aims to get more aggressive with a new database.

After a slew of stories have surfaced in New York about politicians using nonprofits in questionable or illegal ways, the state aims to get more aggressive with a new database.

In Richmond, Va., nonprofits get property tax exemptions by designation, meaning they have to apply and make their case to the Richmond City Council. What standards apply?

In Richmond, Va., nonprofits get property tax exemptions by designation, meaning they have to apply and make their case to the Richmond City Council. What standards apply?

Two Arizona-based nonprofits, Food for the Hungry and the Breast Cancer Society, are under scrutiny for alleged smoke and mirrors in their accounting practices.

Two Arizona-based nonprofits, Food for the Hungry and the Breast Cancer Society, are under scrutiny for alleged smoke and mirrors in their accounting practices.

The viral video sensation “Hot Cheetos and Takis” from Y.N.RichKids is seen as potentially offering the public school system a model for a way to engage children in after-school learning.

The viral video sensation “Hot Cheetos and Takis” from Y.N.RichKids is seen as potentially offering the public school system a model for a way to engage children in after-school learning.

Following in the footsteps of events like Colorado Gives Day, Minnesota’s Give to the Max Day and others, Amplify Austin seeks to raise $1 million for Central Texas nonprofits in 24 hours.

Following in the footsteps of events like Colorado Gives Day, Minnesota’s Give to the Max Day and others, Amplify Austin seeks to raise $1 million for Central Texas nonprofits in 24 hours.

On Saturday in Fredericksburg, Va., approximately 65 artists took to the streets to create works of art where others could look on. We love the concept!

On Saturday in Fredericksburg, Va., approximately 65 artists took to the streets to create works of art where others could look on. We love the concept!

A lawyer representing the owner of a Latham, N.Y. strip club, Nite Moves, is arguing that the all-nude club falls under a state tax law exempting “dramatic or musical art performances.”

A lawyer representing the owner of a Latham, N.Y. strip club, Nite Moves, is arguing that the all-nude club falls under a state tax law exempting “dramatic or musical art performances.”

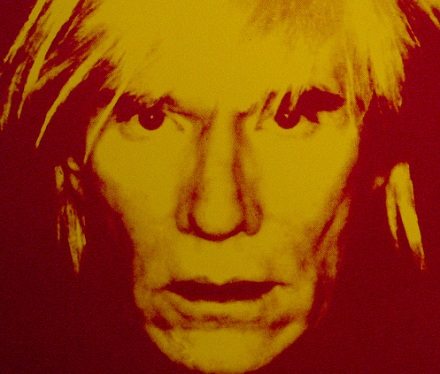

The Andy Warhol Foundation for the Visual Arts plans to sell off the entirety of Warhol’s remaining catalogue, flooding the market and using online “flash auctions” for some pieces.

The Andy Warhol Foundation for the Visual Arts plans to sell off the entirety of Warhol’s remaining catalogue, flooding the market and using online “flash auctions” for some pieces.

The Navy SEAL Foundation, one of the charities supported by the author of a new, unauthorized book describing the raid to kill Osama bin Laden, will reject book proceeds.

The Navy SEAL Foundation, one of the charities supported by the author of a new, unauthorized book describing the raid to kill Osama bin Laden, will reject book proceeds.

![]() There are many ways in which intentions and resources can fit together for a shared intention. This Chicago merger is a nice example.

There are many ways in which intentions and resources can fit together for a shared intention. This Chicago merger is a nice example.

![]() Writing for the Motley Fool, Dan Caplinger suggests that municipalities might consider taxing tax-exempt nonprofits because some have said they have an “unfair advantage” over for-profits.

Writing for the Motley Fool, Dan Caplinger suggests that municipalities might consider taxing tax-exempt nonprofits because some have said they have an “unfair advantage” over for-profits.